- United States

- /

- Media

- /

- NasdaqGM:TTD

3 Stocks That Could Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As major U.S. stock indexes recently closed higher, rebounding from a losing week amidst concerns of a potential government shutdown, investors are keenly observing the market's movements and economic indicators. In this environment, identifying stocks that may be trading below their estimated fair value could present opportunities for those looking to capitalize on market fluctuations and broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trade Desk (TTD) | $49.64 | $96.49 | 48.6% |

| Phibro Animal Health (PAHC) | $39.15 | $77.67 | 49.6% |

| Northwest Bancshares (NWBI) | $12.43 | $24.41 | 49.1% |

| NeuroPace (NPCE) | $10.24 | $20.04 | 48.9% |

| Metropolitan Bank Holding (MCB) | $75.44 | $150.26 | 49.8% |

| Investar Holding (ISTR) | $23.13 | $44.89 | 48.5% |

| Horizon Bancorp (HBNC) | $16.13 | $31.76 | 49.2% |

| Glaukos (GKOS) | $81.28 | $161.55 | 49.7% |

| Customers Bancorp (CUBI) | $65.60 | $131.16 | 50% |

| AbbVie (ABBV) | $223.16 | $438.05 | 49.1% |

We're going to check out a few of the best picks from our screener tool.

Trade Desk (TTD)

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform for digital ad buyers, with a market cap of $23.05 billion.

Operations: The company's revenue primarily comes from its advertising technology platform, generating $2.68 billion.

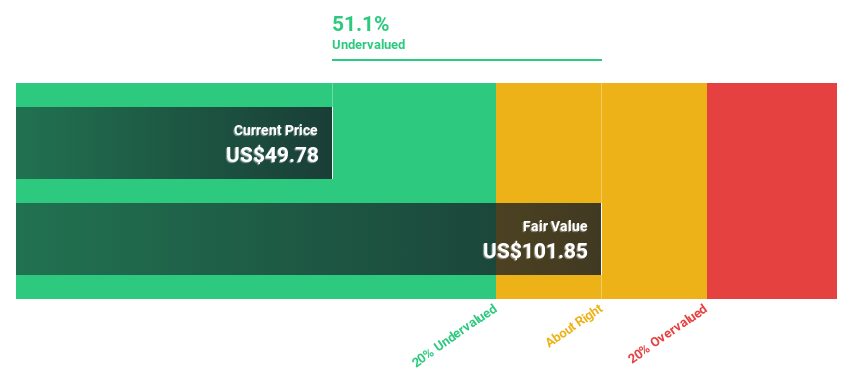

Estimated Discount To Fair Value: 48.6%

Trade Desk is trading at US$49.64, significantly below its estimated fair value of US$96.49, suggesting potential undervaluation based on cash flows. The company's earnings are projected to grow over 20% annually, outpacing the broader market's growth rate. Recent initiatives like Audience Unlimited could enhance revenue streams by offering advertisers cost-effective precision targeting solutions through AI-driven data integration, potentially boosting future cash flows and supporting the stock's valuation case amidst high share price volatility.

- The growth report we've compiled suggests that Trade Desk's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Trade Desk stock in this financial health report.

DoorDash (DASH)

Overview: DoorDash, Inc. operates a commerce platform linking merchants, consumers, and independent contractors in the U.S. and internationally, with a market cap of $112.13 billion.

Operations: Revenue for the company is primarily generated from its Internet Information Providers segment, amounting to $11.90 billion.

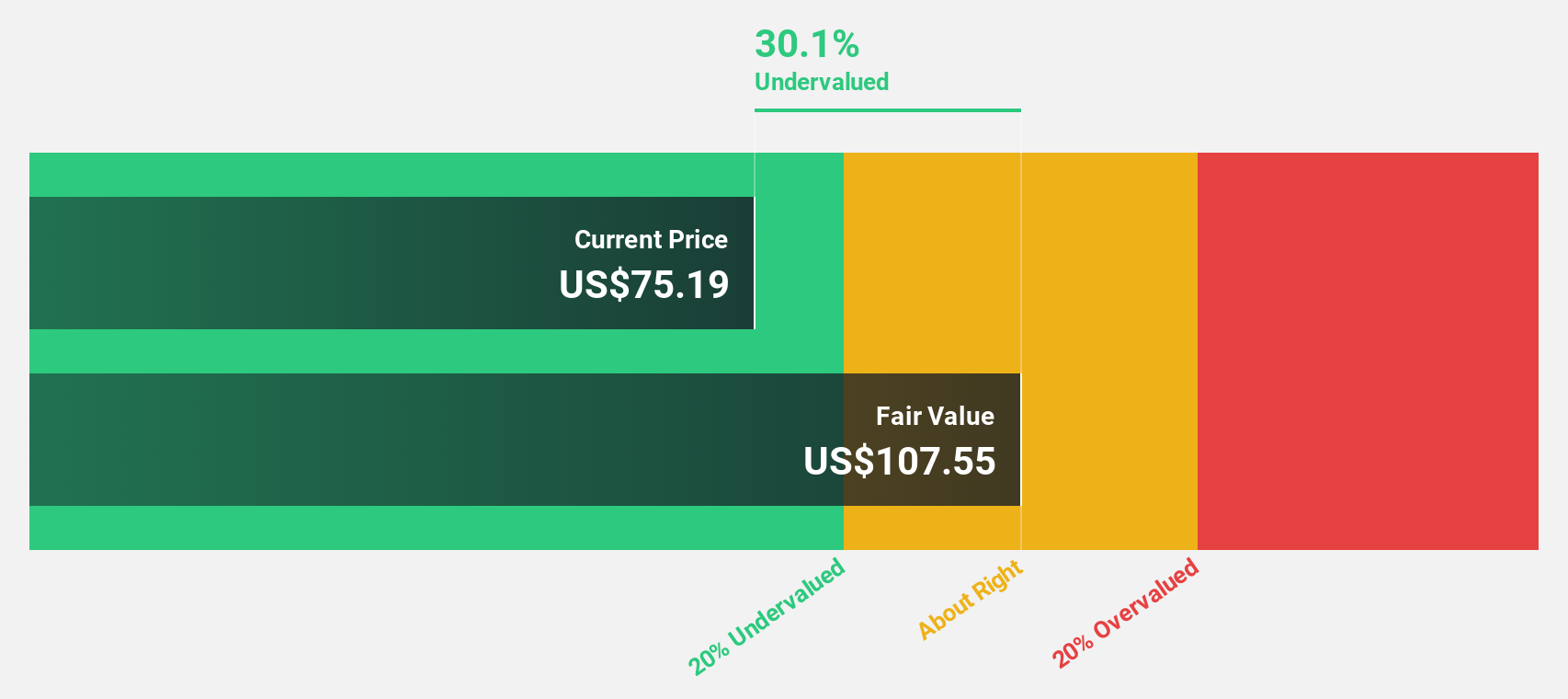

Estimated Discount To Fair Value: 26.1%

DoorDash, trading at US$272.5, is valued below its estimated fair value of US$368.86, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow significantly over the next three years, surpassing the broader market's growth rate. Recent partnerships with Kroger and Brex could enhance revenue streams by expanding delivery offerings and workplace perks, potentially supporting future cash flow improvements despite recent insider selling activity.

- Our expertly prepared growth report on DoorDash implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of DoorDash.

Estée Lauder Companies (EL)

Overview: The Estée Lauder Companies Inc. is a global manufacturer, marketer, and seller of skincare, makeup, fragrance, and hair care products with a market cap of approximately $31.23 billion.

Operations: The company's revenue is primarily generated from skin care products at $6.96 billion, followed by makeup at $4.21 billion, fragrance at $2.49 billion, and hair care products contributing $565 million.

Estimated Discount To Fair Value: 19.9%

Estée Lauder, trading at US$89.13, is slightly undervalued against its estimated fair value of US$111.23 based on cash flows. Despite recent losses and slower revenue growth compared to the market, earnings are projected to grow significantly over the next three years. Recent executive changes, including a new Chief Research & Innovation Officer, aim to enhance product innovation and sustainability efforts, potentially supporting future financial performance amidst current challenges with debt coverage by operating cash flow.

- Insights from our recent growth report point to a promising forecast for Estée Lauder Companies' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Estée Lauder Companies.

Turning Ideas Into Actions

- Investigate our full lineup of 196 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives