- United States

- /

- Electrical

- /

- NYSE:NPWR

3 Intriguing Penny Stocks With Market Caps Over $40M

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, but it is up 16% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this context, identifying stocks with strong financial health and growth potential becomes crucial for investors seeking opportunities beyond traditional investments. Although penny stocks are a somewhat outdated term, they still represent smaller or newer companies that can offer significant value when backed by robust fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.66 | $640.14M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.59 | $259.69M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9048 | $157.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $96.34M | ✅ 3 ⚠️ 2 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.8906 | $6.51M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.44 | $103.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Resources Connection (RGP) | $4.98 | $169.03M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.91 | $508.34M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.45 | $30.22M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 414 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

ATA Creativity Global (AACG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ATA Creativity Global, along with its subsidiaries, offers educational services in China and internationally with a market capitalization of $40.35 million.

Operations: The company generates revenue primarily from its operations in the People's Republic of China, amounting to CN¥275.73 million.

Market Cap: $40.35M

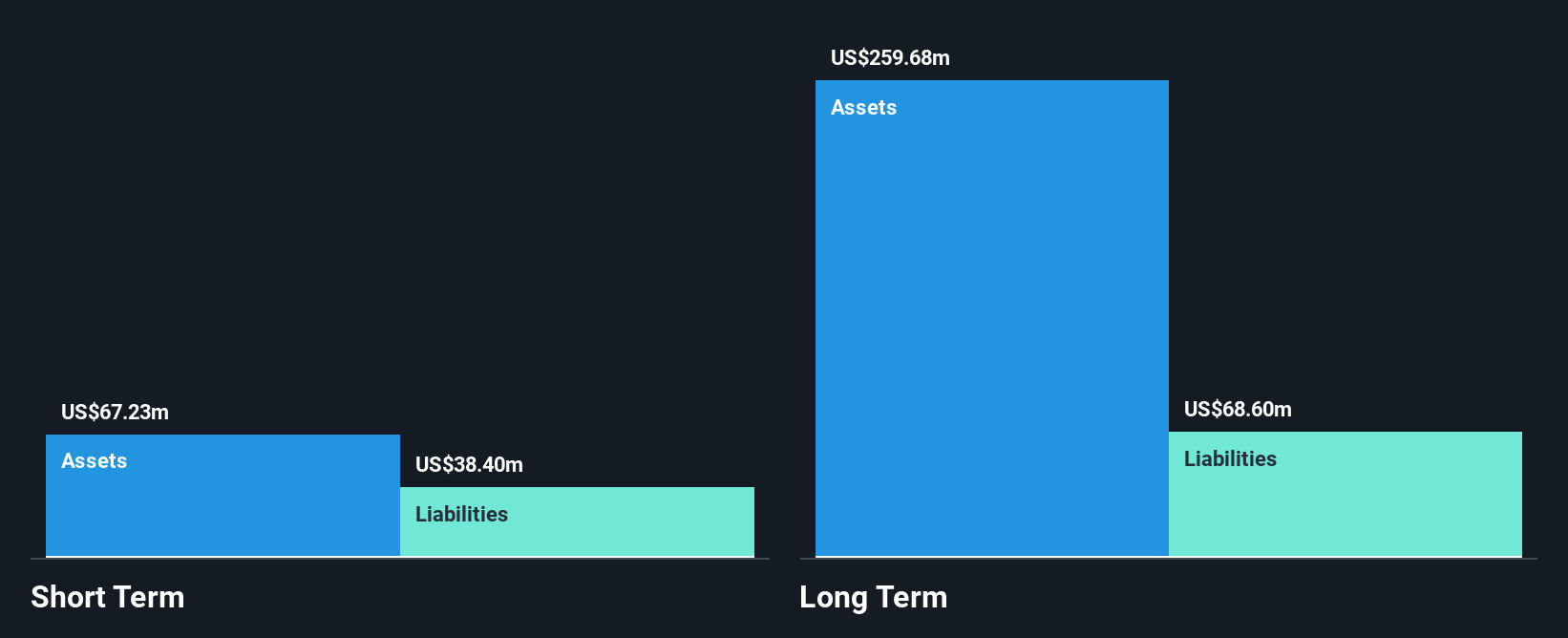

ATA Creativity Global, with a market cap of US$40.35 million, operates primarily in China and has recently shifted its primary exchange to the Nasdaq Capital Market. Despite being unprofitable, it has reduced losses over five years by 32.4% annually and maintains a sufficient cash runway for growth scenarios. The management team is experienced with an average tenure of 5.9 years, though the company faces challenges like high volatility and short-term liabilities exceeding assets (CN¥73.2M vs CN¥371.7M). Recent earnings show a narrowed net loss (CN¥13.34M) and modest revenue growth forecasted for 2025 at RMB 276-281 million.

- Dive into the specifics of ATA Creativity Global here with our thorough balance sheet health report.

- Understand ATA Creativity Global's track record by examining our performance history report.

Smart Sand (SND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Smart Sand, Inc. offers proppant supply and logistics solutions for frac sand customers, with a market cap of $90.81 million.

Operations: The company generates revenue primarily from its Sand segment, which accounts for $288.34 million, and its Smartsystems segment, contributing $5.54 million.

Market Cap: $90.81M

Smart Sand, Inc., with a market cap of US$90.81 million, primarily generates revenue from its Sand segment (US$288.34 million). Despite recent challenges, including a first-quarter net loss of US$24.23 million and declining earnings over five years by 23.3% annually, the company maintains a satisfactory net debt to equity ratio of 2.9%, with debt well covered by operating cash flow (264.4%). The management and board are seasoned with average tenures of 10.9 and 13.1 years respectively, while shareholders have not faced significant dilution recently despite the company's unprofitability and negative return on equity (-9.56%).

- Click here and access our complete financial health analysis report to understand the dynamics of Smart Sand.

- Examine Smart Sand's past performance report to understand how it has performed in prior years.

NET Power (NPWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NET Power Inc. is a U.S.-based energy technology company with a market cap of $624.34 million.

Operations: Currently, there are no reported revenue segments for this U.S.-based energy technology firm.

Market Cap: $624.34M

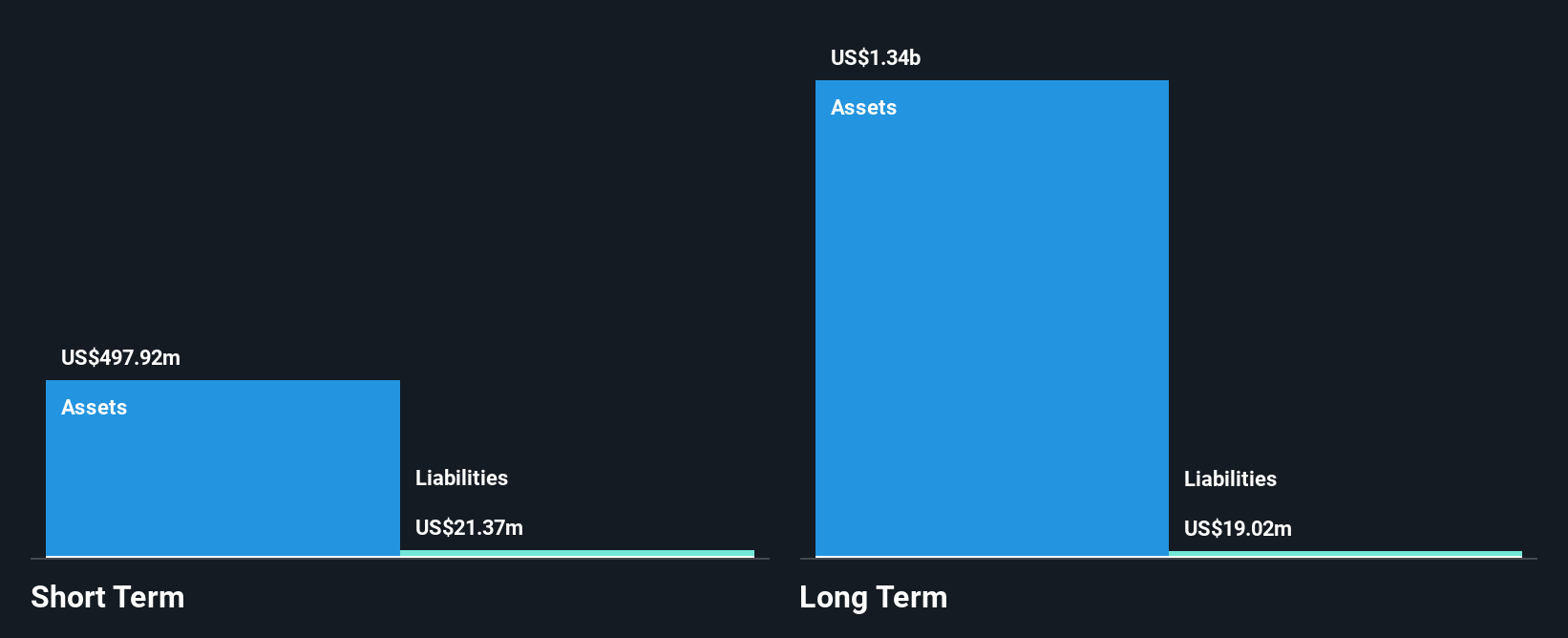

NET Power Inc., with a market cap of US$624.34 million, is pre-revenue, generating less than US$1 million annually. The company recently reported a significant first-quarter net loss of US$119.35 million, highlighting its current unprofitable status and increasing losses over the past five years by 13.7% annually. Despite this, NET Power has no debt and maintains a substantial cash runway exceeding three years based on current free cash flow levels. Recent management changes include the appointment of Caleb Van Dolah as principal accounting officer, while the board remains relatively inexperienced with an average tenure of 2.1 years.

- Navigate through the intricacies of NET Power with our comprehensive balance sheet health report here.

- Gain insights into NET Power's future direction by reviewing our growth report.

Seize The Opportunity

- Access the full spectrum of 414 US Penny Stocks by clicking on this link.

- Curious About Other Options? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NET Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPWR

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)