- Romania

- /

- Oil and Gas

- /

- BVB:SNG

3 European Stocks Possibly Undervalued By Market Estimates In October 2025

Reviewed by Simply Wall St

In October 2025, the European stock market has shown mixed performance, with the pan-European STOXX Europe 600 Index inching higher amid dovish signals from the U.S. Federal Reserve and easing trade tensions between the U.S. and China. With economic indicators such as industrial production contracting in the euro area and the UK economy showing signs of stagnation, investors might find opportunities in stocks that are potentially undervalued by market estimates. Identifying such stocks often involves looking for companies with strong fundamentals that may be temporarily overlooked by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SBO (WBAG:SBO) | €26.95 | €53.16 | 49.3% |

| Pandora (CPSE:PNDORA) | DKK867.40 | DKK1734.70 | 50% |

| Nordisk Bergteknik (OM:NORB B) | SEK12.00 | SEK23.59 | 49.1% |

| Noratis (XTRA:NUVA) | €0.78 | €1.56 | 49.9% |

| Mo-BRUK (WSE:MBR) | PLN296.00 | PLN581.73 | 49.1% |

| Kitron (OB:KIT) | NOK60.30 | NOK120.56 | 50% |

| High Quality Food (BIT:HQF) | €0.614 | €1.22 | 49.7% |

| DSV (CPSE:DSV) | DKK1345.50 | DKK2657.52 | 49.4% |

| doValue (BIT:DOV) | €2.80 | €5.53 | 49.4% |

| Atea (OB:ATEA) | NOK147.60 | NOK293.57 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

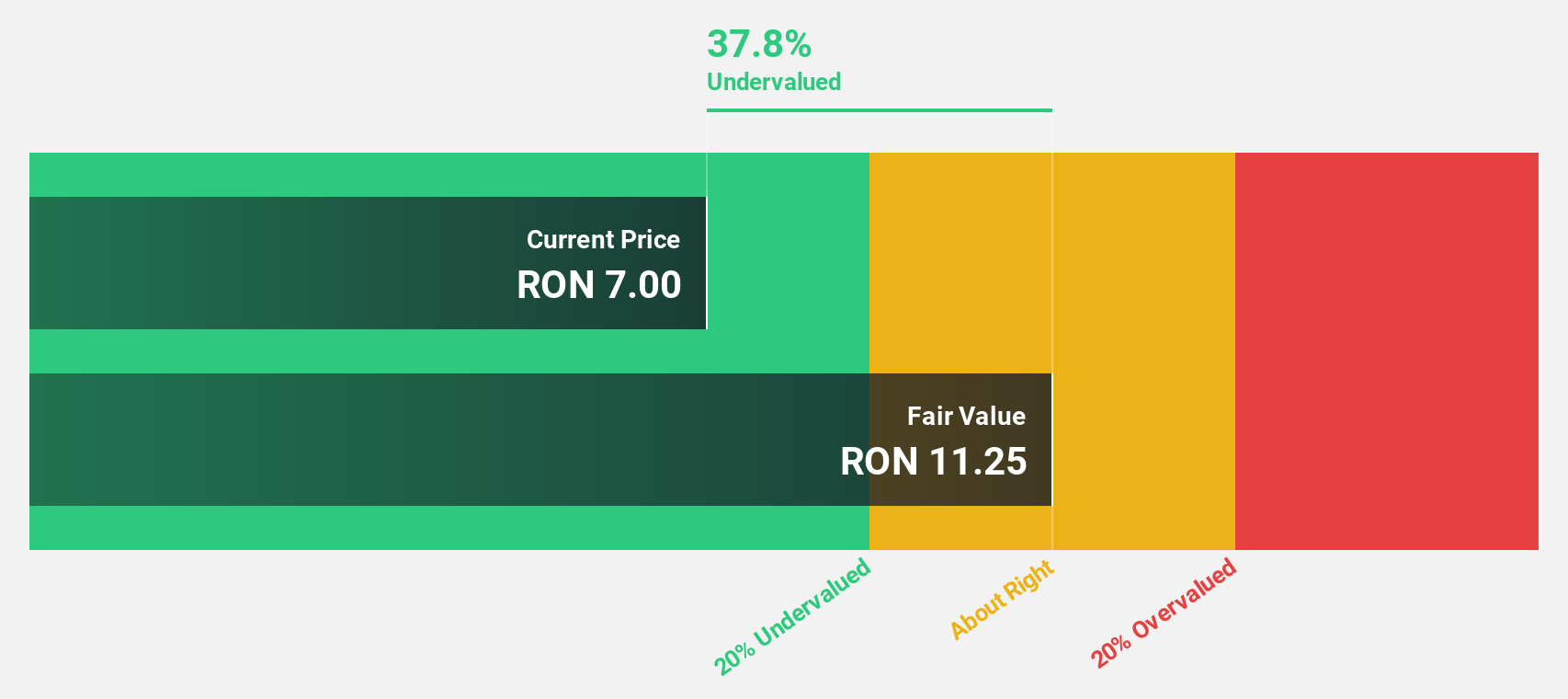

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is involved in the exploration, production, and supply of natural gas in Romania with a market cap of RON33.61 billion.

