- United States

- /

- Diversified Financial

- /

- NasdaqGS:STNE

3 Stocks That May Be Trading Below Estimated Value In August 2025

Reviewed by Simply Wall St

As the United States stock market rebounds from recent losses, major indexes like the Dow Jones Industrial Average and Nasdaq Composite are on track for solid weekly gains, with tech stocks leading the charge. In this environment of renewed optimism, identifying undervalued stocks can provide opportunities for investors to capitalize on potential growth as these equities may be trading below their estimated intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $13.50 | $26.82 | 49.7% |

| Similarweb (SMWB) | $7.56 | $14.88 | 49.2% |

| Old National Bancorp (ONB) | $20.47 | $40.10 | 49% |

| MNTN (MNTN) | $24.98 | $49.17 | 49.2% |

| Ligand Pharmaceuticals (LGND) | $146.32 | $290.34 | 49.6% |

| Kyndryl Holdings (KD) | $30.18 | $59.38 | 49.2% |

| Fiverr International (FVRR) | $22.91 | $45.03 | 49.1% |

| BioLife Solutions (BLFS) | $20.64 | $40.11 | 48.5% |

| Berkshire Hills Bancorp (BHLB) | $24.04 | $46.58 | 48.4% |

| Atlantic Union Bankshares (AUB) | $31.39 | $62.54 | 49.8% |

Let's uncover some gems from our specialized screener.

Chagee Holdings (CHA)

Overview: Chagee Holdings Limited, with a market cap of $4.05 billion, owns, operates, and franchises teahouses under the CHAGEE brand in China and internationally through its subsidiaries.

Operations: The company's revenue is primarily derived from its teahouse operations, generating CN¥13.29 billion from restaurants.

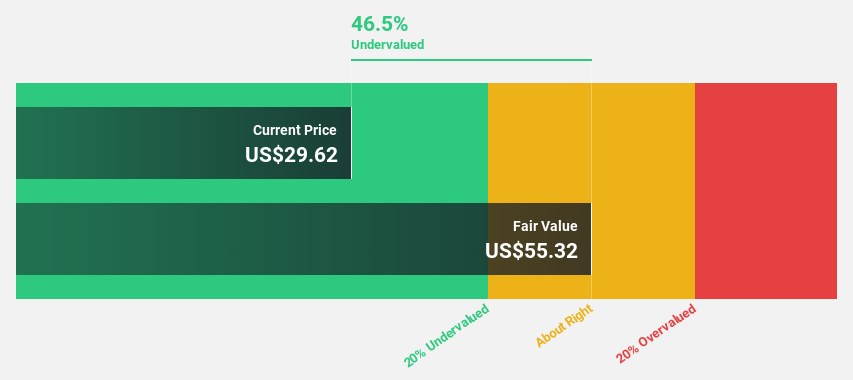

Estimated Discount To Fair Value: 43%

Chagee Holdings appears undervalued, trading at US$21.78, below its estimated fair value of US$38.18. Recent earnings show substantial growth with net income increasing to CNY 678.86 million from CNY 594.26 million year-over-year and revenue reaching CNY 3,392.71 million from CNY 2,506.57 million a year ago. Analysts expect continued strong earnings growth of over 29% annually for the next three years, outpacing the broader U.S. market projections.

- Our expertly prepared growth report on Chagee Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Chagee Holdings here with our thorough financial health report.

DLocal (DLO)

Overview: DLocal Limited, along with its subsidiaries, operates a global payment processing platform and has a market cap of $2.96 billion.

Operations: The company generates revenue of $778.30 million from its payment processing platform worldwide.

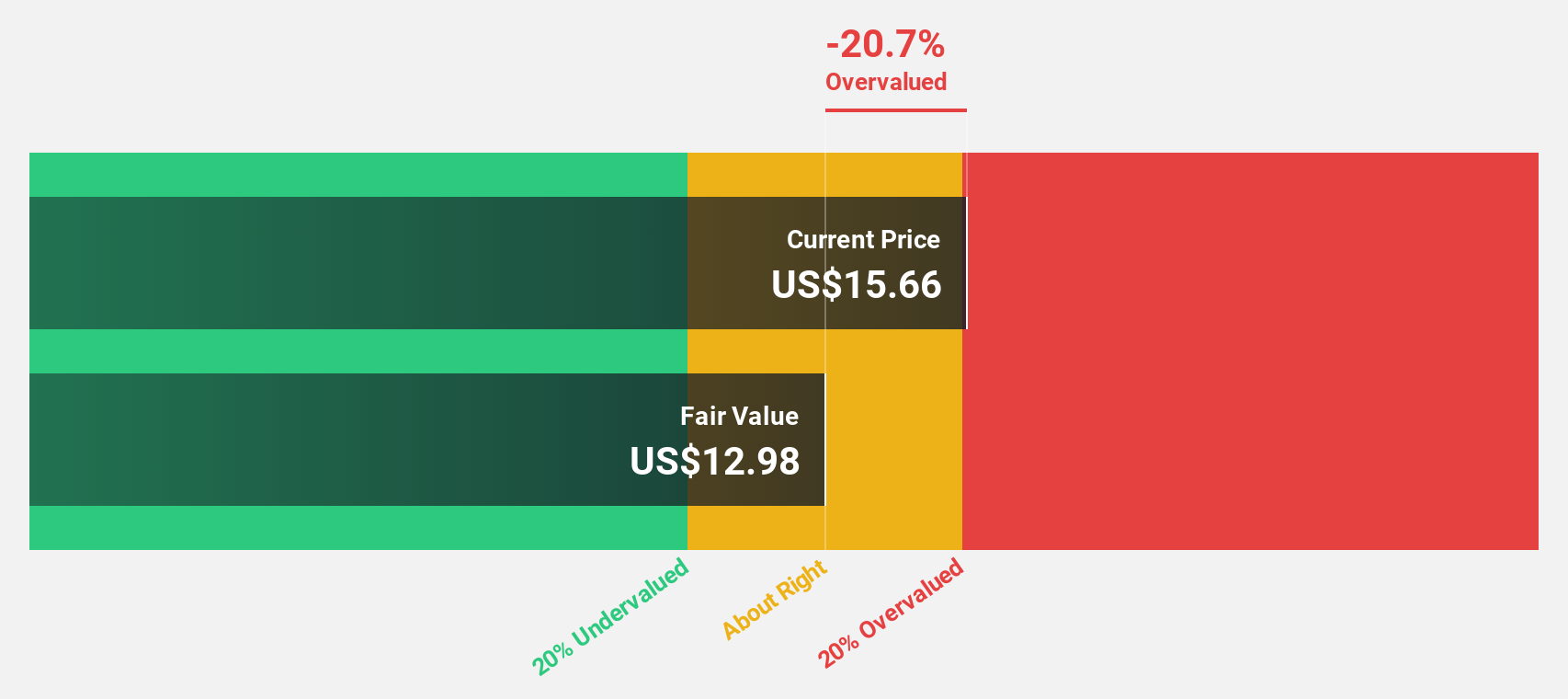

Estimated Discount To Fair Value: 10.8%

DLocal trades at US$10.69, slightly below its estimated fair value of US$11.98, with earnings projected to grow significantly at 24.47% annually, surpassing the broader U.S. market's growth expectations. Recent Q1 results showed net income rising to US$46.63 million from US$17.71 million year-over-year, reflecting strong operational performance despite large one-off items impacting results. The appointment of Will Pruett as an Independent Board Member aims to enhance strategic guidance and scalability efforts moving forward.

- The analysis detailed in our DLocal growth report hints at robust future financial performance.

- Click here to discover the nuances of DLocal with our detailed financial health report.

StoneCo (STNE)

Overview: StoneCo Ltd. offers financial technology and software solutions for electronic commerce in Brazil, with a market cap of $3.64 billion.

Operations: The company's revenue is primarily derived from its Financial Services segment, which generated R$12.24 billion, and its Software segment, which contributed R$1.60 billion.

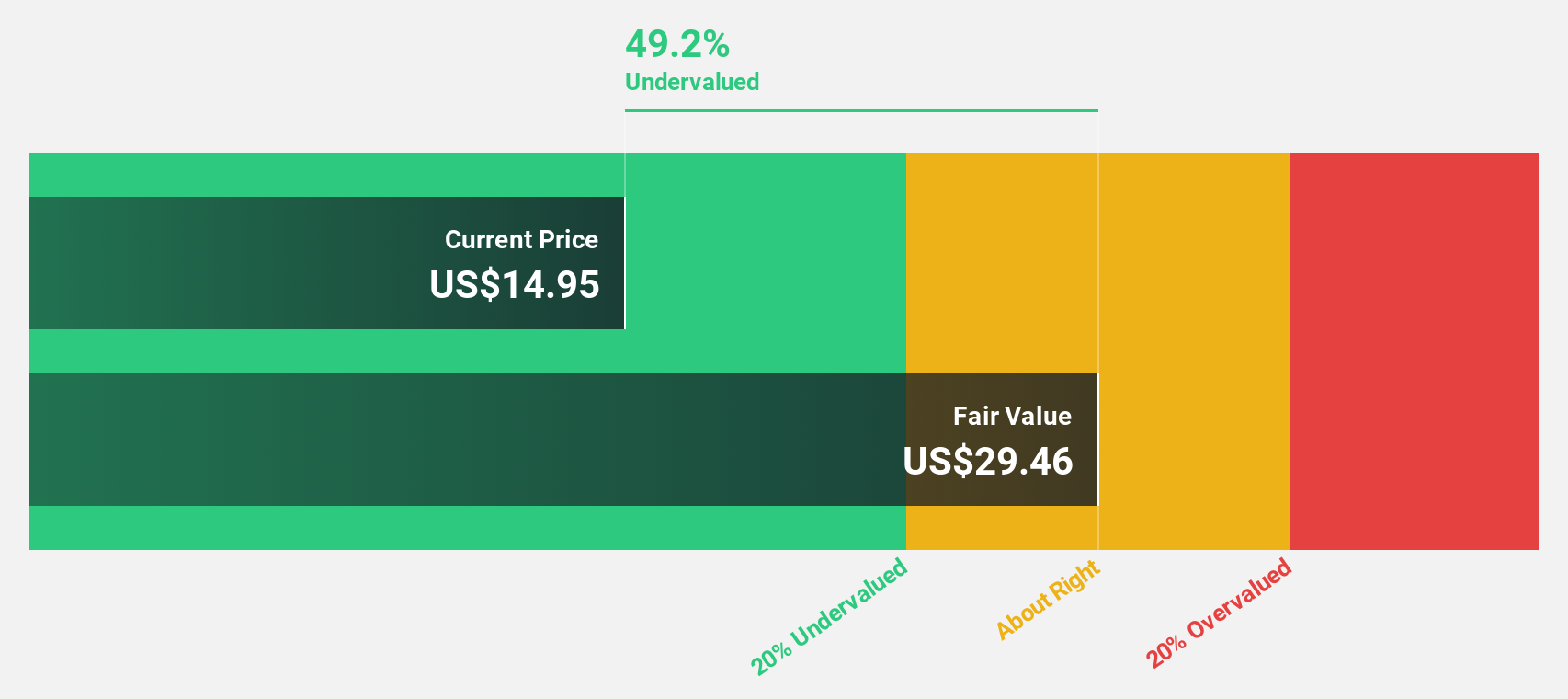

Estimated Discount To Fair Value: 49.7%

StoneCo trades at US$13.50, significantly below its fair value estimate of US$26.82, presenting a strong case for being undervalued based on cash flows. Despite recent exclusion from several Russell indices, its Q2 earnings report shows robust revenue growth to BRL 3.50 billion and net income increase to BRL 630.9 million year-over-year. Analysts forecast high annual profit growth and a potential stock price rise by 20.9%, underscoring its attractive valuation relative to peers and industry standards.

- In light of our recent growth report, it seems possible that StoneCo's financial performance will exceed current levels.

- Navigate through the intricacies of StoneCo with our comprehensive financial health report here.

Key Takeaways

- Navigate through the entire inventory of 167 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STNE

StoneCo

Provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives