- Singapore

- /

- Healthcare Services

- /

- SGX:BSL

3 Promising Asian Penny Stocks With Market Caps Below US$2B

Reviewed by Simply Wall St

As global markets react to economic shifts and monetary policy changes, investors are increasingly looking towards Asia for potential opportunities. Penny stocks, a term often associated with speculative investments, can still hold significant promise when backed by strong financials. In this article, we explore several Asian penny stocks that exhibit solid fundamentals and could offer growth potential for those interested in exploring smaller or newer companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.68 | HK$2.19B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.46 | HK$903.04M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.975 | SGD395.16M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.21 | ₱843.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.02 | NZ$252.29M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 970 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Greentown Service Group (SEHK:2869)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greentown Service Group Co. Ltd., along with its subsidiaries, offers residential property management services in the People's Republic of China and internationally, with a market cap of HK$13.99 billion.

Operations: The company's revenue is primarily derived from Property Services (CN¥13.02 billion), Consulting Services (CN¥2.42 billion), and Community Living Services excluding Technology Services (CN¥2.65 billion).

Market Cap: HK$14B

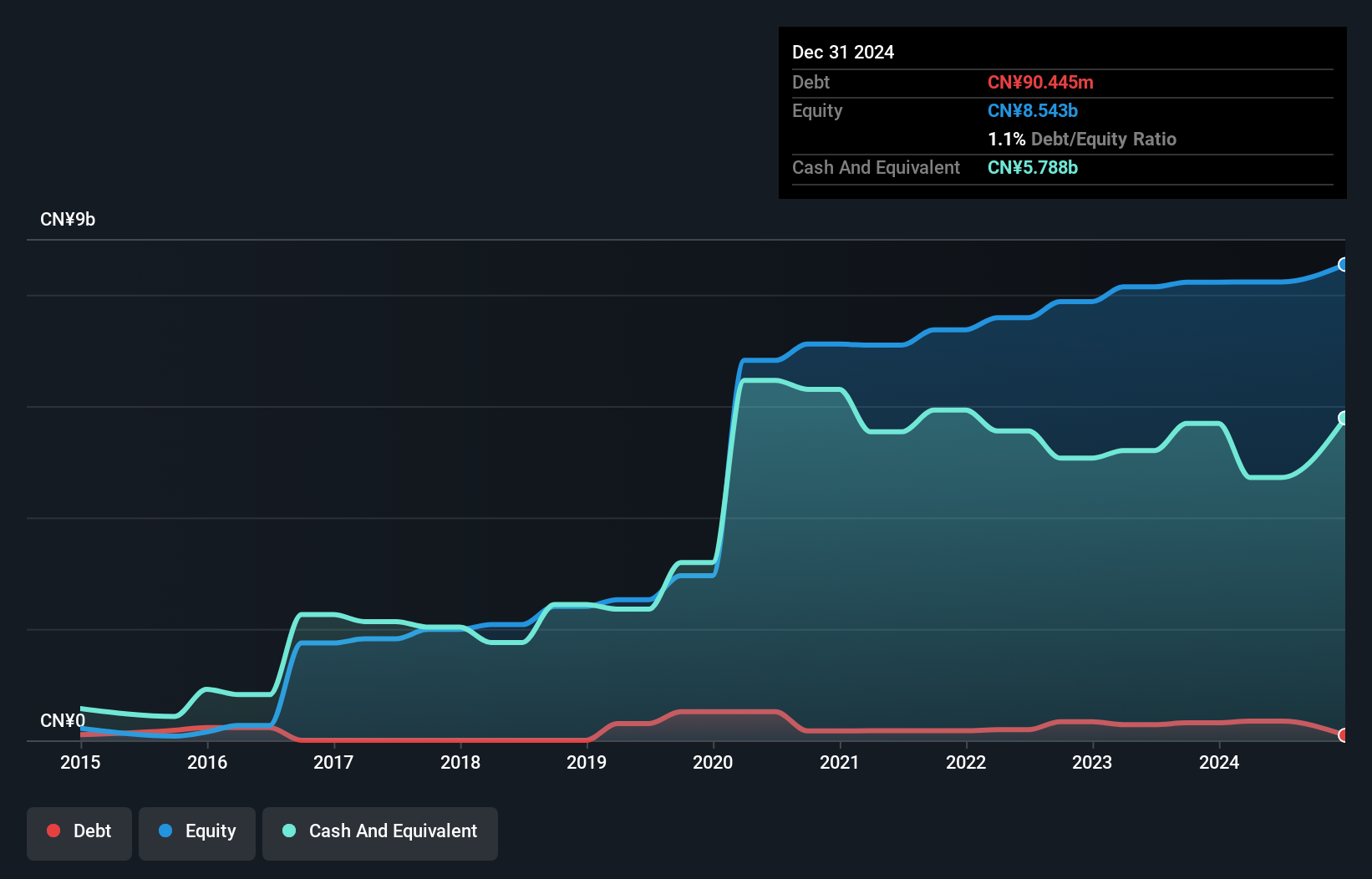

Greentown Service Group demonstrates a stable financial position with short-term assets of CN¥13.6 billion exceeding its liabilities, and debt well-covered by operating cash flow. The company's earnings have shown improvement, growing 17.1% over the past year, surpassing industry averages. Despite a low return on equity at 10.2%, Greentown's debt to equity ratio has significantly decreased from 7.5% to 1% over five years, indicating improved financial health. A recent share buyback program could enhance net asset value and earnings per share, suggesting strategic efforts to bolster shareholder value amidst trading below estimated fair value by 58%.

- Take a closer look at Greentown Service Group's potential here in our financial health report.

- Understand Greentown Service Group's earnings outlook by examining our growth report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD13.70 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which generated CN¥25.07 billion, followed by its shipping segment with CN¥1.15 billion.

Market Cap: SGD13.7B

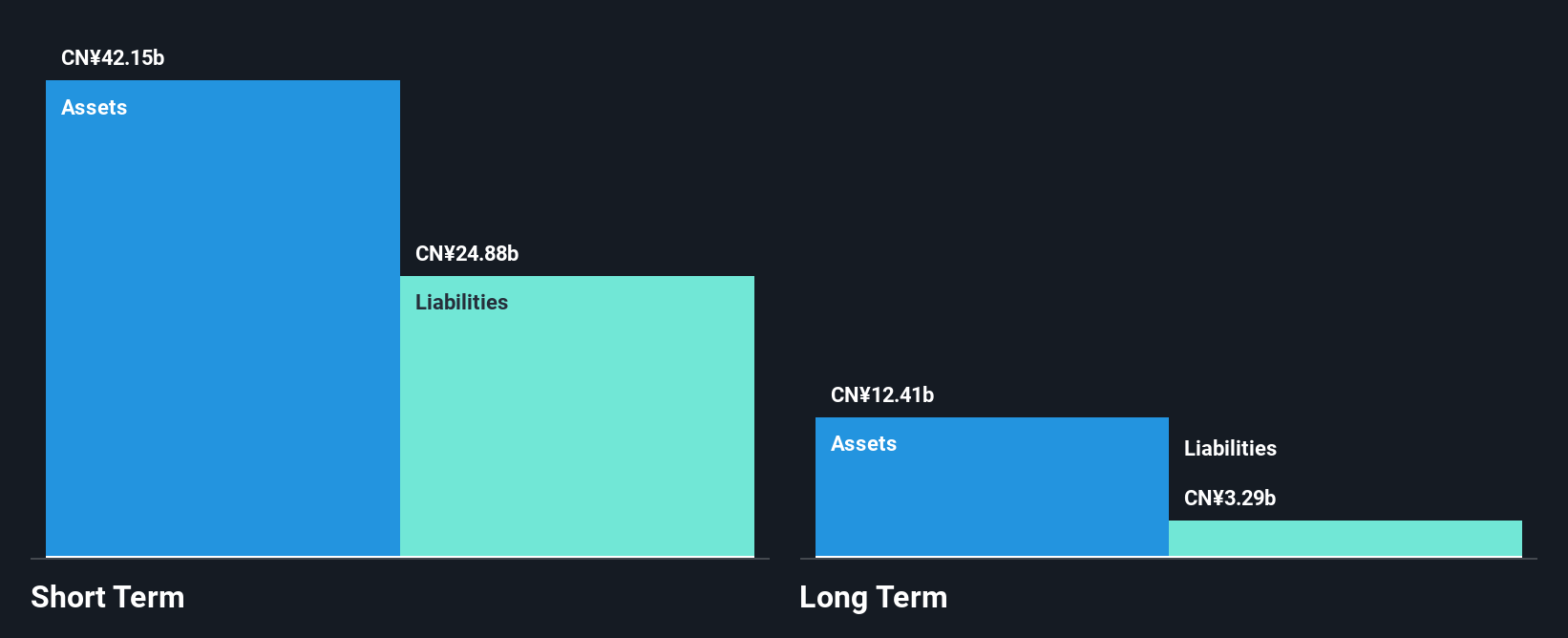

Yangzijiang Shipbuilding (Holdings) Ltd. exhibits strong financial health, with short-term assets of CN¥40.2 billion comfortably covering both short and long-term liabilities. The company’s earnings have grown significantly, with a 42.7% increase over the past year, outpacing industry averages. Its debt is well-managed and covered by operating cash flow, while having more cash than total debt further strengthens its position. Recent contracts worth US$1.90 billion bolster its order book but are not expected to impact 2025 earnings significantly. Trading at a substantial discount to estimated fair value highlights potential investment appeal amidst stable profitability indicators like high return on equity at 27.8%.

- Unlock comprehensive insights into our analysis of Yangzijiang Shipbuilding (Holdings) stock in this financial health report.

- Assess Yangzijiang Shipbuilding (Holdings)'s future earnings estimates with our detailed growth reports.

Raffles Medical Group (SGX:BSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raffles Medical Group Ltd offers integrated private healthcare services across Singapore, Greater China, Vietnam, Cambodia, and Japan with a market capitalization of SGD1.84 billion.

Operations: The company generates revenue from Hospital Services (SGD352.07 million), Insurance Services (SGD186.63 million), and Healthcare Services (SGD295.96 million).

Market Cap: SGD1.84B

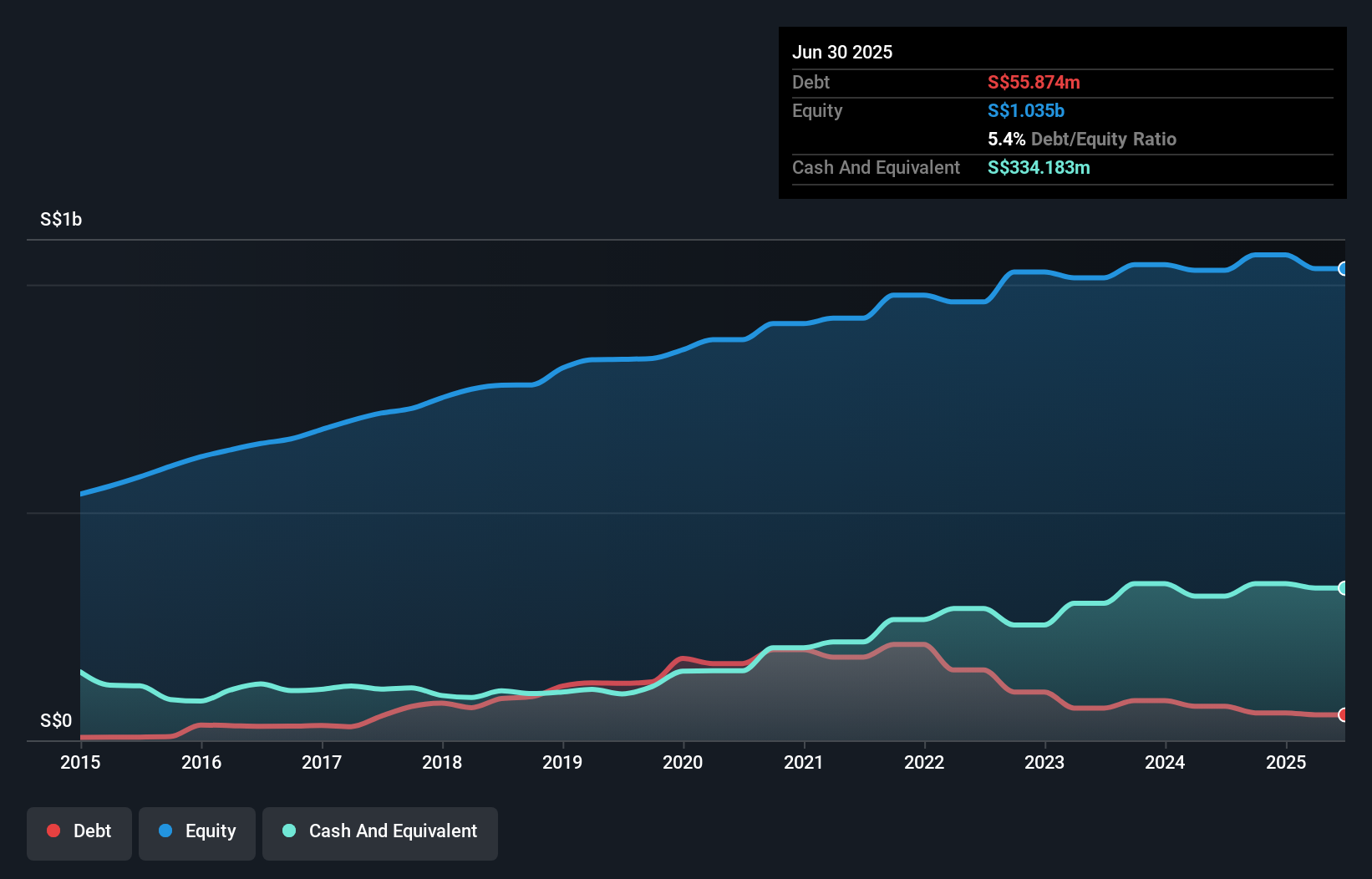

Raffles Medical Group Ltd, with a market cap of S$1.84 billion, presents a mixed picture for investors considering penny stocks. The company is trading at 49.2% below its estimated fair value, suggesting potential undervaluation. It has stable financial health with short-term assets of S$500.3 million exceeding both short and long-term liabilities, and more cash than total debt enhances its fiscal stability. Recent leadership changes include the appointment of Ms. Woo Yeng Yeng as CFO, bringing extensive experience in finance strategy and governance. However, profit margins have slightly declined from last year and dividend sustainability remains uncertain amidst an unstable track record.

- Get an in-depth perspective on Raffles Medical Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Raffles Medical Group's future.

Make It Happen

- Take a closer look at our Asian Penny Stocks list of 970 companies by clicking here.

- Interested In Other Possibilities? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BSL

Raffles Medical Group

Provides integrated private healthcare services primarily in Singapore, Greater China, Vietnam, Cambodia, and Japan.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026