Operations: The company's revenue segments include RON7.79 billion from upstream operations, RON589.22 million from storage, and RON548.74 million from electricity.

Estimated Discount To Fair Value: 40.4%

SNGN Romgaz is trading at RON8.98, significantly below its estimated fair value of RON15.06, indicating it may be undervalued based on cash flows. Recent earnings reports show steady growth with sales and net income increasing year-over-year for the second quarter, despite a slight dip in six-month net income. The company's strategic partnership with Electrica to develop renewable energy projects further enhances its growth potential while leveraging existing operational strengths and market opportunities in the Romanian energy sector.

- Our comprehensive growth report raises the possibility that SNGN Romgaz is poised for substantial financial growth.

- Get an in-depth perspective on SNGN Romgaz's balance sheet by reading our health report here.

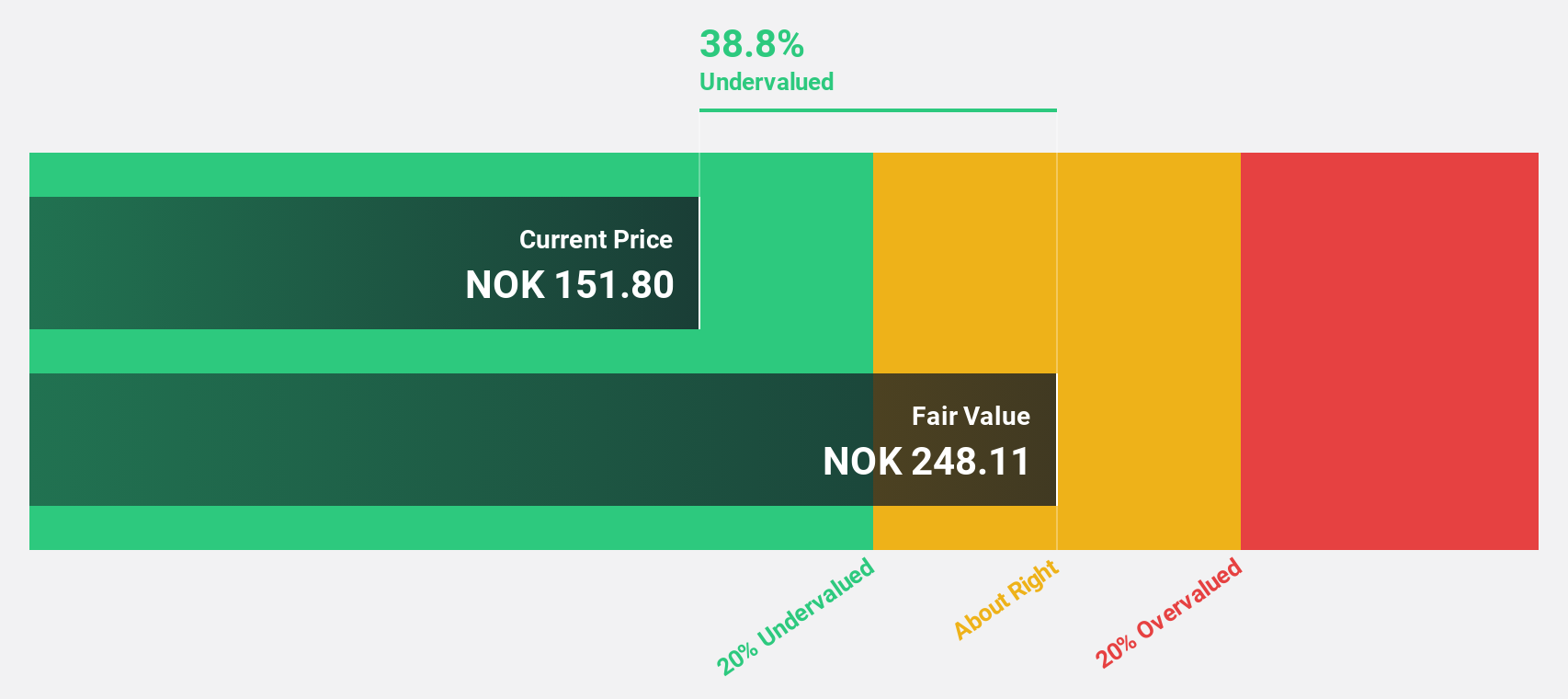

Atea (OB:ATEA)

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK15.90 billion.

Operations: The company's revenue segments are as follows: Norway generates NOK9.02 billion, Sweden contributes NOK13.50 billion, Denmark accounts for NOK8.48 billion, Finland provides NOK3.55 billion, and the Baltics add NOK1.89 billion to the total revenue.

Estimated Discount To Fair Value: 49.7%

Atea ASA is trading at NOK147.6, significantly below its estimated fair value of NOK293.57, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 22.9% annually, outpacing the Norwegian market's growth rate. Despite a modest past year earnings increase of 0.4%, Atea's recent share buyback program underscores management's confidence in its valuation and future prospects, although its dividend coverage remains a concern due to insufficient earnings support.

- Our earnings growth report unveils the potential for significant increases in Atea's future results.

- Take a closer look at Atea's balance sheet health here in our report.

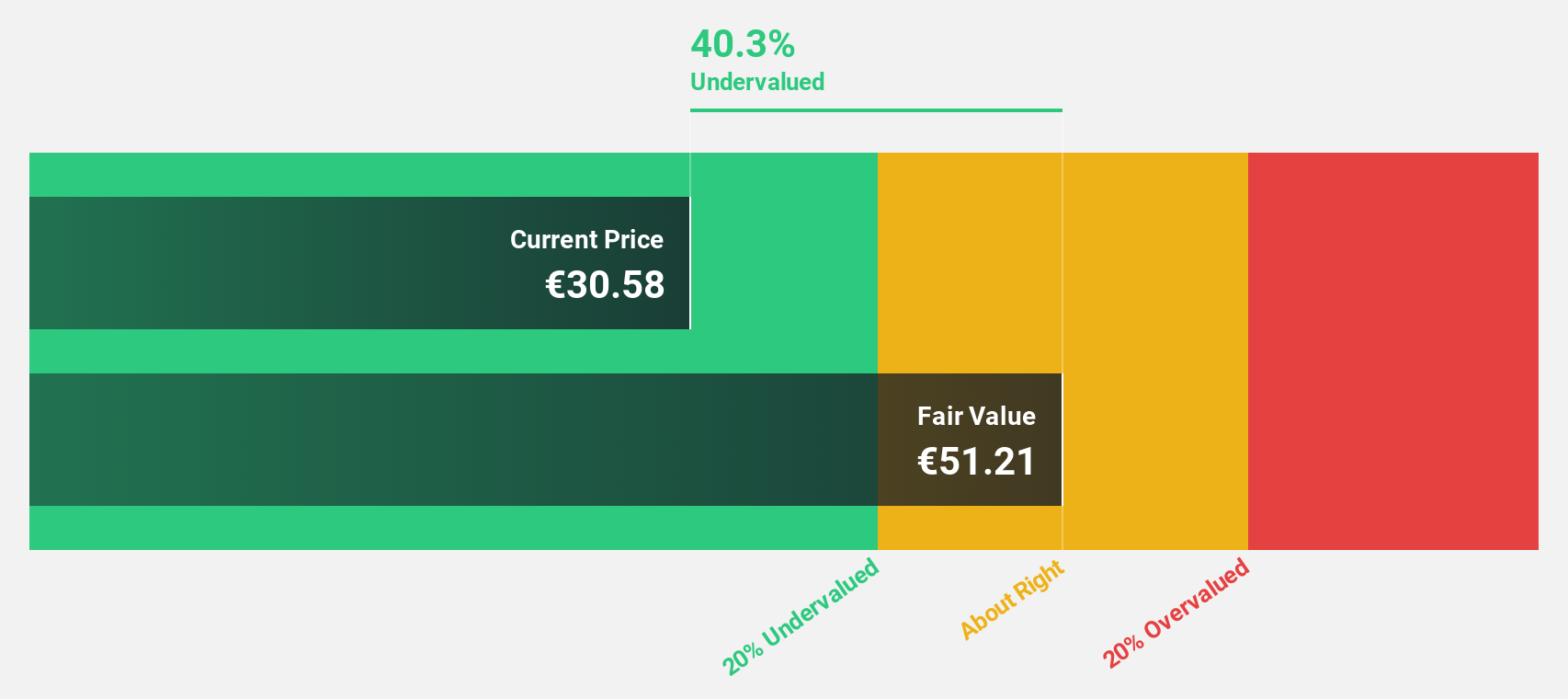

PVA TePla (XTRA:TPE)

Overview: PVA TePla AG, along with its subsidiaries, provides systems and solutions for manufacturing components used in energy storage systems, photovoltaic modules, and wind turbines globally, with a market cap of €631.34 million.

Operations: The company's revenue segments include €94.85 million from Industrial Systems and €176.00 million from Semiconductor Systems, which includes Solar Systems.

Estimated Discount To Fair Value: 40.3%

PVA TePla is trading at €30.58, well below its estimated fair value of €51.21, suggesting undervaluation based on cash flows. The company forecasts robust annual earnings growth of 20.3%, surpassing the German market average, despite recent declines in quarterly sales and net income. Revenue is expected to grow at 14.3% annually, supported by new guidance targeting €500 million by 2028, though current revenue guidance for 2025 remains conservative at the lower end of projections (€260-280 million).

- Our expertly prepared growth report on PVA TePla implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of PVA TePla.

Next Steps

- Gain an insight into the universe of 213 Undervalued European Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SNG

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026