- United States

- /

- Media

- /

- NYSE:OMC

3 Reliable Dividend Stocks Yielding Up To 4.3%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with tech stocks slumping after recent highs, investors are closely monitoring developments in trade talks and potential interest rate cuts by the Federal Reserve. In this environment of uncertainty, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to navigate through volatile markets.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.93% | ★★★★★☆ |

| Universal (UVV) | 5.63% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.37% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.70% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.52% | ★★★★★★ |

| Ennis (EBF) | 5.51% | ★★★★★★ |

| Dillard's (DDS) | 6.22% | ★★★★★★ |

| Credicorp (BAP) | 4.93% | ★★★★★☆ |

| Columbia Banking System (COLB) | 6.16% | ★★★★★★ |

| Chevron (CVX) | 4.78% | ★★★★★★ |

Click here to see the full list of 146 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

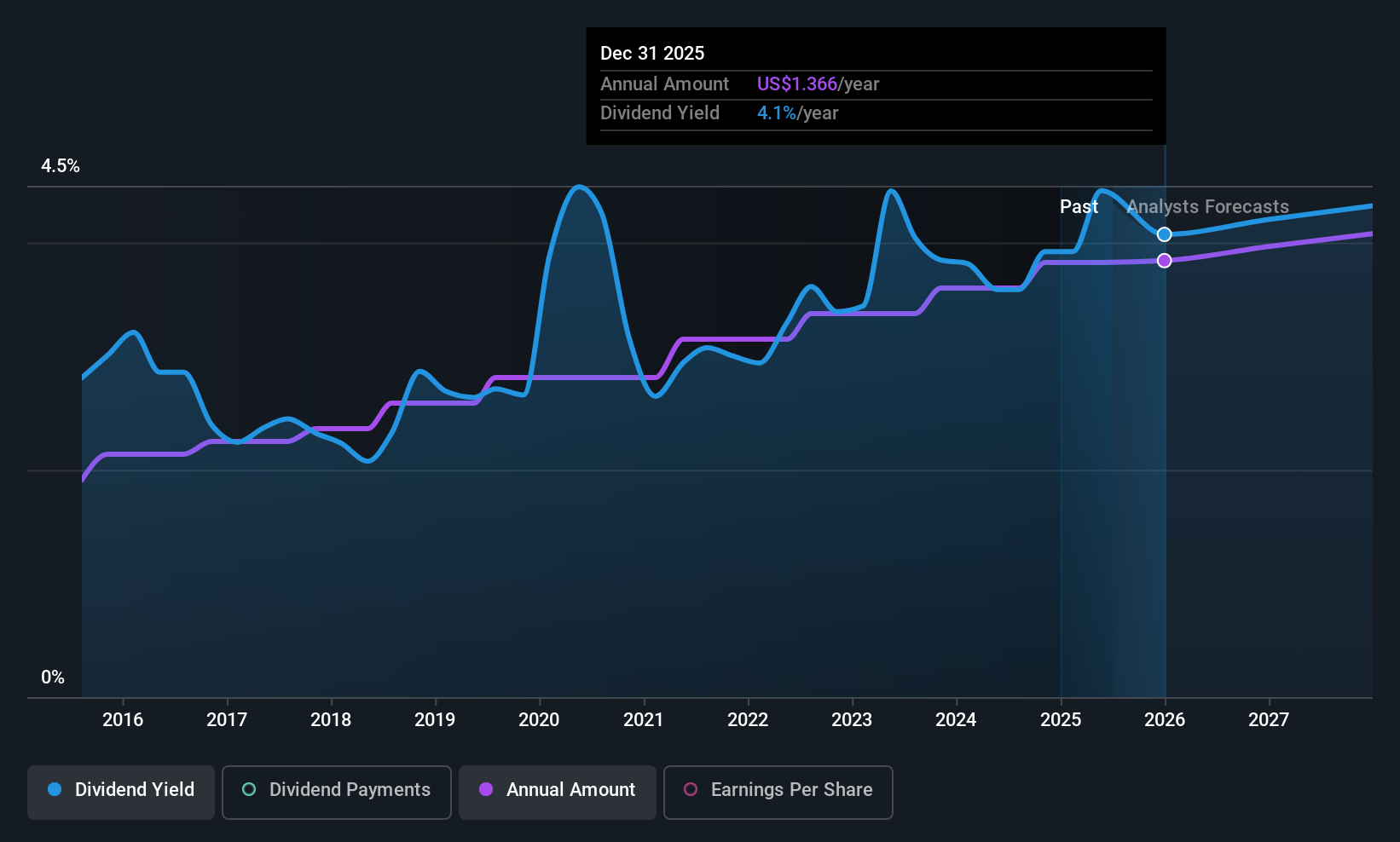

Atlantic Union Bankshares (AUB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Atlantic Union Bankshares Corporation is a bank holding company for Atlantic Union Bank, offering banking and financial services to consumers and businesses in the United States, with a market cap of approximately $4.45 billion.

Operations: Atlantic Union Bankshares Corporation generates its revenue primarily from Consumer Banking, which accounts for $359.18 million, and Wholesale Banking, contributing $394.66 million.

Dividend Yield: 4.3%

Atlantic Union Bankshares offers a stable dividend with a current yield of 4.35%, though it falls short of the top 25% in the US market. The company's dividends are well-covered by earnings, with a payout ratio currently at 60% and forecasted to improve to 36.6% in three years, suggesting sustainability. Recent executive changes include the planned retirement of CFO Robert M. Gorman, which may impact strategic direction but doesn't immediately affect dividend reliability or growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Atlantic Union Bankshares.

- The valuation report we've compiled suggests that Atlantic Union Bankshares' current price could be quite moderate.

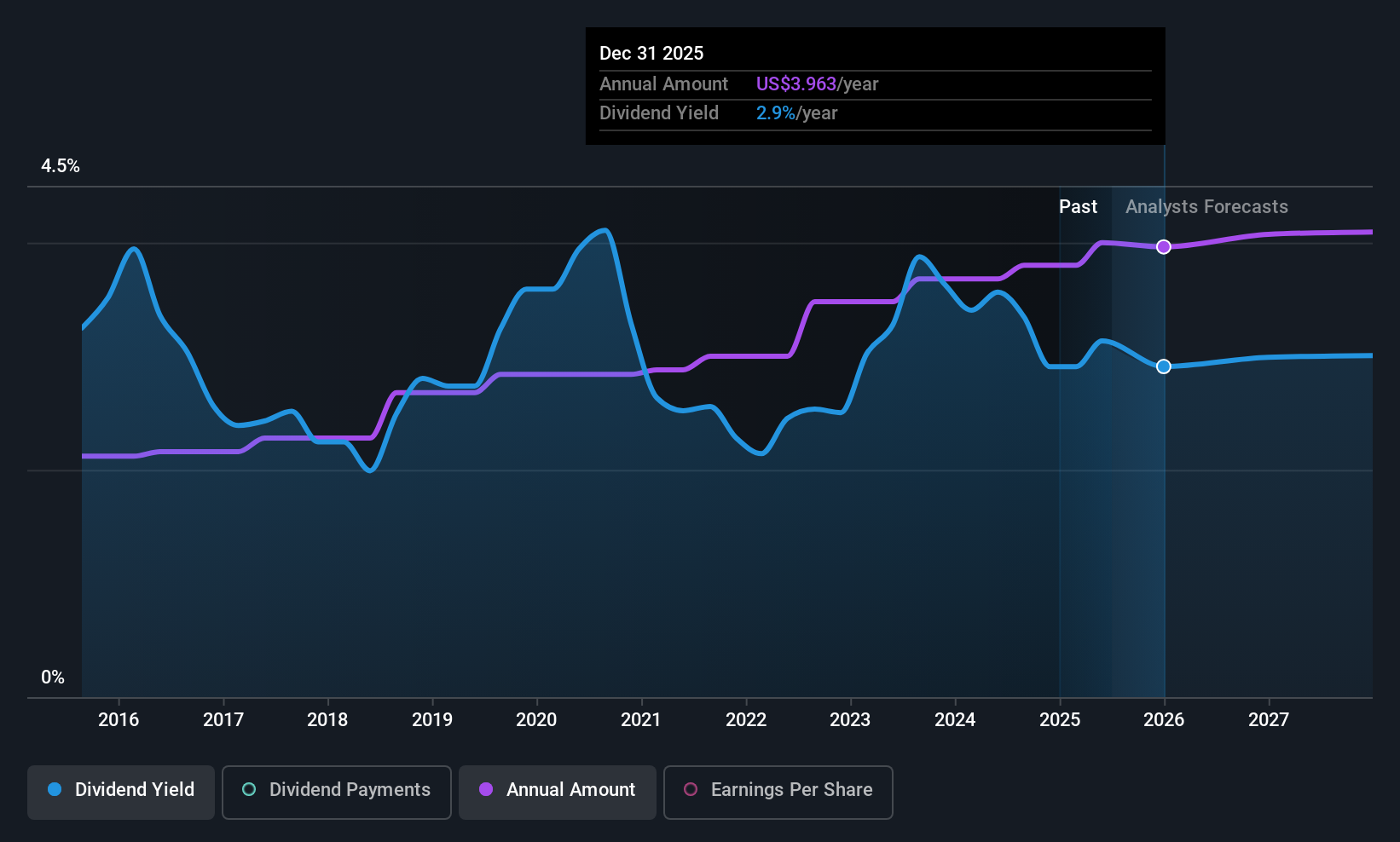

Cullen/Frost Bankers (CFR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cullen/Frost Bankers, Inc. is the bank holding company for Frost Bank, offering commercial and consumer banking services in Texas, with a market cap of approximately $8.29 billion.

Operations: Cullen/Frost Bankers, Inc. generates revenue primarily from its Banking segment with $1.84 billion and Frost Wealth Advisors contributing $209.17 million.

Dividend Yield: 3.1%

Cullen/Frost Bankers maintains a stable dividend history with recent growth, increasing its quarterly payout to US$1.00 per share. Despite a yield of 3.11% being below the top 25% in the US market, dividends are well-covered by earnings, reflected in a current payout ratio of 41.3%. The company's addition to the Russell 1000 Value-Defensive Index underscores its defensive qualities, while raised earnings guidance suggests potential for continued dividend reliability and growth.

- Get an in-depth perspective on Cullen/Frost Bankers' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Cullen/Frost Bankers is trading beyond its estimated value.

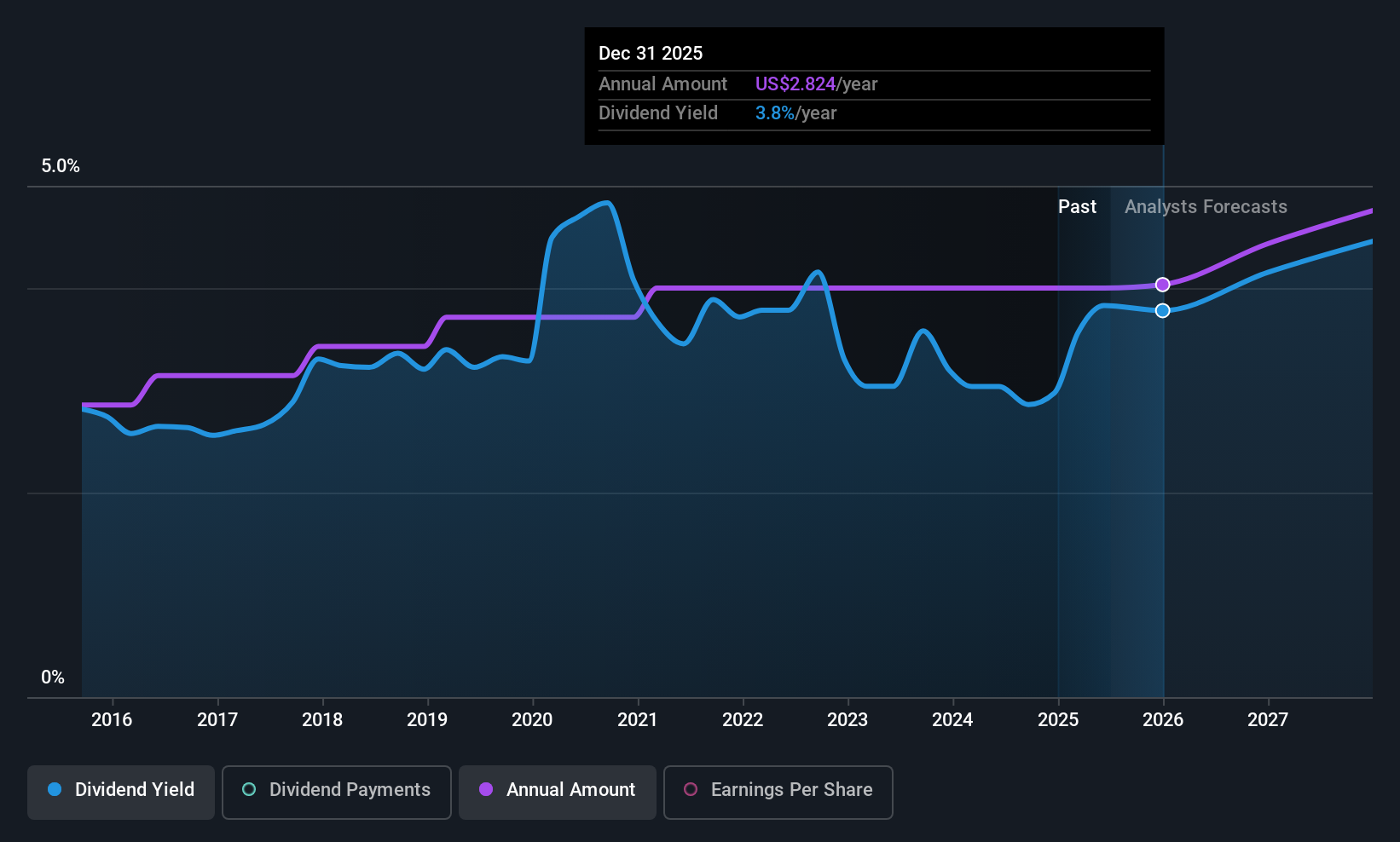

Omnicom Group (OMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Omnicom Group Inc., along with its subsidiaries, provides advertising, marketing, and corporate communications services with a market cap of approximately $13.92 billion.

Operations: Omnicom Group Inc. generates revenue of $15.75 billion from its advertising, marketing, and corporate communications services industry.

Dividend Yield: 3.9%

Omnicom Group's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 37.9% and a stable history over the past decade. The recent quarterly dividend is US$0.70 per share, although its yield of 3.89% trails the top quartile in the US market. Recent strategic partnerships and acquisition talks suggest an active growth strategy, yet high debt levels may be a concern for some investors focusing on financial stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Omnicom Group.

- Insights from our recent valuation report point to the potential undervaluation of Omnicom Group shares in the market.

Seize The Opportunity

- Get an in-depth perspective on all 146 Top US Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMC

Omnicom Group

Offers advertising, marketing, and corporate communications services.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives