3 Global Stocks Estimated To Be Trading At Up To 27.3% Discount

Reviewed by Simply Wall St

As global markets experience fluctuations driven by inflation data and interest rate speculations, investors are closely watching economic indicators for signs of stability. With U.S. stocks reaching record highs amid hopes of rate cuts and European markets buoyed by easing trade tensions, the search for undervalued opportunities becomes even more pertinent. In this environment, identifying stocks that are trading at a discount can offer potential value, especially when broader market conditions suggest room for growth or recovery.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimicron Technology (TWSE:3037) | NT$139.00 | NT$276.98 | 49.8% |

| Sunjin Beauty ScienceLtd (KOSDAQ:A086710) | ₩10620.00 | ₩21109.98 | 49.7% |

| Nan Juen International (TPEX:6584) | NT$228.00 | NT$453.12 | 49.7% |

| Matsuya R&DLtd (TSE:7317) | ¥715.00 | ¥1426.77 | 49.9% |

| Kioxia Holdings (TSE:285A) | ¥2465.00 | ¥4905.46 | 49.7% |

| InPost (ENXTAM:INPST) | €13.36 | €26.63 | 49.8% |

| IDI (ENXTPA:IDIP) | €79.20 | €157.95 | 49.9% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.80 | NZ$1.60 | 49.9% |

| E-Globe (BIT:EGB) | €0.66 | €1.32 | 50% |

| Clemondo Group (OM:CLEM) | SEK9.65 | SEK19.21 | 49.8% |

Let's explore several standout options from the results in the screener.

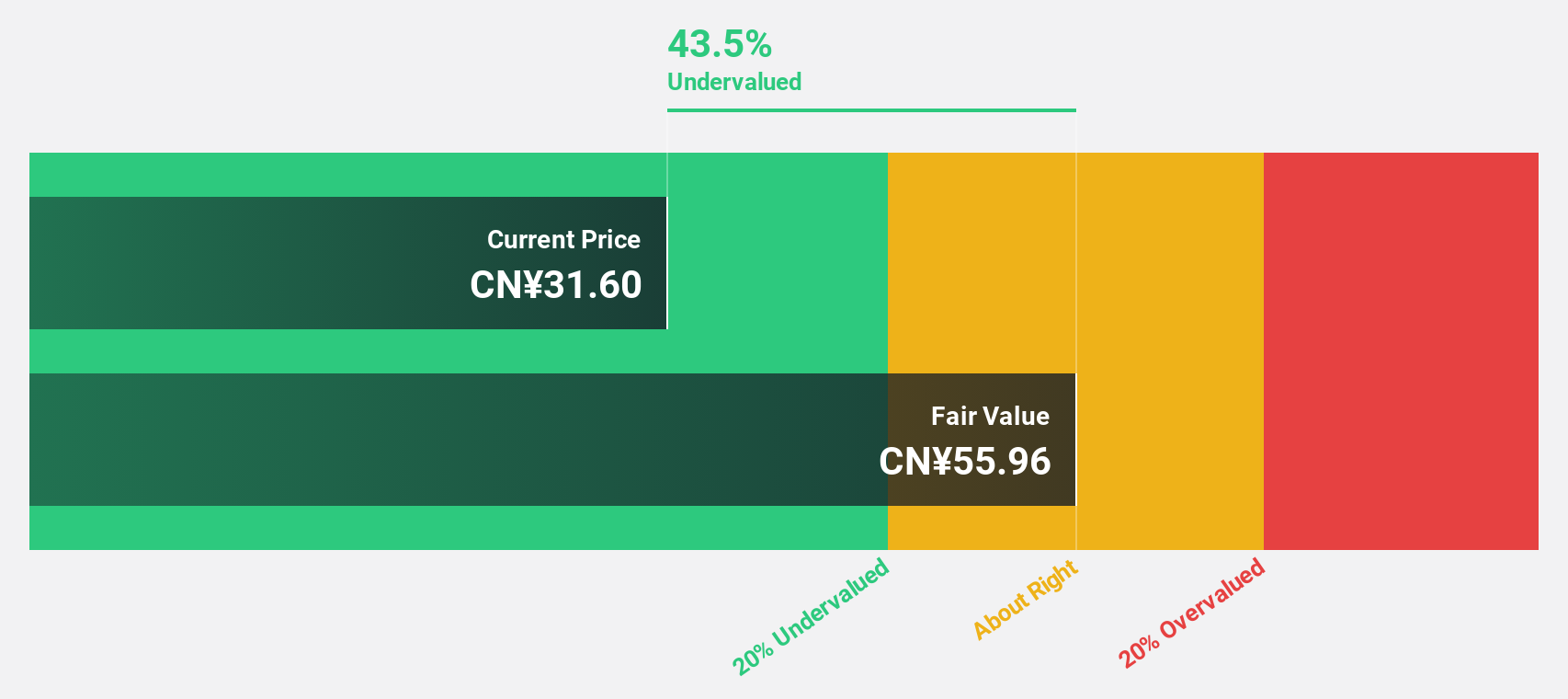

EmbedWay Technologies (Shanghai) (SHSE:603496)

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of CN¥9.60 billion.

Operations: EmbedWay Technologies (Shanghai) Corporation generates its revenue through its network visibility infrastructure and intelligent system platform offerings in China.

Estimated Discount To Fair Value: 20.1%

EmbedWay Technologies (Shanghai) is trading at CN¥31.83, below its estimated fair value of CN¥39.85, indicating it may be undervalued based on cash flows. Despite a recent decline in revenue and net income for the first half of 2025, the company is forecast to achieve significant annual profit growth and become profitable within three years. Revenue growth is expected to outpace the Chinese market significantly, although return on equity remains modest at 12.7%.

- According our earnings growth report, there's an indication that EmbedWay Technologies (Shanghai) might be ready to expand.

- Unlock comprehensive insights into our analysis of EmbedWay Technologies (Shanghai) stock in this financial health report.

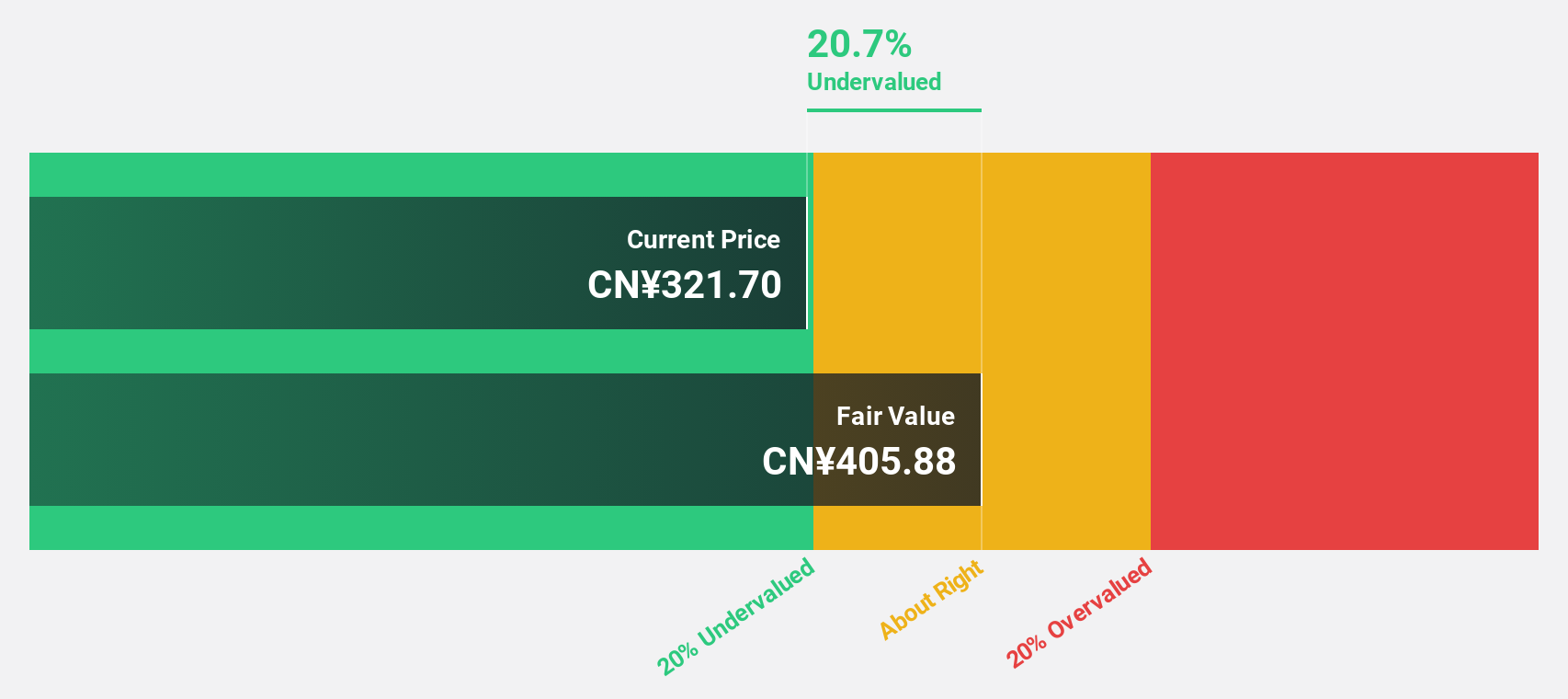

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. is involved in the research, development, production, and sales of beverages in China with a market cap of CN¥148.17 billion.

Operations: The company generates revenue of CN¥18.70 billion from the production, sales, and wholesale of beverages and pre-packaged foods in China.

Estimated Discount To Fair Value: 27.3%

Eastroc Beverage(Group) is trading at CN¥296.65, which is 27.3% below its estimated fair value of CN¥408.15, suggesting potential undervaluation based on cash flows. Recent earnings show strong performance with net income rising to CNY 2.37 billion for the first half of 2025, up from CNY 1.73 billion a year ago. Despite being removed from an index, forecasts indicate robust revenue and profit growth exceeding market averages over the next few years.

- The growth report we've compiled suggests that Eastroc Beverage(Group)'s future prospects could be on the up.

- Click here to discover the nuances of Eastroc Beverage(Group) with our detailed financial health report.

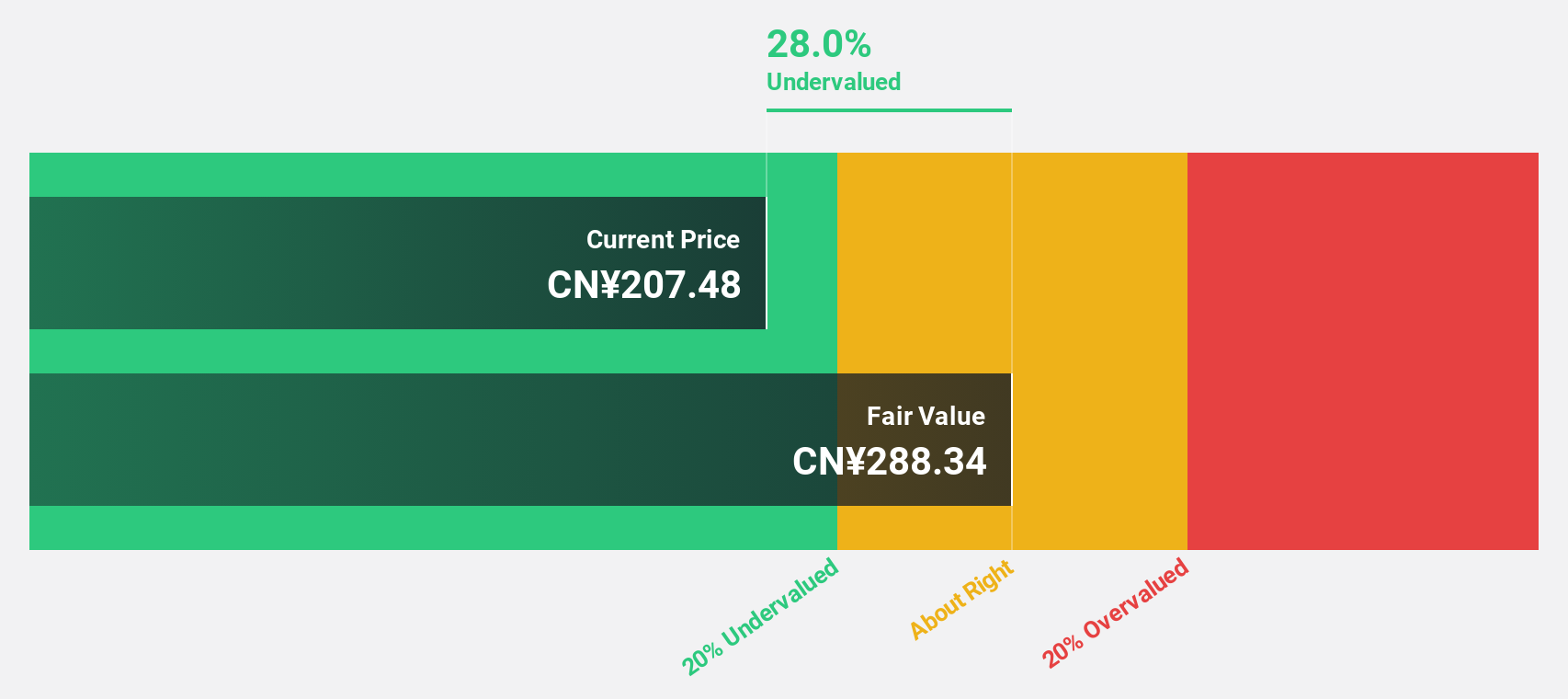

Beijing Roborock Technology (SHSE:688169)

Overview: Beijing Roborock Technology Co., Ltd. focuses on the research, development, and production of home cleaning devices in China and has a market cap of CN¥54.15 billion.

Operations: The company generates revenue from its Industrial Automation & Controls segment, amounting to CN¥15.43 billion.

Estimated Discount To Fair Value: 26.4%

Beijing Roborock Technology is trading at CN¥206.7, 26.4% below its estimated fair value of CN¥280.94, highlighting potential undervaluation based on cash flows. Despite a recent dip in net income to CNY 677.51 million for the first half of 2025 from CNY 1,120.76 million a year ago, forecasts show earnings growth exceeding market averages at 27.3% annually over the next three years, offering promising prospects amid high share price volatility and improved revenue expectations.

- Our earnings growth report unveils the potential for significant increases in Beijing Roborock Technology's future results.

- Navigate through the intricacies of Beijing Roborock Technology with our comprehensive financial health report here.

Turning Ideas Into Actions

- Get an in-depth perspective on all 501 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastroc Beverage(Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605499

Eastroc Beverage(Group)

Engages in the research and development, production, and sales of beverages in China.

High growth potential with solid track record.

Market Insights

Community Narratives