- United States

- /

- Consumer Services

- /

- NYSE:CHGG

3 Promising Penny Stocks With Market Caps Below $600M

Reviewed by Simply Wall St

As the U.S. market faces a challenging period with tech stocks under pressure and major indices experiencing losses, investors are exploring alternative opportunities to diversify their portfolios. Penny stocks, though often seen as remnants of past market trends, continue to offer potential for growth when backed by strong financials. This article will explore three promising penny stocks that stand out for their financial resilience and potential to deliver value in today's uncertain economic climate.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.71 | $375.03M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.59 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9908 | $174.44M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $4.27 | $736.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.90 | $55.56M | ✅ 5 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.90 | $249.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.79 | $1.01B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.88 | $6.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.05 | $69.78M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 368 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Black Diamond Therapeutics (BDTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Black Diamond Therapeutics, Inc. is a clinical-stage oncology company specializing in the discovery and development of MasterKey therapies for genetically defined tumors, with a market cap of $220.34 million.

Operations: Black Diamond Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $220.34M

Black Diamond Therapeutics, Inc., a clinical-stage oncology company, has recently transitioned to profitability, reporting net income of US$37.48 million for the first nine months of 2025 compared to a loss in the previous year. With no debt and strong short-term assets exceeding liabilities, its financial position is robust. Despite having high-quality earnings and an experienced management team, its return on equity remains low at 17%. The company's Price-To-Earnings ratio of 10.5x suggests it may be undervalued compared to the broader market. However, earnings are projected to decline significantly over the next three years.

- Jump into the full analysis health report here for a deeper understanding of Black Diamond Therapeutics.

- Review our growth performance report to gain insights into Black Diamond Therapeutics' future.

Stitch Fix (SFIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stitch Fix, Inc. operates in the United States, providing clothing and accessories, with a market cap of approximately $568.37 million.

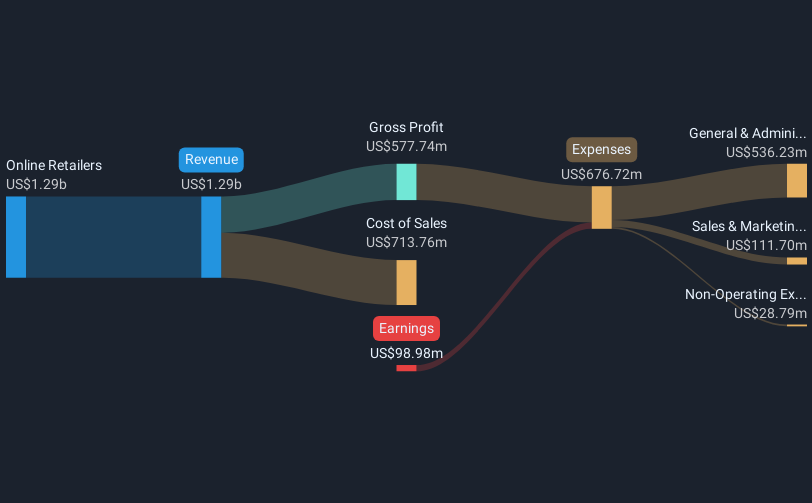

Operations: The company's revenue is primarily derived from its online retail segment, which generated $1.27 billion.

Market Cap: $568.37M

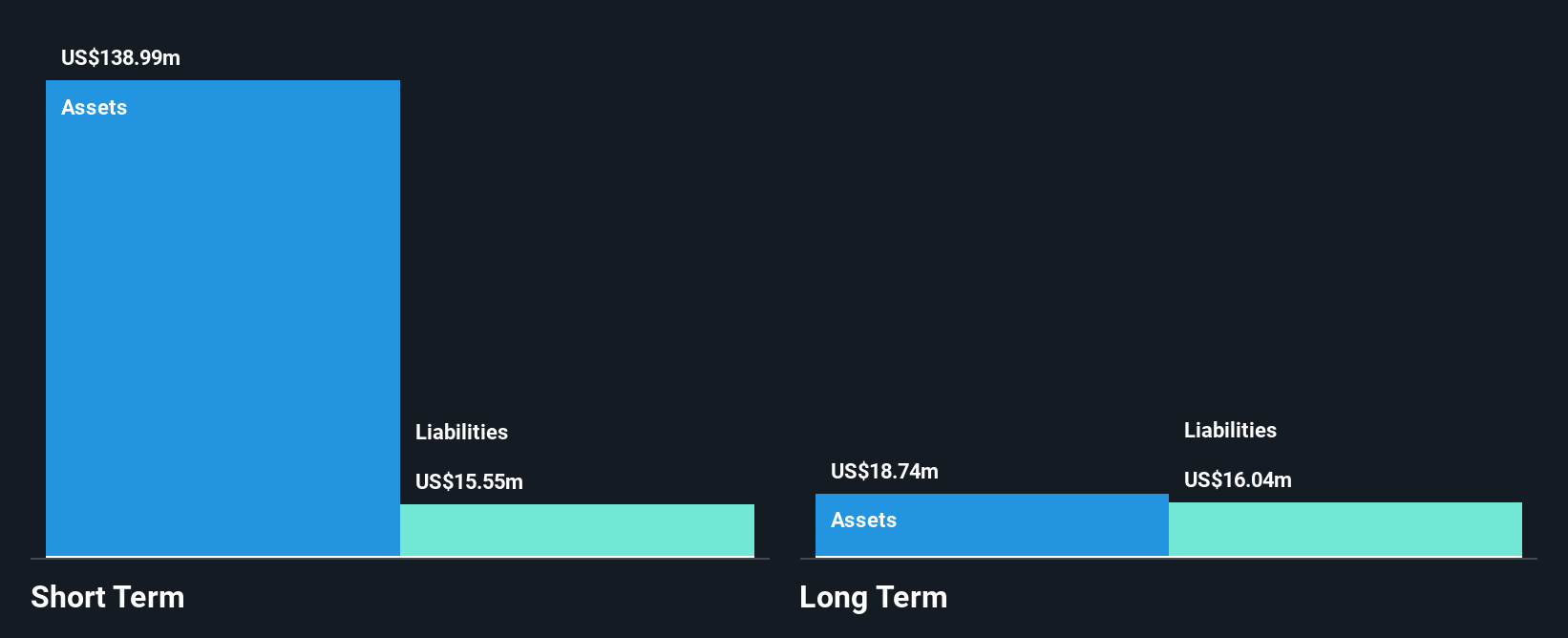

Stitch Fix, Inc. has a market cap of approximately US$568.37 million and reported revenue of US$1.27 billion, though it remains unprofitable with a net loss of US$28.74 million for the fiscal year ending August 2025. Despite this, the company maintains a strong financial position with short-term assets exceeding both its short and long-term liabilities, and no debt on its balance sheet for the past five years. Recent innovations like Stitch Fix Vision aim to enhance customer engagement through personalized styling experiences powered by generative AI, potentially positioning Stitch Fix to leverage its extensive client data for future growth opportunities.

- Click here and access our complete financial health analysis report to understand the dynamics of Stitch Fix.

- Assess Stitch Fix's future earnings estimates with our detailed growth reports.

Chegg (CHGG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chegg, Inc. offers personalized learning assistance to students globally, focusing on academic and skill development, with a market cap of approximately $99.66 million.

Operations: The company's revenue is derived from its Educational Services segment, specifically within Education & Training Services, which generated $506.58 million.

Market Cap: $99.66M

Chegg, Inc., with a market cap of approximately US$99.66 million, is navigating challenges typical of many penny stocks. Despite being unprofitable and not expected to achieve profitability in the near term, Chegg maintains a solid cash runway exceeding three years due to positive free cash flow. Recent strategic shifts include significant workforce reductions and leadership changes, with Dan Rosensweig resuming his role as CEO. The company trades significantly below its estimated fair value and has reduced its debt-to-equity ratio over five years while dealing with volatility in share price and increased losses over the past five years.

- Click to explore a detailed breakdown of our findings in Chegg's financial health report.

- Gain insights into Chegg's future direction by reviewing our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 368 US Penny Stocks here.

- Looking For Alternative Opportunities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHGG

Chegg

Provides individualized learning support to students that helps build essential academic, life, and job skills to achieve success in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)