3 European Stocks Estimated To Be Undervalued By Up To 48.4%

Reviewed by Simply Wall St

As European markets navigate the complexities of interest rate policies and trade uncertainties, the pan-European STOXX Europe 600 Index has remained relatively stable, with major indexes in Italy, Germany, France, and the UK showing modest gains. In this environment of cautious optimism and economic growth in certain sectors, identifying undervalued stocks can present opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK41.84 | SEK82.51 | 49.3% |

| Qt Group Oyj (HLSE:QTCOM) | €44.02 | €86.04 | 48.8% |

| Prosegur Cash (BME:CASH) | €0.706 | €1.38 | 48.8% |

| Noratis (XTRA:NUVA) | €0.785 | €1.56 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.40 | NOK59.87 | 49.2% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.379 | €0.74 | 48.5% |

| Endomines Finland Oyj (HLSE:PAMPALO) | €26.10 | €50.75 | 48.6% |

| E-Globe (BIT:EGB) | €0.685 | €1.32 | 48.3% |

| Aker BioMarine (OB:AKBM) | NOK84.30 | NOK168.11 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK261.00 | SEK505.98 | 48.4% |

Let's review some notable picks from our screened stocks.

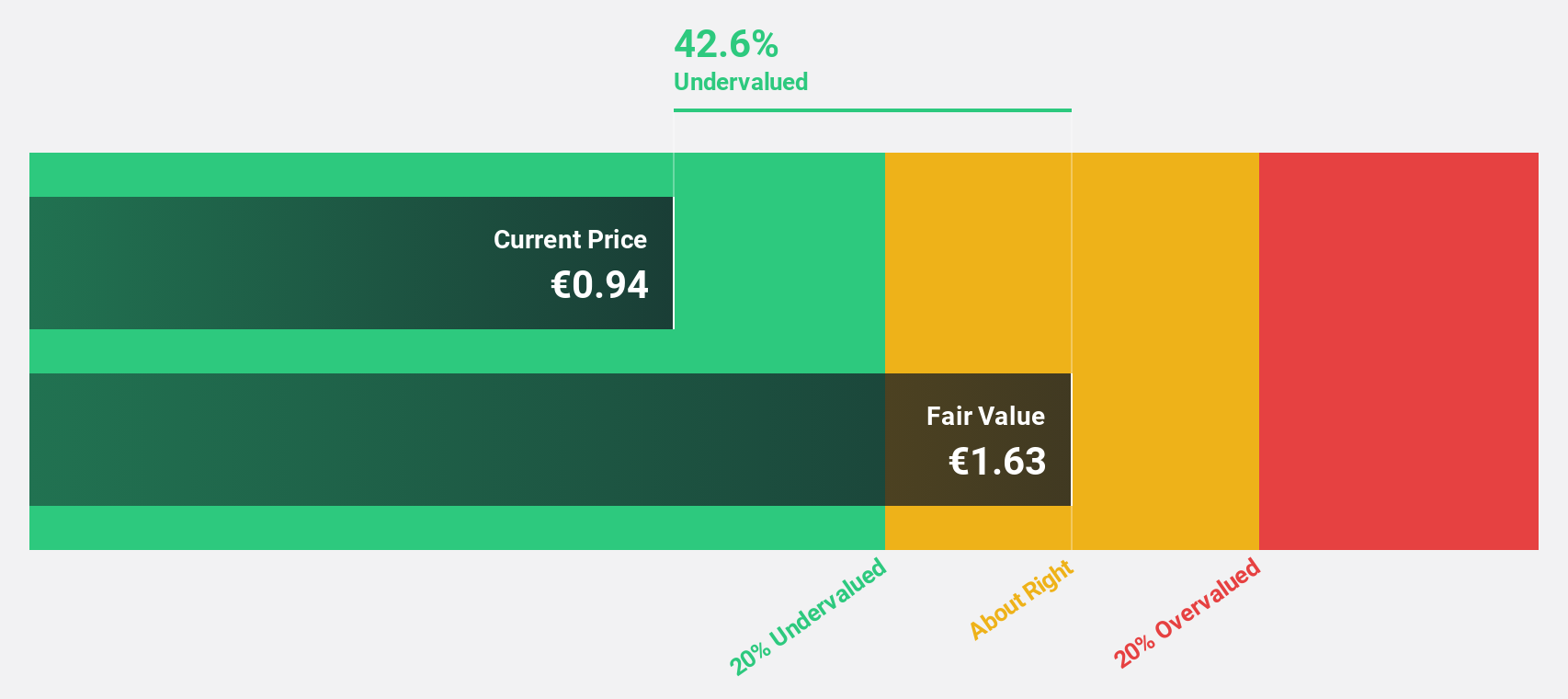

PostNL (ENXTAM:PNL)

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €525.47 million.

Operations: The company's revenue segments include Parcels generating €2.41 billion and Mail in The Netherlands contributing €1.32 billion.

Estimated Discount To Fair Value: 20.2%

PostNL appears undervalued based on cash flows, trading at €1.03 against a fair value estimate of €1.29, representing over 20% undervaluation. Despite recent net losses and slow revenue growth (1.8% annually), earnings are forecast to grow significantly at 73.91% per year, with profitability expected within three years—above average market growth. However, interest payments and dividends remain inadequately covered by earnings or free cash flow, posing potential risks to financial stability.

- Insights from our recent growth report point to a promising forecast for PostNL's business outlook.

- Click to explore a detailed breakdown of our findings in PostNL's balance sheet health report.

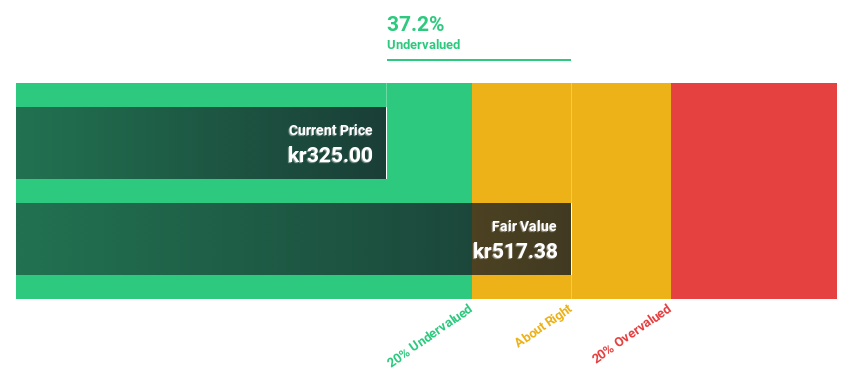

Absolent Air Care Group (OM:ABSO)

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units with a market cap of SEK2.95 billion.

Operations: The company's revenue is primarily derived from its Industrial segment, which accounts for SEK1.07 billion, and the Commercial Kitchen segment, contributing SEK235.28 million.

Estimated Discount To Fair Value: 48.4%

Absolent Air Care Group is trading at SEK 261, significantly below its estimated fair value of SEK 505.98, indicating substantial undervaluation based on cash flows. Despite a drop in recent sales and net income, the company's earnings are forecast to grow robustly at 40.2% annually—outpacing the Swedish market's growth rate. However, profit margins have declined from last year and significant insider selling occurred recently, which may warrant caution for potential investors.

- According our earnings growth report, there's an indication that Absolent Air Care Group might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Absolent Air Care Group.

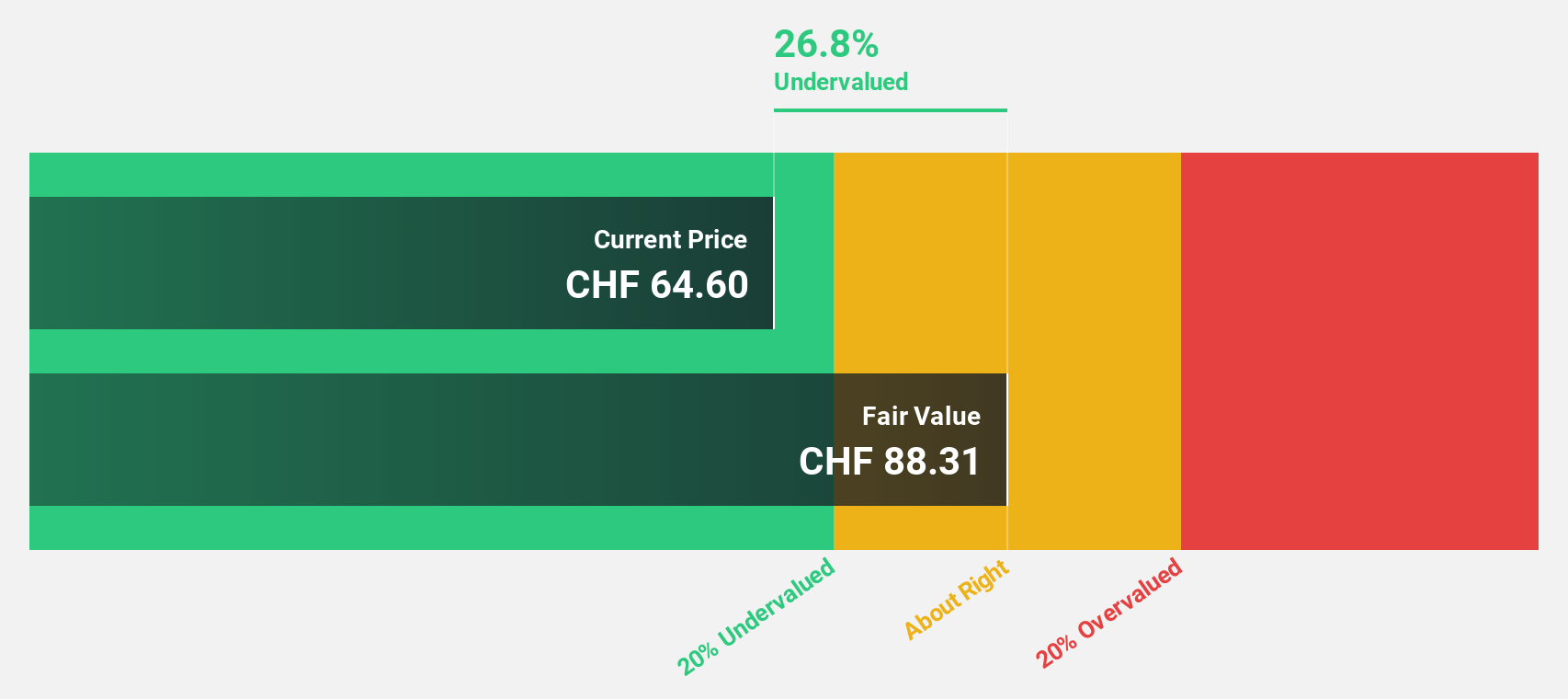

Landis+Gyr Group (SWX:LAND)

Overview: Landis+Gyr Group AG, along with its subsidiaries, offers integrated energy management solutions to the utility sector across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of CHF1.96 billion.

Operations: The company's revenue segments include $967.49 million from the Americas, $639.04 million from Europe, the Middle East and Africa (EMEA), and $158.68 million from the Asia Pacific region.

Estimated Discount To Fair Value: 23.4%

Landis+Gyr Group is trading at CHF68, considerably below its estimated fair value of CHF88.81, reflecting significant undervaluation based on cash flows. The company is expected to become profitable within three years and forecasts suggest revenue growth of 5.4% annually, outpacing the Swiss market's 3.9%. A recent agreement with Withlacoochee River Electric Cooperative to deploy advanced grid solutions may enhance future cash flow prospects despite a forecasted low return on equity of 10.5%.

- The growth report we've compiled suggests that Landis+Gyr Group's future prospects could be on the up.

- Dive into the specifics of Landis+Gyr Group here with our thorough financial health report.

Next Steps

- Dive into all 216 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives