- United States

- /

- Metals and Mining

- /

- NYSEAM:UAMY

3 Promising Penny Stocks With Market Caps Below $500M

Reviewed by Simply Wall St

As the U.S. market inches higher amid ongoing trade policy uncertainties, investors are keeping a close eye on developments that could impact economic growth and inflation. Penny stocks, though often considered a relic of past speculative booms, remain relevant for those seeking opportunities in smaller or newer companies. These stocks can offer significant potential when backed by strong financials and growth prospects, providing a unique avenue for investors looking to discover promising under-the-radar companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.43 | $513.56M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9214 | $148.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.37 | $243.42M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.73 | $443.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $97.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $2.06 | $36.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.85 | $6.15M | ✅ 2 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $5.00 | $46.41M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.51 | $431.16M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 424 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

United States Antimony (UAMY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United States Antimony Corporation is involved in the production and sale of antimony, zeolite, and precious metals across the United States and Canada, with a market cap of approximately $269.17 million.

Operations: The company's revenue is primarily derived from its antimony segment, which generated $15.43 million, and its zeolite segment, contributing $3.43 million.

Market Cap: $269.17M

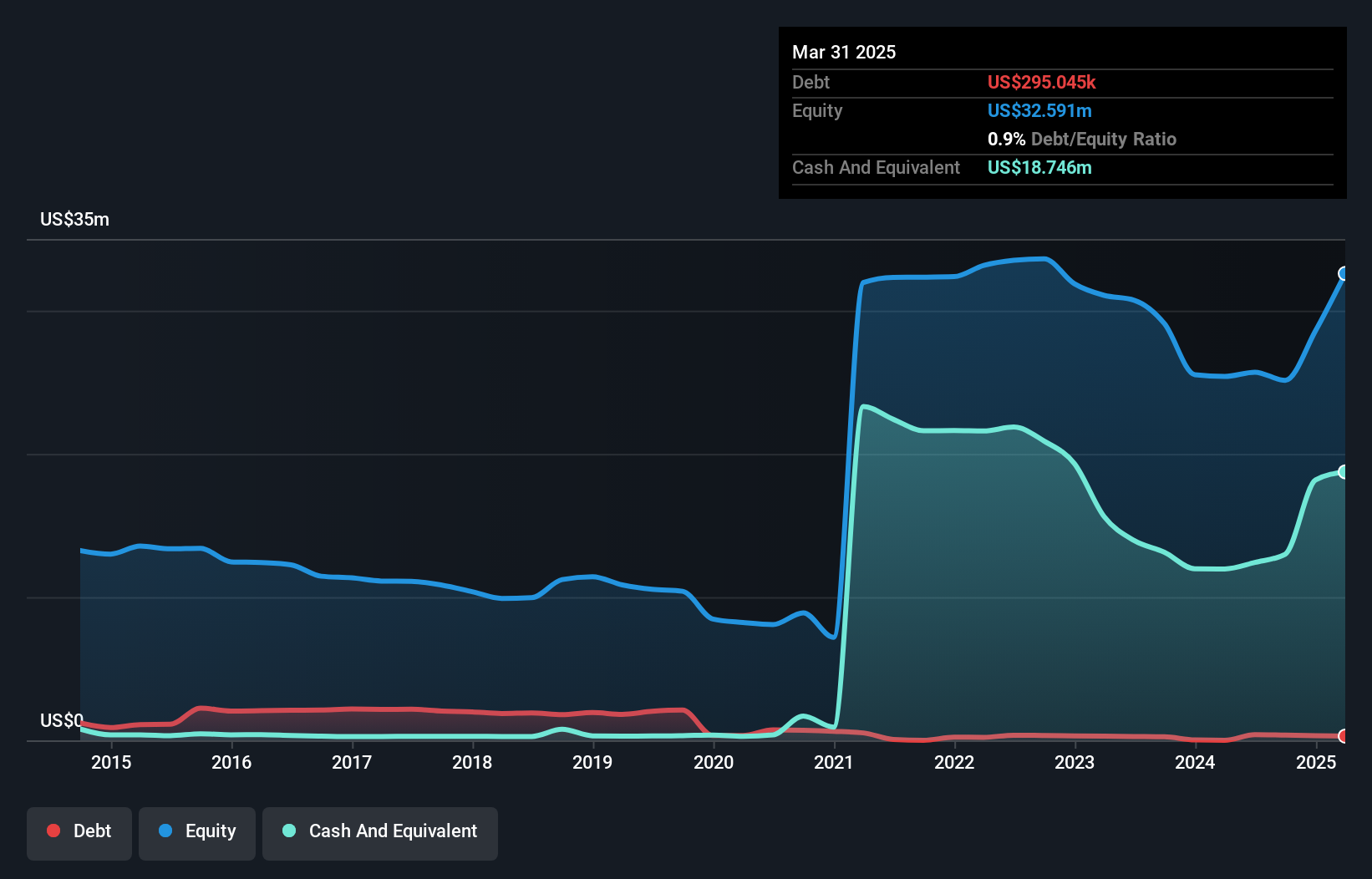

United States Antimony Corporation, with a market cap of approximately US$269.17 million, recently experienced significant index inclusions, being added to multiple Russell indices. The company reported first-quarter sales of US$7 million and a net income of US$0.55 million, marking an improvement from the previous year's loss. While it has more cash than debt and covers both short- and long-term liabilities with its assets, it remains unprofitable with volatile share prices and a negative return on equity. Despite this, analysts anticipate substantial stock price growth potential at 120.4%, although management's inexperience may pose challenges.

- Jump into the full analysis health report here for a deeper understanding of United States Antimony.

- Examine United States Antimony's earnings growth report to understand how analysts expect it to perform.

VAALCO Energy (EGY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: VAALCO Energy, Inc. is an independent energy company focused on the acquisition, exploration, development, and production of crude oil, natural gas, and natural gas liquids in Gabon, Egypt, Equatorial Guinea, Cote d'Ivoire, and Canada with a market cap of $397.63 million.

Operations: The company generates revenue of $489.16 million from its activities in the exploration and production of hydrocarbons.

Market Cap: $397.63M

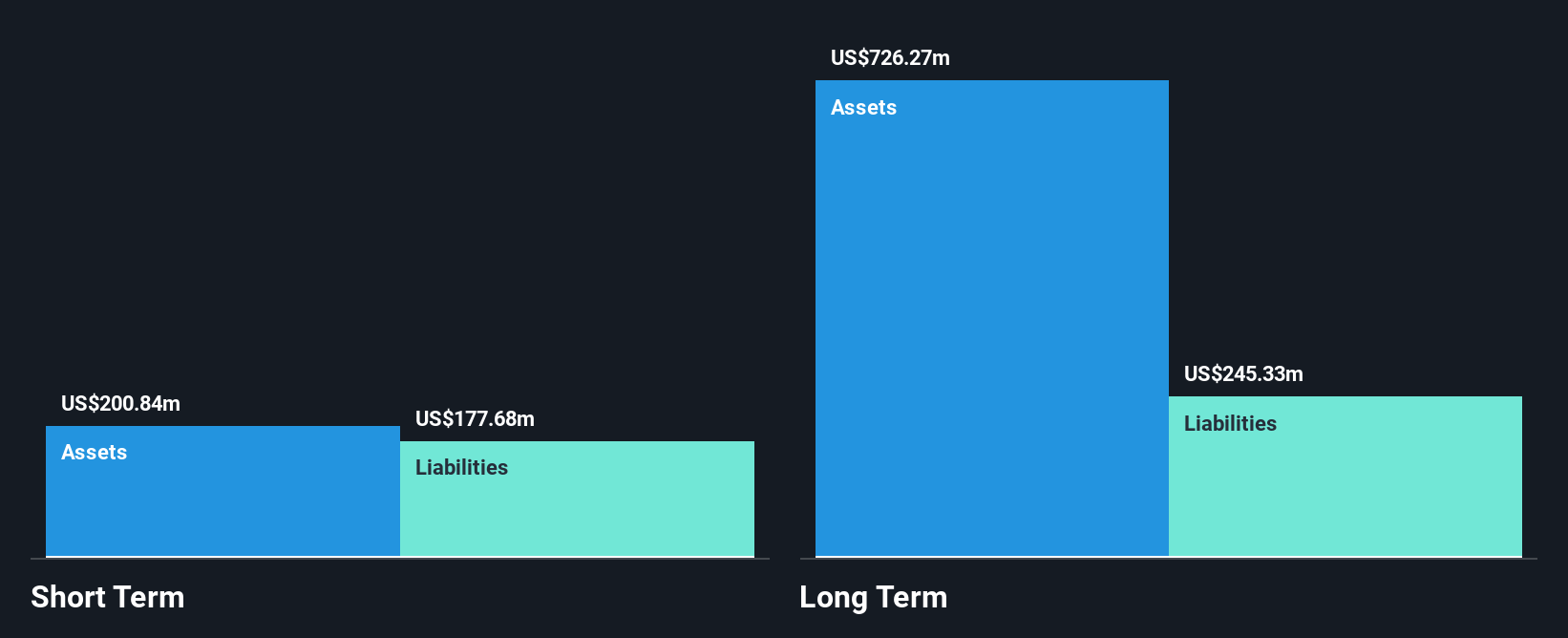

VAALCO Energy, Inc., with a market cap of US$397.63 million, recently joined several Russell 2000 indices, highlighting its growing recognition. The company reported first-quarter net income of US$7.73 million and maintains high-quality earnings without debt concerns. However, its short-term assets do not cover long-term liabilities, and it faces declining earnings forecasts over the next three years. Despite stable weekly volatility and an experienced board and management team, VAALCO's dividend is not well covered by free cash flows, posing potential risks for investors seeking sustainable returns in the penny stock arena.

- Click here to discover the nuances of VAALCO Energy with our detailed analytical financial health report.

- Evaluate VAALCO Energy's prospects by accessing our earnings growth report.

TETRA Technologies (TTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company with a market cap of $431.16 million.

Operations: The company generates revenue through its Water & Flowback Services segment, which contributed $278.24 million, and its Completion Fluids & Products segment, which brought in $327.04 million.

Market Cap: $431.16M

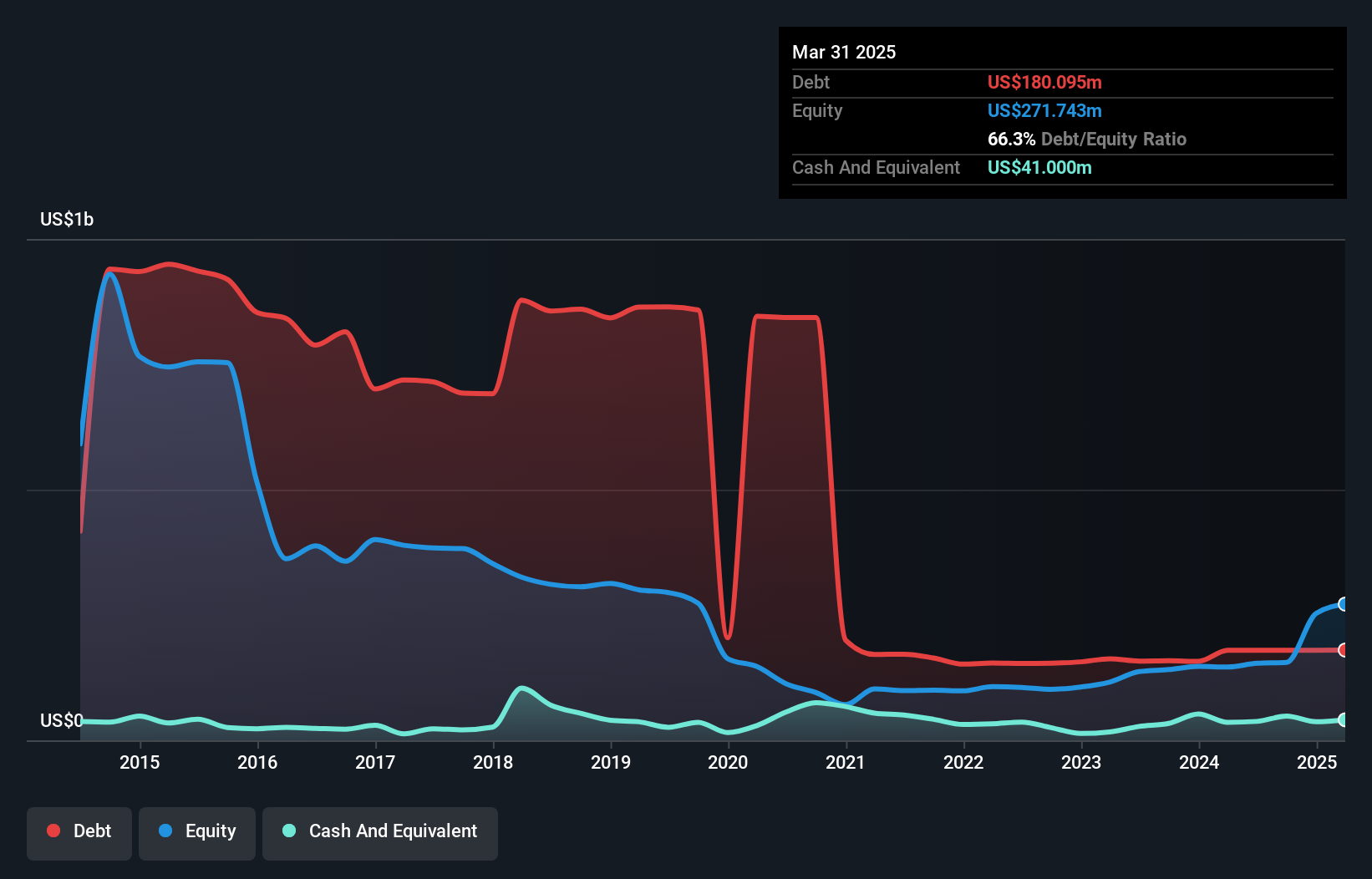

TETRA Technologies, Inc., with a market cap of US$431.16 million, has recently shifted focus from growth to value indices, reflecting its evolving market perception. The company reported first-quarter revenue of US$157.14 million and net income of US$4.05 million, showing significant profit growth over the past year. TETRA's debt levels have improved substantially over five years, yet interest coverage remains a concern with EBIT covering interest payments only 2.8 times. Despite high non-cash earnings and seasoned management, investors should consider the implications of recent index reclassifications and ongoing challenges in managing debt effectively within the penny stock landscape.

- Click to explore a detailed breakdown of our findings in TETRA Technologies' financial health report.

- Explore TETRA Technologies' analyst forecasts in our growth report.

Turning Ideas Into Actions

- Jump into our full catalog of 424 US Penny Stocks here.

- Curious About Other Options? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UAMY

United States Antimony

Produces and sells antimony, zeolite, and precious metals in the United States and Canada.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives