- China

- /

- Real Estate

- /

- SHSE:600067

3 Global Penny Stocks With Over US$600M Market Cap

Reviewed by Simply Wall St

Global markets have recently been buoyed by U.S. inflation data, driving speculation about potential interest rate cuts in September, with small-cap stocks leading the charge. In this context, penny stocks—often smaller or newer companies—remain a relevant investment area due to their potential for growth when backed by strong financials. This article will explore several global penny stocks that stand out for their financial strength and offer intriguing opportunities for investors seeking under-the-radar companies with long-term potential.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.63 | A$115.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.63 | HK$958.71M | ✅ 4 ⚠️ 1 View Analysis > |

| GTN (ASX:GTN) | A$0.395 | A$76.27M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.65 | HK$2.15B | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.635 | SGD257.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.865 | MYR6.65B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.17 | £185.96M | ✅ 4 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €32.04M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,780 stocks from our Global Penny Stocks screener.

We'll examine a selection from our screener results.

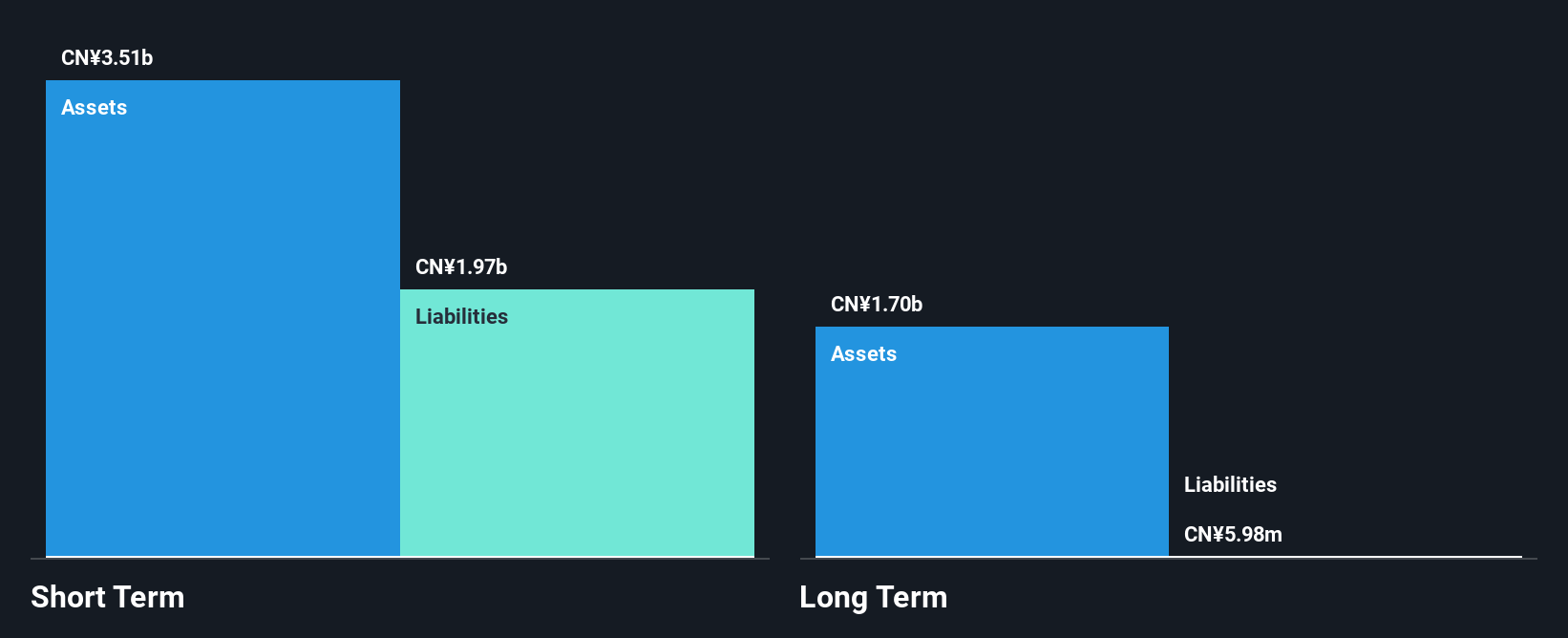

Citychamp Dartong Advanced Materials (SHSE:600067)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Citychamp Dartong Advanced Materials Co., Ltd. operates in the advanced materials sector and has a market cap of approximately CN¥4.39 billion.

Operations: Citychamp Dartong Advanced Materials Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.39B

Citychamp Dartong Advanced Materials Co., Ltd. operates with a market cap of approximately CN¥4.39 billion and is currently pre-revenue, indicating potential growth challenges. The company has managed to reduce its debt to equity ratio from 84% to 43.5% over five years, reflecting improved financial management, although it remains unprofitable with a negative return on equity of -8.72%. Despite these hurdles, Citychamp's short-term assets significantly exceed both its short- and long-term liabilities, providing some financial stability. Moreover, the stock trades at 33% below estimated fair value, suggesting potential undervaluation in the market.

- Jump into the full analysis health report here for a deeper understanding of Citychamp Dartong Advanced Materials.

- Understand Citychamp Dartong Advanced Materials' track record by examining our performance history report.

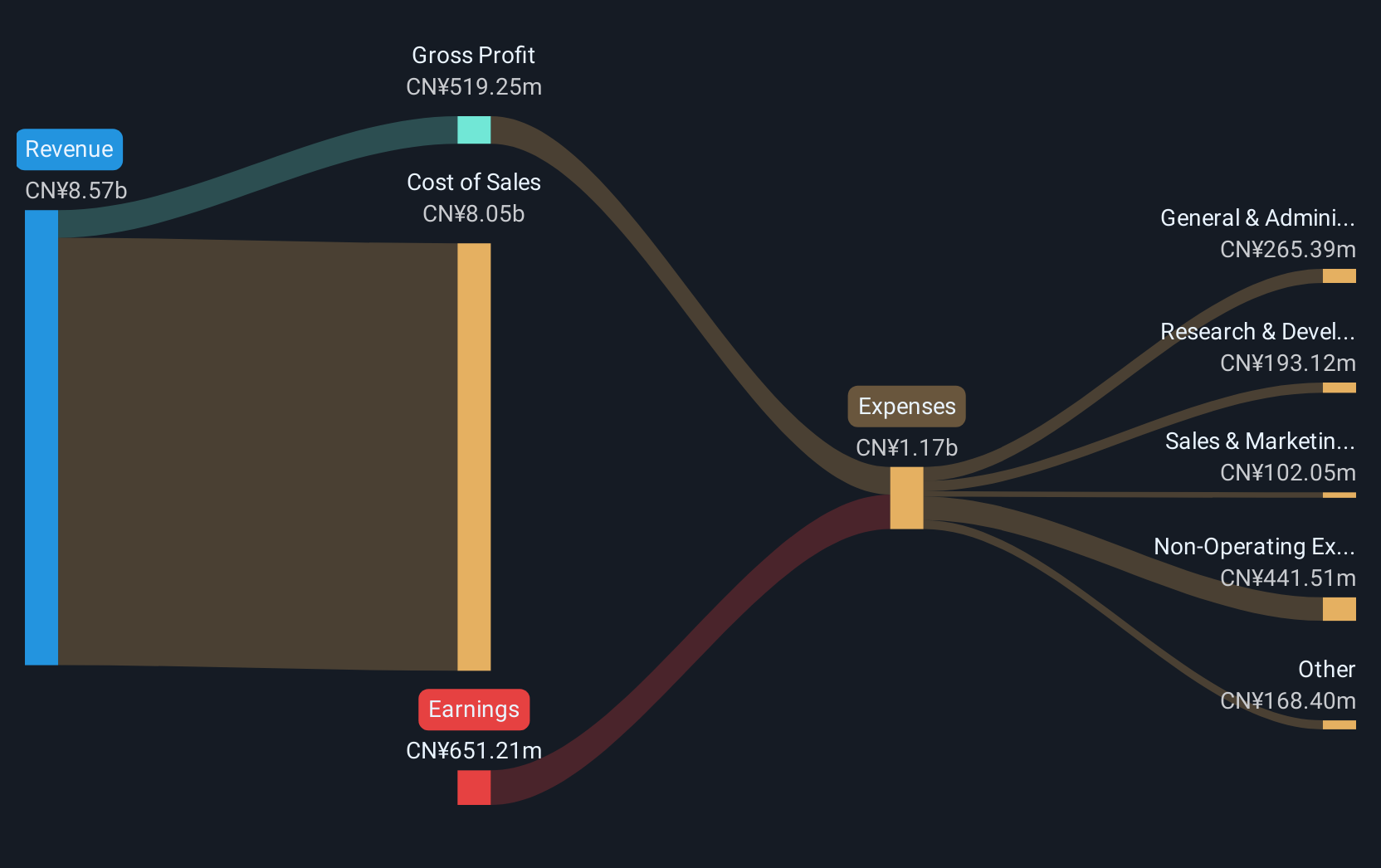

Shaanxi Beiyuan Chemical Industry Group (SHSE:601568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaanxi Beiyuan Chemical Industry Group Co., Ltd. operates in the chemical industry, focusing on the production and sale of various chemical products, with a market cap of approximately CN¥16.64 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥16.64B

Shaanxi Beiyuan Chemical Industry Group, with a market cap of CN¥16.64 billion, shows promising financial stability and growth potential despite its challenges. The company has effectively managed its debt, reducing the debt to equity ratio from 15.6% to 0.5% over five years, and maintains more cash than total debt. Earnings have grown by 20.4% over the past year, surpassing industry averages; however, long-term earnings have declined annually by 33.7%. While dividends are not well covered by earnings or free cash flows, short-term assets exceed both short- and long-term liabilities significantly enhancing liquidity positions.

- Get an in-depth perspective on Shaanxi Beiyuan Chemical Industry Group's performance by reading our balance sheet health report here.

- Learn about Shaanxi Beiyuan Chemical Industry Group's historical performance here.

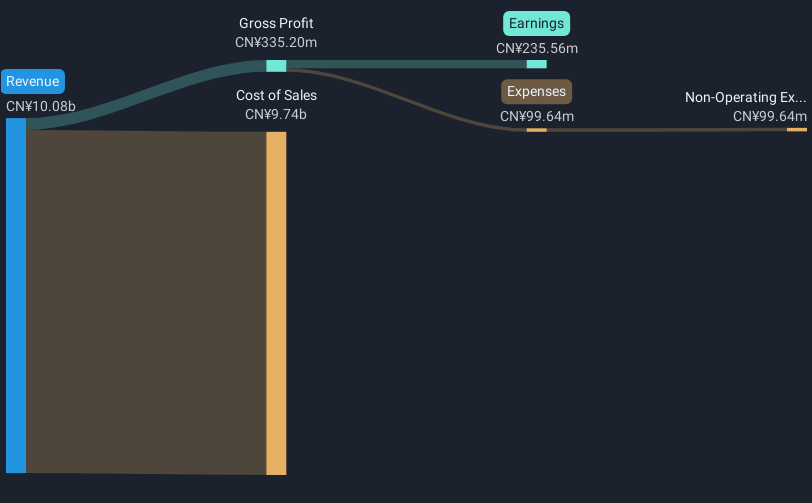

Shandong Mining Machinery Group (SZSE:002526)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Mining Machinery Group Co., Ltd. (SZSE:002526) operates in the manufacturing and distribution of mining machinery and equipment, with a market cap of CN¥7.18 billion.

Operations: Shandong Mining Machinery Group Co., Ltd. does not report specific revenue segments, focusing instead on its core operations in the manufacturing and distribution of mining machinery and equipment.

Market Cap: CN¥7.18B

Shandong Mining Machinery Group, with a market cap of CN¥7.18 billion, demonstrates financial stability through short-term assets (CN¥3.5 billion) exceeding both short- and long-term liabilities. The company maintains more cash than total debt, and its debt is well covered by operating cash flow (79.3%). Despite stable weekly volatility at 4% over the past year, the firm faces challenges such as negative earnings growth (-12.2%) and a declining net profit margin (5.7% from 6%). Recent events include a dividend decrease and an extraordinary shareholders meeting to discuss share offering extensions for 2024.

- Navigate through the intricacies of Shandong Mining Machinery Group with our comprehensive balance sheet health report here.

- Evaluate Shandong Mining Machinery Group's historical performance by accessing our past performance report.

Key Takeaways

- Dive into all 3,780 of the Global Penny Stocks we have identified here.

- Looking For Alternative Opportunities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600067

Citychamp Dartong Advanced Materials

Citychamp Dartong Advanced Materials Co., Ltd.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives