- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

3 Stocks Estimated To Be Up To 49.9% Below Their Intrinsic Value

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has seen an 18% increase over the past year with earnings projected to grow by 15% annually. In this context, identifying stocks that are potentially undervalued can be a strategic move for investors seeking opportunities where current prices may not fully reflect intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sotera Health (SHC) | $12.11 | $24.19 | 49.9% |

| Semrush Holdings (SEMR) | $9.58 | $19.08 | 49.8% |

| Roku (ROKU) | $90.05 | $174.73 | 48.5% |

| Rapid7 (RPD) | $22.53 | $43.87 | 48.6% |

| Hims & Hers Health (HIMS) | $57.32 | $114.17 | 49.8% |

| FB Financial (FBK) | $48.09 | $93.90 | 48.8% |

| Definitive Healthcare (DH) | $4.00 | $7.90 | 49.4% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $21.74 | $43.44 | 50% |

| ACNB (ACNB) | $42.67 | $84.73 | 49.6% |

| Acadia Realty Trust (AKR) | $18.95 | $36.77 | 48.5% |

Let's review some notable picks from our screened stocks.

Celsius Holdings (CELH)

Overview: Celsius Holdings, Inc. is involved in the development, processing, manufacturing, marketing, selling, and distribution of functional energy drinks across various regions including the United States, North America, Europe, and the Asia Pacific with a market cap of $11.95 billion.

Operations: The company's revenue primarily comes from its non-alcoholic beverages segment, generating $1.33 billion.

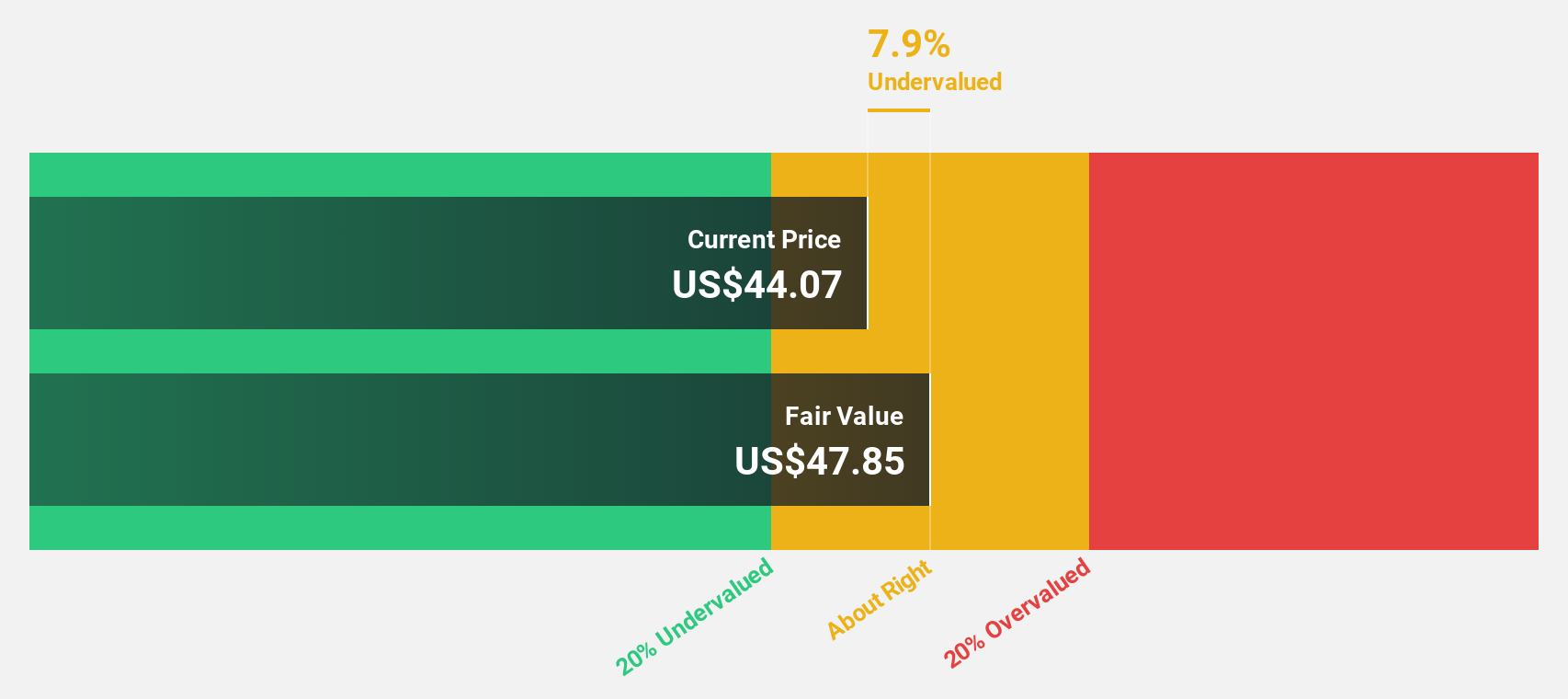

Estimated Discount To Fair Value: 10.3%

Celsius Holdings, trading at US$46.31, is undervalued relative to its estimated fair value of US$51.6. Despite a recent decline in profit margins and net income, the company anticipates significant earnings growth of 31.8% annually over the next three years, surpassing market averages. Recent amendments to increase authorized shares and shelf registration filings indicate potential capital raising efforts, which could impact future valuations but may also support growth initiatives.

- Our expertly prepared growth report on Celsius Holdings implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Celsius Holdings with our detailed financial health report.

Sotera Health (SHC)

Overview: Sotera Health Company offers sterilization, lab testing, and advisory services to the healthcare industry across the United States, Canada, Europe, and internationally with a market cap of $3.36 billion.

Operations: The company's revenue is derived from three segments: Nordion ($181.91 million), Nelson Labs ($223.84 million), and Sterigenics ($701.04 million).

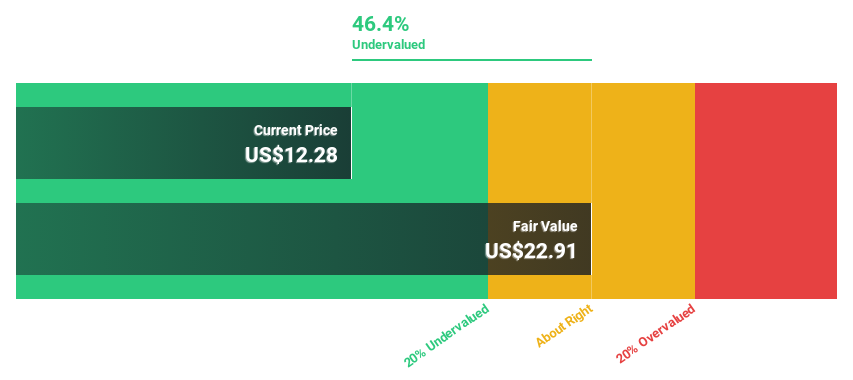

Estimated Discount To Fair Value: 49.9%

Sotera Health is trading at US$12.11, significantly below its estimated fair value of US$24.19, suggesting it may be undervalued based on cash flows. Despite a net loss in the recent quarter and lower profit margins compared to last year, earnings are forecast to grow significantly at 49.2% annually over the next three years. Recent additions to multiple Russell growth indices highlight increased market visibility, potentially enhancing investor interest despite current financial challenges.

- Upon reviewing our latest growth report, Sotera Health's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Sotera Health's balance sheet health report.

MINISO Group Holding (MNSO)

Overview: MINISO Group Holding Limited is an investment holding company involved in the retail and wholesale of lifestyle and pop toy products across China, Asia, the Americas, Europe, Indonesia, and globally with a market cap of approximately $5.37 billion.

Operations: The company generates revenue from its MINISO Brand, excluding Africa and Germany, amounting to CN¥16.60 billion, and from its TOP TOY Brand at CN¥1.12 billion.

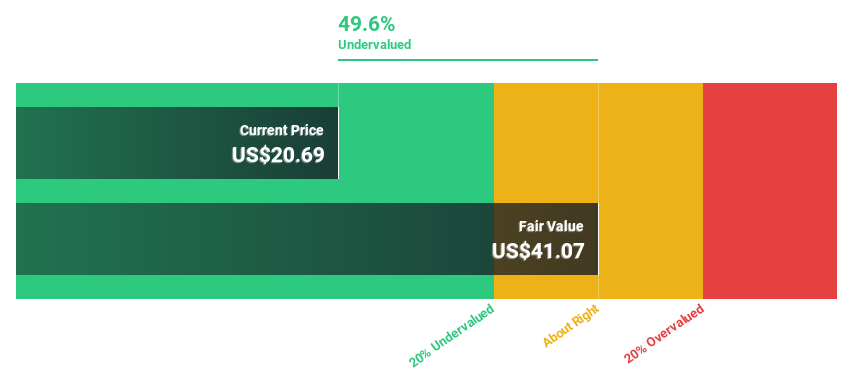

Estimated Discount To Fair Value: 41.4%

MINISO Group Holding, trading at US$18.95, is valued 41.4% below its estimated fair value of US$32.34, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly by 21.2% annually over the next three years, outpacing the broader U.S. market's growth rate of 14.9%. However, its dividend yield of 3.45% isn't well-supported by free cash flows, which may warrant investor caution despite robust profit forecasts and strategic expansions in Canada and planned IPOs for Top Toy in Hong Kong.

- In light of our recent growth report, it seems possible that MINISO Group Holding's financial performance will exceed current levels.

- Get an in-depth perspective on MINISO Group Holding's balance sheet by reading our health report here.

Next Steps

- Delve into our full catalog of 169 Undervalued US Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives