- United States

- /

- Machinery

- /

- NYSE:KMT

3 High-Quality Dividend Stocks Yielding Up To 4.1%

Reviewed by Simply Wall St

With the Dow Jones Industrial Average, S&P 500, and Nasdaq all reaching record highs following a tamer-than-expected inflation report, investors are closely examining opportunities in a buoyant market. In such an environment, high-quality dividend stocks can offer both income and potential for capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.64% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.91% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.34% | ★★★★★★ |

| German American Bancorp (GABC) | 3.01% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.02% | ★★★★★★ |

| Ennis (EBF) | 5.89% | ★★★★★★ |

| Employers Holdings (EIG) | 3.07% | ★★★★★☆ |

| CVB Financial (CVBF) | 4.29% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.76% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.48% | ★★★★★☆ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

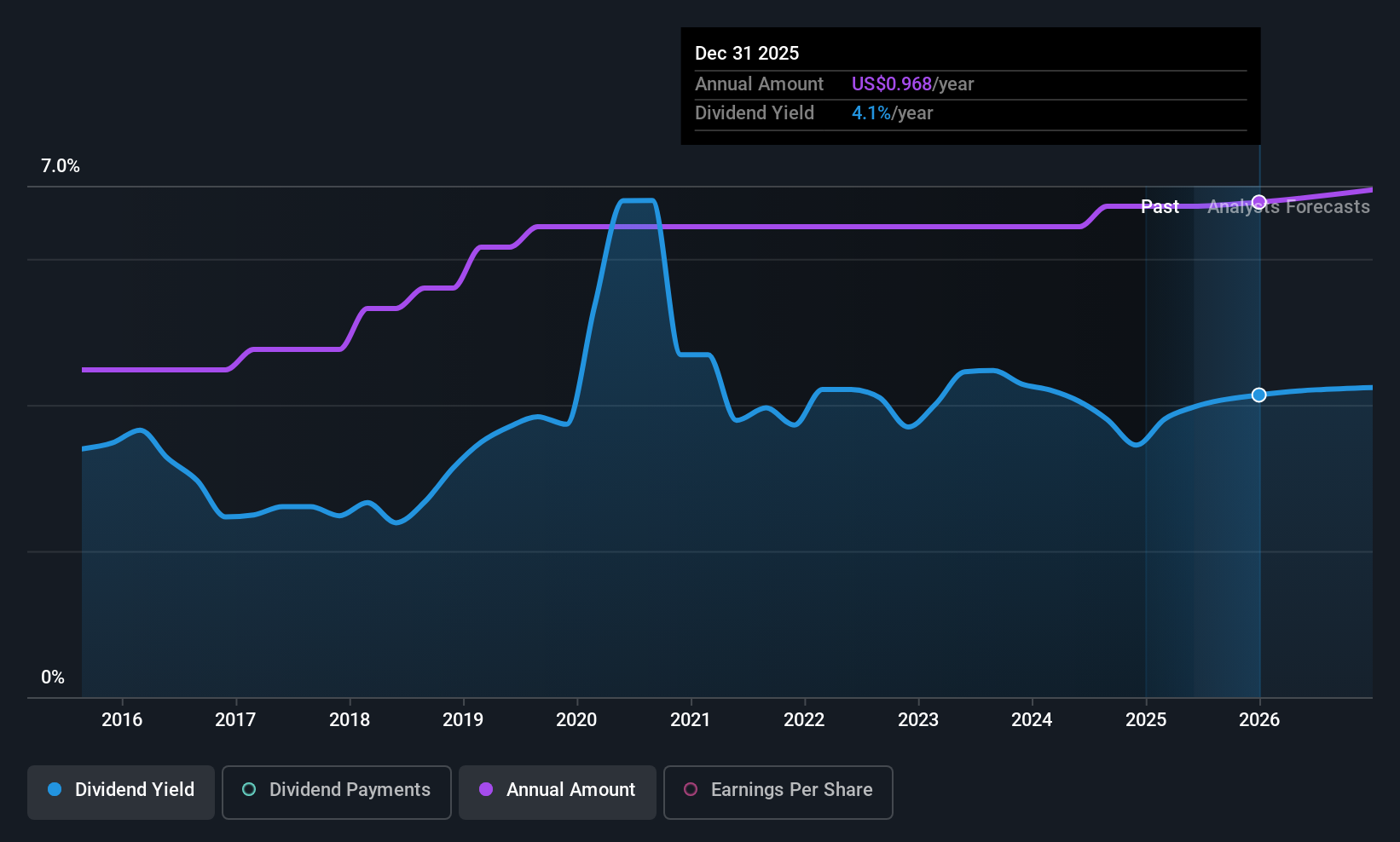

First Financial Bancorp (FFBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Financial Bancorp is a bank holding company for First Financial Bank, offering commercial banking and related services to individuals and businesses across Ohio, Indiana, Kentucky, and Illinois, with a market cap of approximately $2.33 billion.

Operations: First Financial Bancorp generates its revenue primarily through its Community Banking segment, which accounts for $781.66 million.

Dividend Yield: 4.1%

First Financial Bancorp. offers a reliable dividend yield of 4.11%, supported by a low payout ratio of 38.1%, indicating coverage by earnings. The company has consistently grown its dividends over the past decade with stability, though it falls short compared to top-tier dividend payers in the US market. Recent earnings show strong growth, with net income rising to US$71.92 million for Q3 2025 from US$52.45 million a year earlier, despite significant insider selling recently noted.

- Navigate through the intricacies of First Financial Bancorp with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that First Financial Bancorp is trading behind its estimated value.

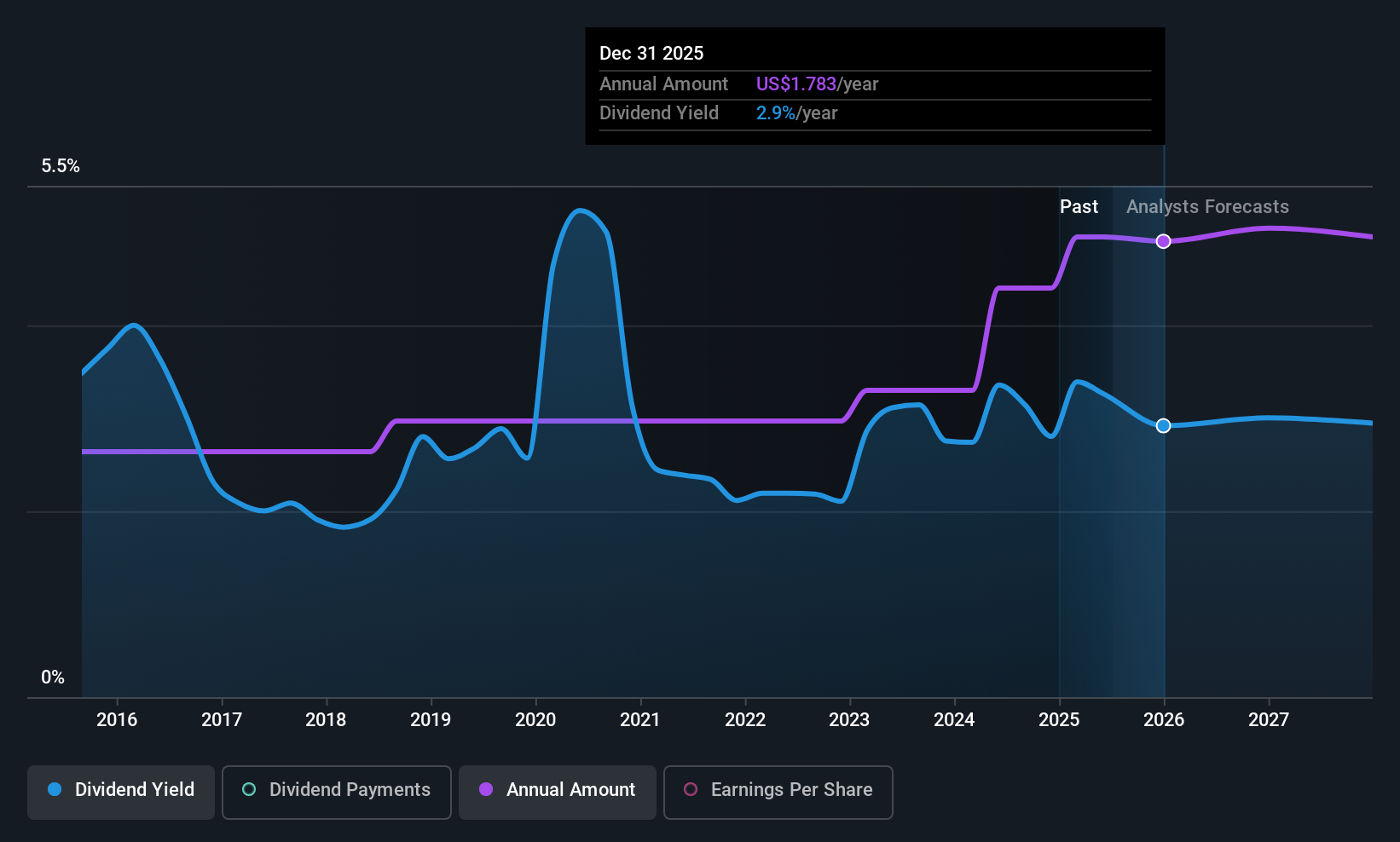

Hancock Whitney (HWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hancock Whitney Corporation, with a market cap of $4.76 billion, operates as the financial holding company for Hancock Whitney Bank, offering traditional and online banking services to commercial, small business, and retail customers in the United States.

Operations: Hancock Whitney Corporation generates revenue primarily through its banking operations, totaling $1.43 billion.

Dividend Yield: 3.2%

Hancock Whitney's dividend yield of 3.23% is backed by a low payout ratio of 31.2%, ensuring coverage by earnings, with this trend expected to continue in three years. Despite being below top-tier yields, dividends have been stable and growing over the past decade. Recent announcements include a regular quarterly dividend of $0.45 per share for Q4 2025 and strong Q3 earnings growth, with net income at US$127.47 million compared to US$115.57 million last year amidst ongoing share buybacks.

- Click here and access our complete dividend analysis report to understand the dynamics of Hancock Whitney.

- Our expertly prepared valuation report Hancock Whitney implies its share price may be lower than expected.

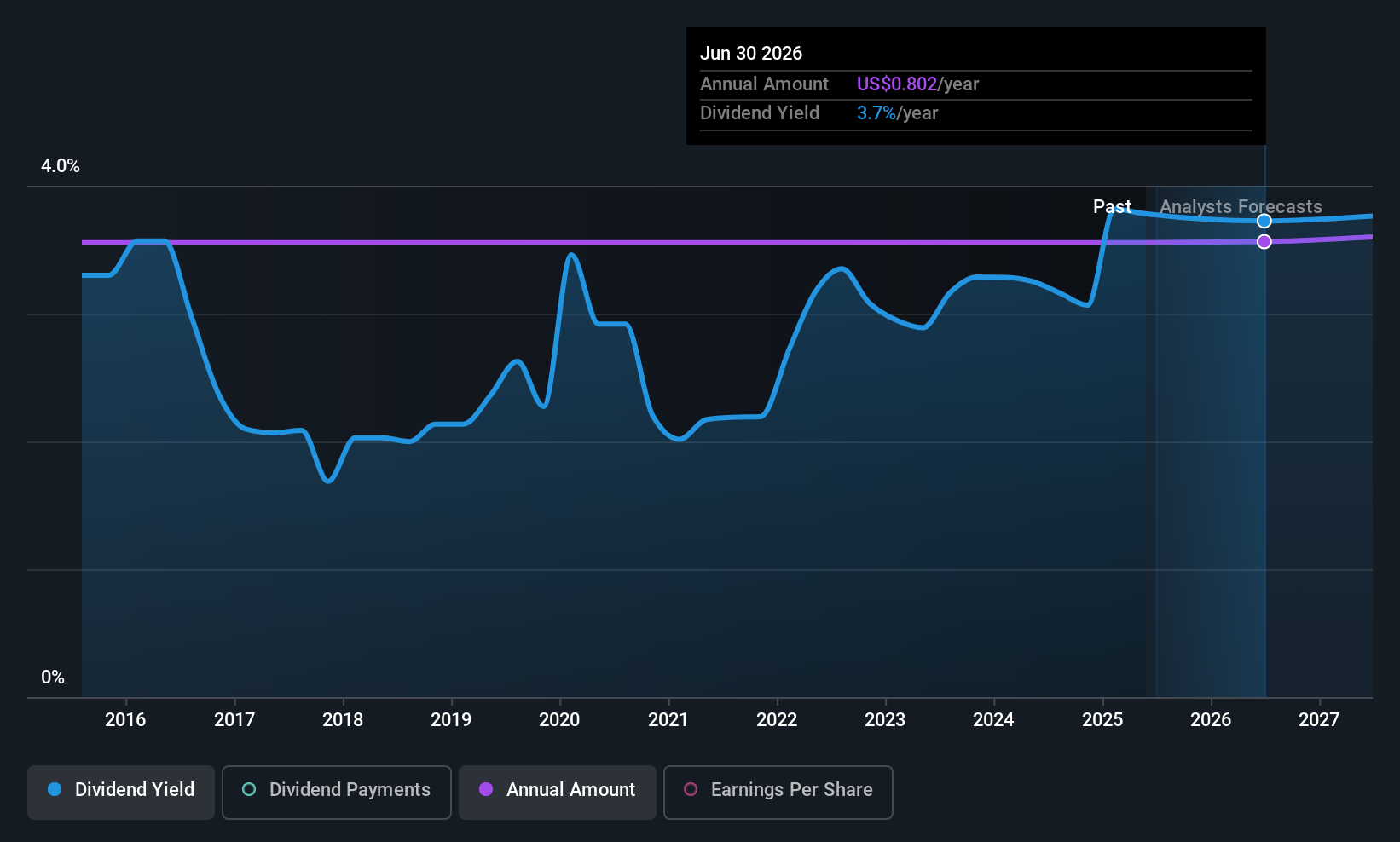

Kennametal (KMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kennametal Inc. develops and applies tungsten carbides, ceramics, and hard materials solutions globally with a market cap of approximately $1.71 billion.

Operations: Kennametal Inc.'s revenue is primarily derived from its Metal Cutting segment, which generated $1.22 billion, and its Infrastructure segment, which contributed $747.16 million.

Dividend Yield: 3.5%

Kennametal's dividend yield of 3.52% is supported by a payout ratio of 66.4%, indicating coverage by earnings, and a cash payout ratio of 51.1%, ensuring sustainability through cash flows. While the yield is lower than the top quartile in the US market, dividends have shown stability and growth over the past decade. Recent financial results showed decreased annual sales at US$1.97 billion, with net income declining to US$93.13 million, amidst ongoing share repurchases and consistent quarterly dividends of $0.20 per share.

- Unlock comprehensive insights into our analysis of Kennametal stock in this dividend report.

- Our valuation report unveils the possibility Kennametal's shares may be trading at a discount.

Taking Advantage

- Navigate through the entire inventory of 137 Top US Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and hard materials and solutions worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives