3 Stocks That May Be Trading Below Estimated Value In October 2025

Reviewed by Simply Wall St

As of October 2025, U.S. markets have been on an upward trajectory, with major indices like the Dow Jones Industrial Average and S&P 500 reaching fresh records despite concerns over a government shutdown. This resilient performance highlights the importance of identifying stocks that may be trading below their estimated value, offering potential opportunities for investors in a market setting characterized by record highs and ongoing economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.84 | $13.44 | 49.1% |

| SLM (SLM) | $27.23 | $53.64 | 49.2% |

| Phibro Animal Health (PAHC) | $39.01 | $77.67 | 49.8% |

| Northwest Bancshares (NWBI) | $12.33 | $24.41 | 49.5% |

| Investar Holding (ISTR) | $22.70 | $45.37 | 50% |

| Hess Midstream (HESM) | $34.34 | $66.83 | 48.6% |

| HCI Group (HCI) | $189.77 | $376.13 | 49.5% |

| First Commonwealth Financial (FCF) | $16.75 | $32.97 | 49.2% |

| First Busey (BUSE) | $23.06 | $45.30 | 49.1% |

| Alnylam Pharmaceuticals (ALNY) | $460.99 | $889.36 | 48.2% |

Here's a peek at a few of the choices from the screener.

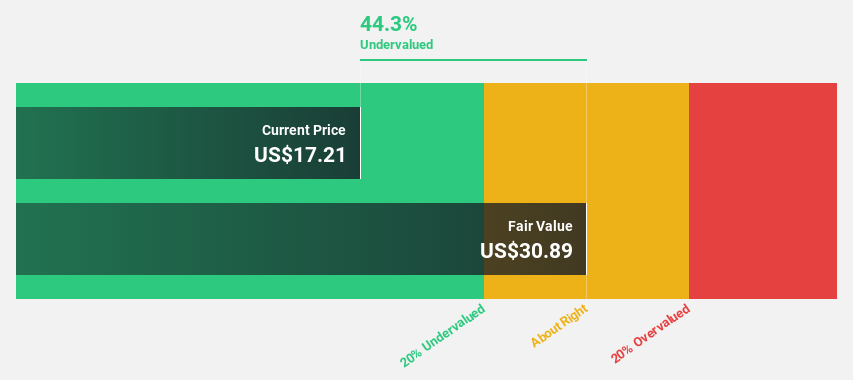

Lyft (LYFT)

Overview: Lyft, Inc. operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada, with a market cap of approximately $8.87 billion.

Operations: Lyft generates revenue primarily from its Internet Information Providers segment, totaling $6.11 billion.

Estimated Discount To Fair Value: 24.6%

Lyft is trading at US$22.61, significantly below its estimated fair value of US$29.99, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 31.6% annually, outpacing the broader U.S. market's growth expectations. Recent strategic partnerships with Waymo and Baidu enhance Lyft's position in autonomous vehicle technology, potentially improving operational efficiency and reducing costs through fleet management innovations like Flexdrive and Apollo Go integration in Europe and Nashville by 2026.

- The growth report we've compiled suggests that Lyft's future prospects could be on the up.

- Take a closer look at Lyft's balance sheet health here in our report.

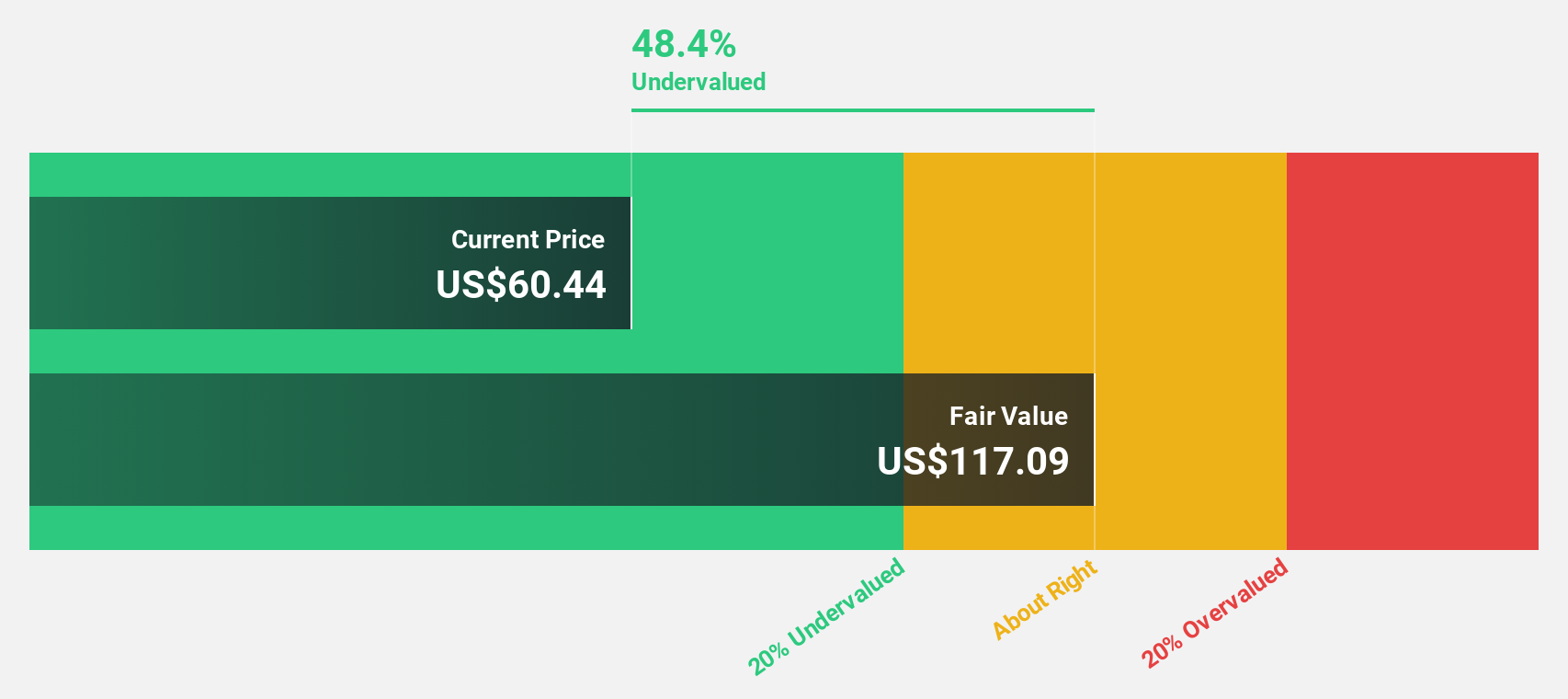

EQT (EQT)

Overview: EQT Corporation is involved in the production, gathering, and transmission of natural gas with a market cap of approximately $35.05 billion.

Operations: The company generates revenue primarily from two segments: Production, which contributes $6.70 billion, and Gathering, which adds $1.28 billion.

Estimated Discount To Fair Value: 42.5%

EQT is trading at US$55.76, well below its estimated fair value of US$96.96, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 25.4% annually, surpassing the U.S. market growth rate of 15.4%. Recent agreements for LNG supply with Commonwealth LNG and Sempra Infrastructure expand EQT's global reach, enhancing its capacity to optimize international cargos and potentially boosting revenue streams in the energy sector.

- Upon reviewing our latest growth report, EQT's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of EQT.

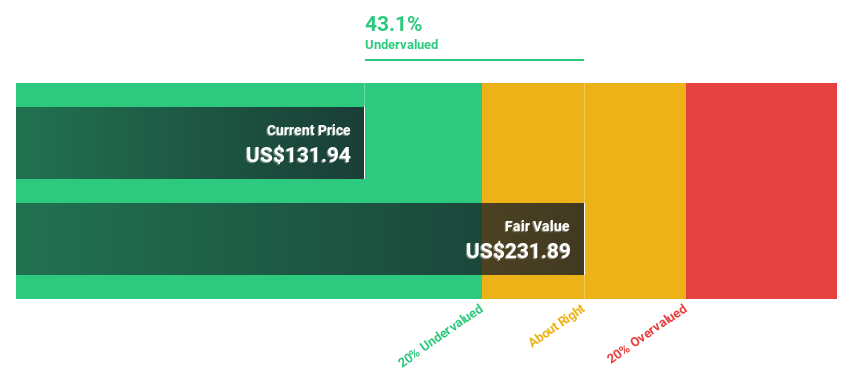

Jabil (JBL)

Overview: Jabil Inc. offers manufacturing services and solutions globally, with a market cap of approximately $23.06 billion.

Operations: The company's revenue segments include Electronics Manufacturing Services at $18.42 billion and Diversified Manufacturing Services at $15.31 billion.

Estimated Discount To Fair Value: 17.4%

Jabil's recent earnings report highlighted strong financial performance with Q4 sales reaching US$8.25 billion, up from US$6.96 billion the previous year, and net income improving to US$218 million. Despite trading at US$215.69, below its fair value estimate of US$261.06, its profit margins have decreased to 2.2%. The company's earnings are forecasted to grow significantly at 20.3% annually over the next three years, outpacing the U.S market growth rate of 15.4%.

- Our expertly prepared growth report on Jabil implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Jabil stock in this financial health report.

Taking Advantage

- Explore the 203 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives