- United States

- /

- Consumer Durables

- /

- NYSE:SN

3 Stocks That Could Be Undervalued By Up To 49.7%

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights with major indices like the S&P 500, Dow, and Nasdaq hitting record highs driven by a surge in technology stocks, investors are keenly exploring opportunities that may still be undervalued amidst this bullish trend. Identifying undervalued stocks requires a careful assessment of their intrinsic value compared to current market prices, especially in an environment where interest rates have been cut and tech investments are booming.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SolarEdge Technologies (SEDG) | $34.71 | $68.38 | 49.2% |

| Pinnacle Financial Partners (PNFP) | $97.68 | $186.59 | 47.7% |

| Phibro Animal Health (PAHC) | $40.54 | $77.67 | 47.8% |

| NeuroPace (NPCE) | $10.32 | $19.97 | 48.3% |

| McGraw Hill (MH) | $13.79 | $26.94 | 48.8% |

| ImmunityBio (IBRX) | $2.85 | $5.67 | 49.7% |

| Exact Sciences (EXAS) | $53.59 | $102.68 | 47.8% |

| Columbia Banking System (COLB) | $26.91 | $53.25 | 49.5% |

| Advanced Flower Capital (AFCG) | $4.50 | $8.76 | 48.6% |

| AbbVie (ABBV) | $221.99 | $442.29 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

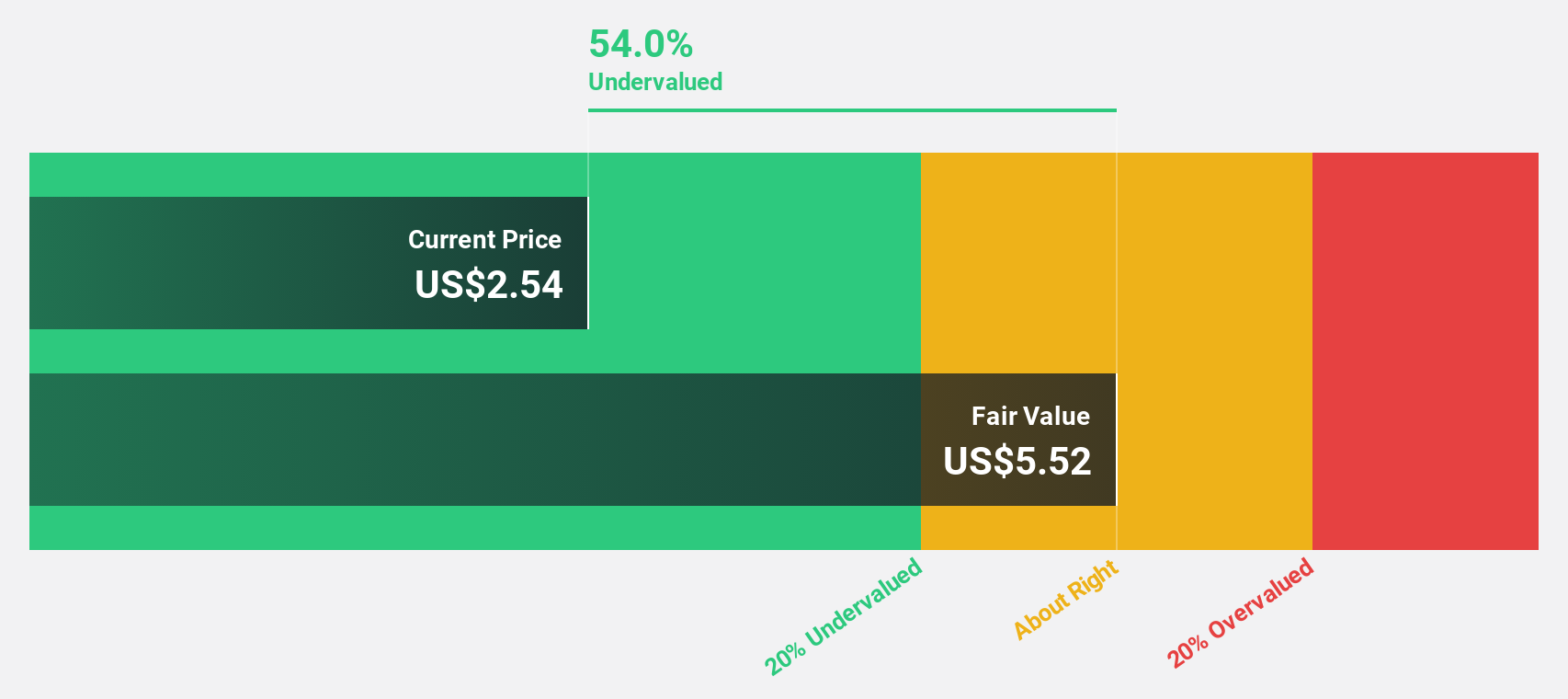

ImmunityBio (IBRX)

Overview: ImmunityBio, Inc. is a commercial-stage biotechnology company focused on developing next-generation therapies to enhance natural immune systems against cancers and infectious diseases, with a market cap of approximately $2.61 billion.

Operations: The company generates revenue of $56.60 million from its efforts in advancing therapies designed to strengthen immune responses against cancer and infectious diseases.

Estimated Discount To Fair Value: 49.7%

ImmunityBio, Inc. is trading at US$2.85, significantly below its estimated fair value of US$5.67, suggesting potential undervaluation based on cash flows. Recent promising clinical trials for ANKTIVA in various cancers and long COVID highlight potential growth avenues. The company's revenue is forecast to grow rapidly at 57.6% per year, outpacing the broader market, with profitability expected within three years despite past shareholder dilution and negative equity challenges.

- Insights from our recent growth report point to a promising forecast for ImmunityBio's business outlook.

- Dive into the specifics of ImmunityBio here with our thorough financial health report.

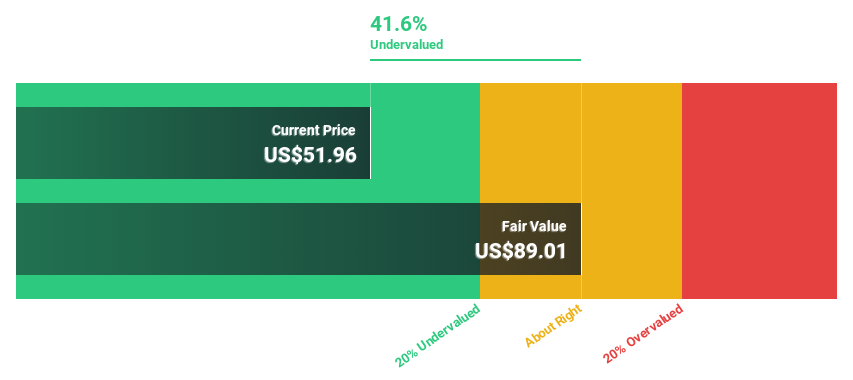

Hims & Hers Health (HIMS)

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers with licensed healthcare professionals across the United States, the United Kingdom, and internationally, with a market cap of approximately $11.38 billion.

Operations: The company's revenue primarily comes from its online retailers segment, which generated approximately $2.01 billion.

Estimated Discount To Fair Value: 10%

Hims & Hers Health is trading at US$56.20, slightly below its estimated fair value of US$62.47, indicating possible undervaluation based on cash flows. Despite earnings growing by a very large amount over the past year and revenue forecasted to grow faster than the market, regulatory challenges persist with FDA warnings about misbranded products. Additionally, Novo Nordisk terminated their partnership due to concerns over deceptive practices related to compounded drugs, impacting investor confidence.

- Our growth report here indicates Hims & Hers Health may be poised for an improving outlook.

- Take a closer look at Hims & Hers Health's balance sheet health here in our report.

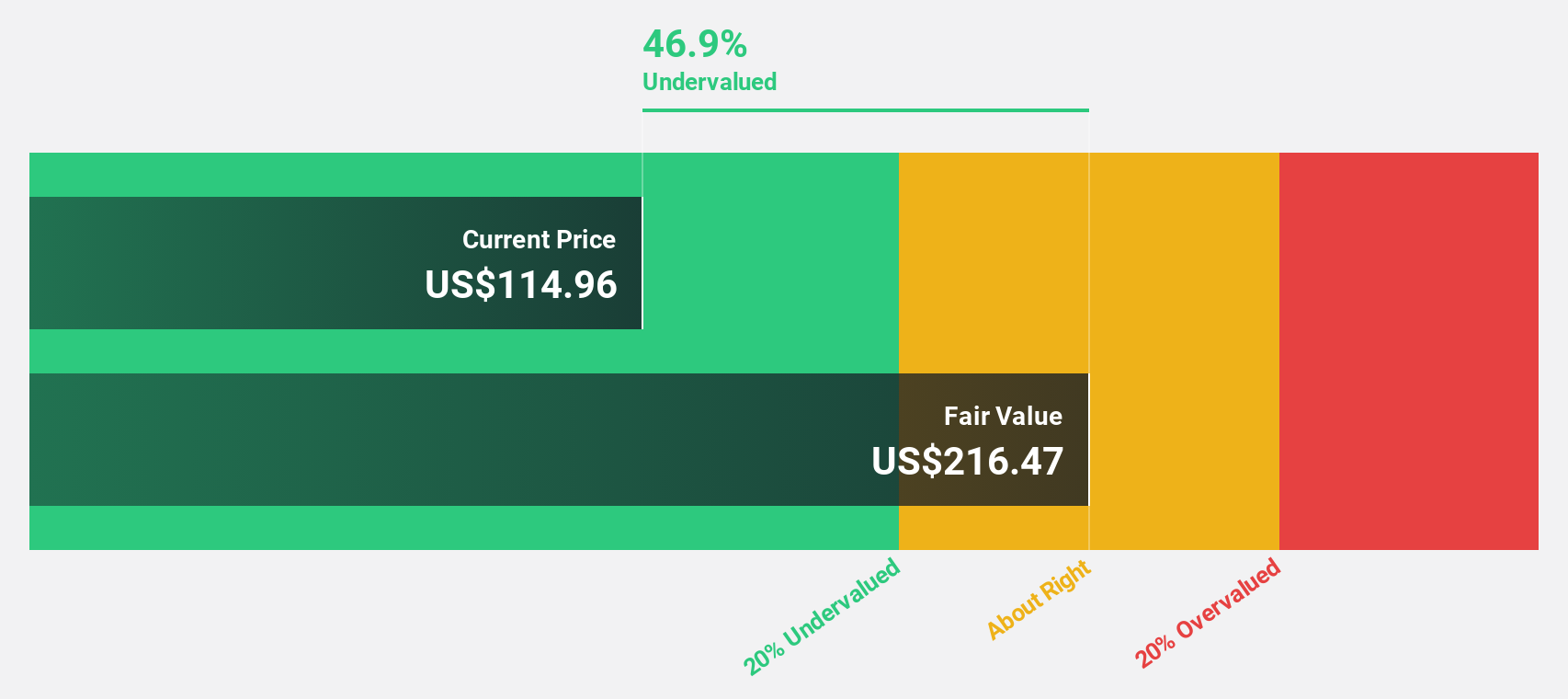

SharkNinja (SN)

Overview: SharkNinja, Inc. is a product design and technology company that offers consumer solutions in the United States, China, and internationally, with a market cap of approximately $16.08 billion.

Operations: SharkNinja generates revenue primarily from its Appliance & Tool segment, which amounts to $5.88 billion.

Estimated Discount To Fair Value: 30%

SharkNinja is trading at US$116.95, significantly below its estimated fair value of US$167.14, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth over the past year and forecasts a 16.71% annual profit increase, outpacing the broader market's growth expectations. Recent product innovations and strategic expansions into new markets could bolster future cash flow, though recent executive changes may introduce some operational uncertainties in the short term.

- According our earnings growth report, there's an indication that SharkNinja might be ready to expand.

- Get an in-depth perspective on SharkNinja's balance sheet by reading our health report here.

Key Takeaways

- Navigate through the entire inventory of 192 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives