- United States

- /

- Entertainment

- /

- NYSE:SE

3 Stocks Including Grab Holdings That May Be Undervalued For Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced a notable 12% rise over the past year with earnings forecasted to grow by 15% annually. In such an environment, identifying undervalued stocks can offer potential opportunities for investors seeking to enhance their portfolios by focusing on companies that may be trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $14.98 | $29.30 | 48.9% |

| Rapid7 (RPD) | $22.56 | $43.72 | 48.4% |

| Hess Midstream (HESM) | $38.18 | $73.29 | 47.9% |

| Freshpet (FRPT) | $69.39 | $133.26 | 47.9% |

| FB Financial (FBK) | $48.14 | $93.90 | 48.7% |

| Definitive Healthcare (DH) | $4.02 | $7.83 | 48.6% |

| Carter Bankshares (CARE) | $17.93 | $35.50 | 49.5% |

| Camden National (CAC) | $41.89 | $83.75 | 50% |

| ACNB (ACNB) | $43.09 | $85.05 | 49.3% |

| Acadia Realty Trust (AKR) | $18.72 | $36.72 | 49% |

We'll examine a selection from our screener results.

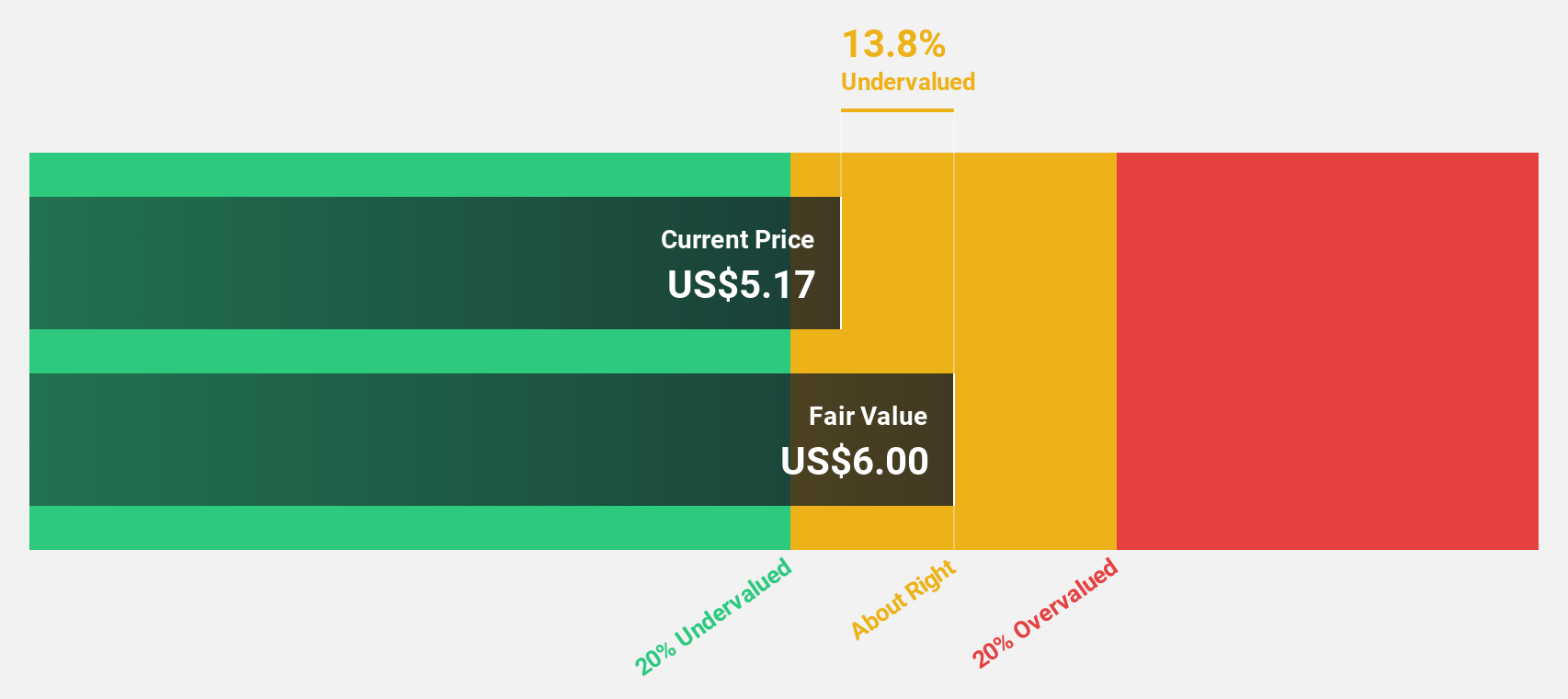

Grab Holdings (GRAB)

Overview: Grab Holdings Limited operates as a provider of superapps across Southeast Asia, offering a range of services including transportation, food delivery, and digital payments, with a market cap of $20.78 billion.

Operations: The company's revenue is primarily derived from its Mobility segment at $1.08 billion, Deliveries at $1.56 billion, and Financial Services contributing $273 million.

Estimated Discount To Fair Value: 23.3%

Grab Holdings is trading at US$5.13, 23.3% below its estimated fair value of US$6.69, suggesting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 40.6% per year, outpacing the broader US market's growth rate and becoming profitable this year with a net income of US$10 million in Q1 2025. However, revenue growth forecasts are moderate at 14.3%, and the company's Return on Equity remains low at a projected 8.6%. Recent developments include a $1.5 billion fixed-income offering and ongoing M&A discussions with Indonesia’s GoTo Group.

- Our expertly prepared growth report on Grab Holdings implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Grab Holdings.

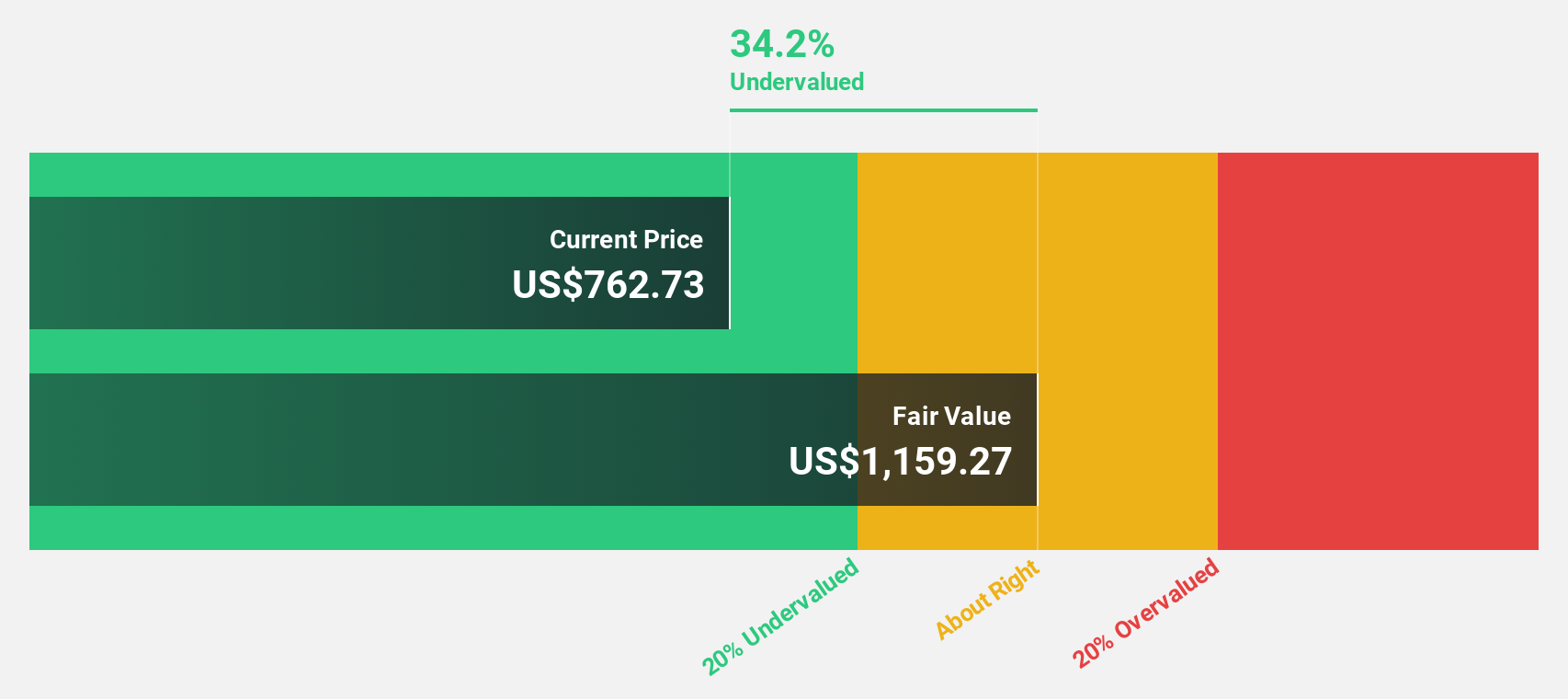

Eli Lilly (LLY)

Overview: Eli Lilly and Company is engaged in the discovery, development, and marketing of human pharmaceuticals across the United States, Europe, China, Japan, and other international markets with a market cap of approximately $692.83 billion.

Operations: Eli Lilly generates its revenue primarily from the discovery, development, manufacturing, marketing, and sales of pharmaceutical products, totaling $49.00 billion.

Estimated Discount To Fair Value: 36.1%

Eli Lilly's stock is trading at US$789.8, significantly below its estimated fair value of US$1,236.53, presenting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 22.4% annually over the next three years, outpacing the broader US market's growth rate. Despite high debt levels and reliance on non-cash earnings, recent FDA approval for Kisunla in Alzheimer's treatment could bolster future revenue streams and enhance profitability prospects.

- The analysis detailed in our Eli Lilly growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Eli Lilly.

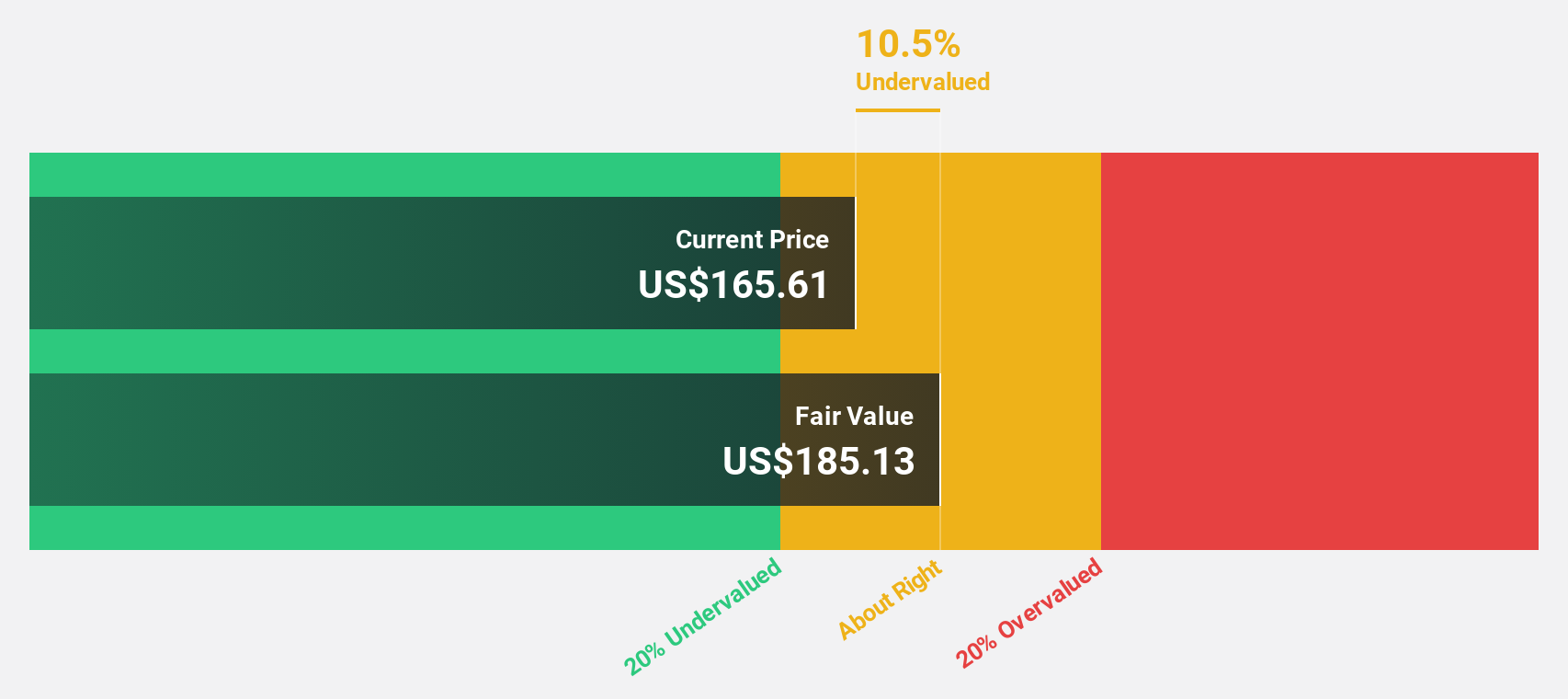

Sea (SE)

Overview: Sea Limited operates as a consumer internet company through its subsidiaries, serving markets in Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of approximately $93.69 billion.

Operations: Sea Limited generates revenue through several segments, including E-Commerce ($13.19 billion), Digital Entertainment ($1.95 billion), and Digital Financial Services ($2.66 billion).

Estimated Discount To Fair Value: 18.8%

Sea Limited's stock, trading at US$161.3, is undervalued relative to its estimated fair value of US$198.64. The company's earnings are projected to grow significantly at 30.18% annually, surpassing the broader US market growth rate. Recent earnings reports show a substantial turnaround with net income reaching US$403.05 million from a loss last year, highlighting improved profitability and cash flow strength despite revenue growth forecasts trailing behind the 20% mark annually.

- In light of our recent growth report, it seems possible that Sea's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Sea's balance sheet health report.

Next Steps

- Click this link to deep-dive into the 174 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives