As European markets rally, with the STOXX Europe 600 Index reaching record levels amid optimism for lower U.S. borrowing costs, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In such an environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy for those looking to navigate the current economic landscape while potentially benefiting from attractive yields.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.72% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.82% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.77% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.95% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.92% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

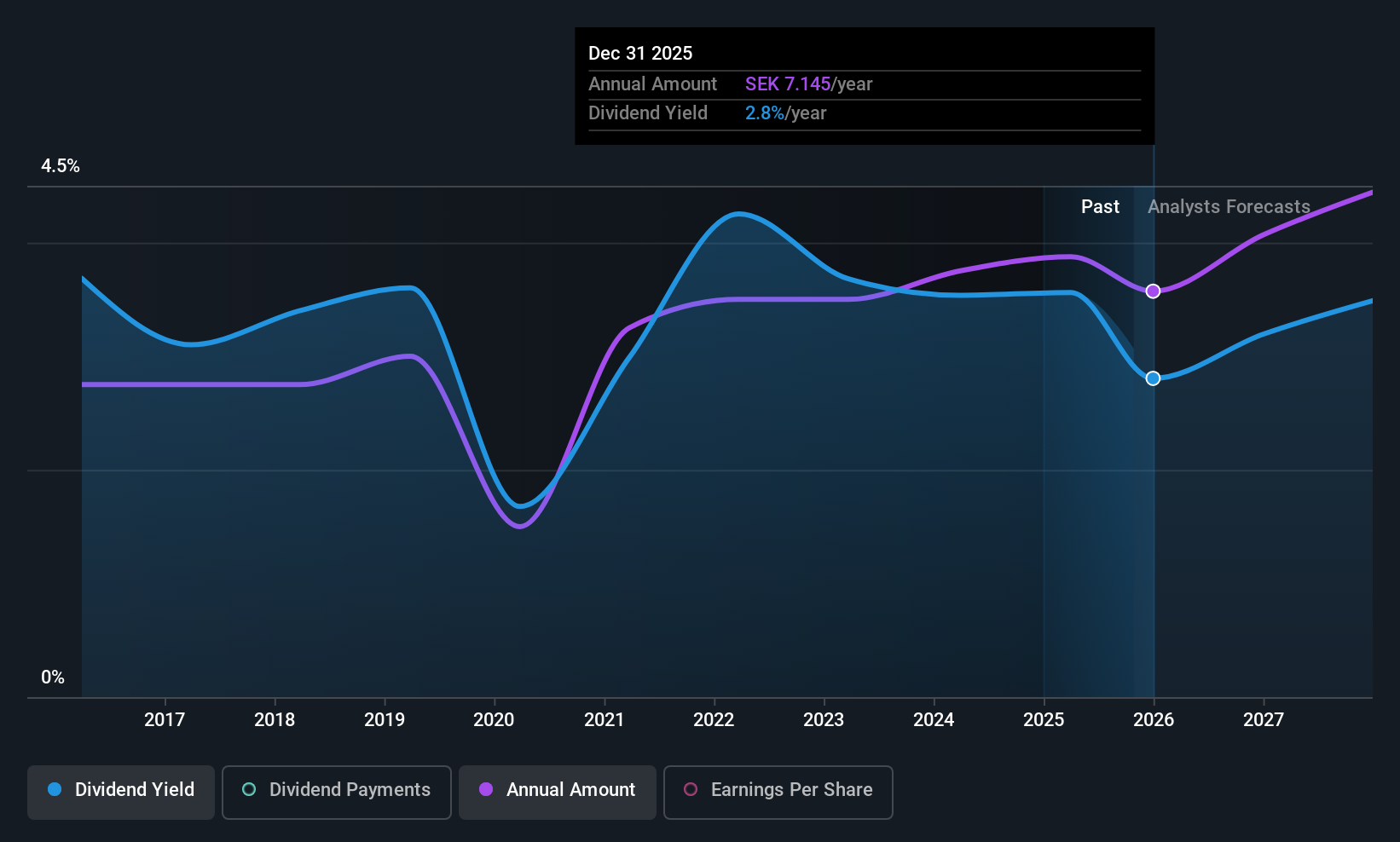

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services with a market capitalization of approximately SEK110.51 billion.

Operations: AB SKF's revenue is derived from two main segments: Automotive, contributing SEK27.82 billion, and Industrial, generating SEK67.73 billion.

Dividend Yield: 3.2%

AB SKF's dividend yield of 3.19% is below the top quartile in Sweden, and its dividend history has been volatile over the past decade. However, dividends have shown growth and are supported by earnings (65.7% payout ratio) and cash flows (57.7% cash payout ratio). Recent strategic expansions, including a new Super-precision centre in Italy, align with their focus on operational excellence and sustainability. Leadership changes aim to enhance business segments' strategic direction amidst plans for an automotive division separation.

- Get an in-depth perspective on AB SKF's performance by reading our dividend report here.

- Our valuation report unveils the possibility AB SKF's shares may be trading at a discount.

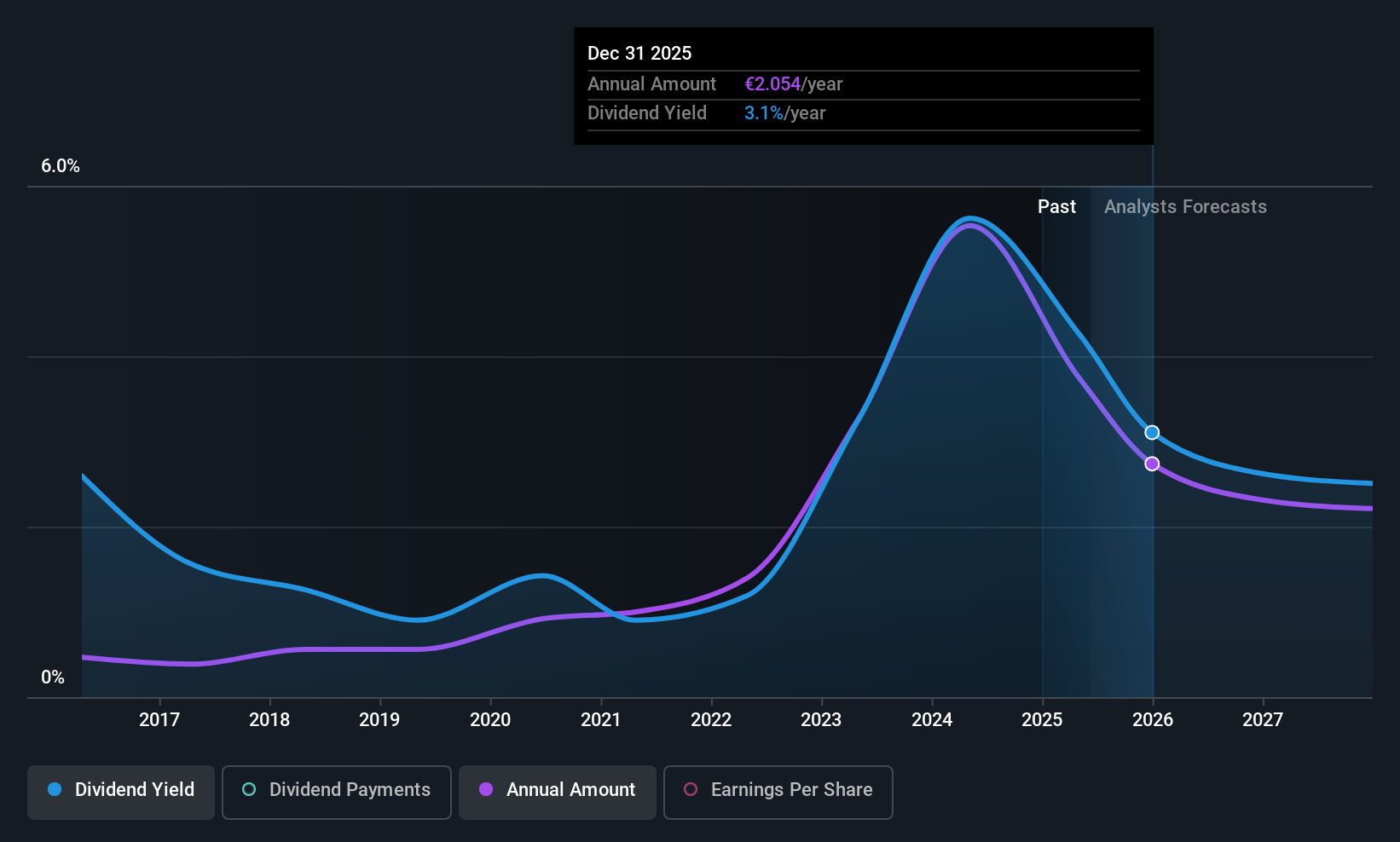

VERBUND (WBAG:VER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VERBUND AG, with a market cap of €22.18 billion, operates in the generation, trading and sale of electricity to various markets and customers both in Austria and internationally.

Operations: VERBUND AG's revenue segments include Grid (€1.62 billion), Hydro (€3.12 billion), Sales (€6.78 billion), and New Renewables (€323.30 million).

Dividend Yield: 4.4%

VERBUND's dividend payments have been volatile over the past decade, though they have increased overall. The company's dividends are supported by earnings (55% payout ratio) and cash flows (62.7% cash payout ratio), indicating a sustainable distribution despite an unstable track record. Recent earnings show a slight decline in sales for Q2 2025 to €1.67 billion, with net income stable at €406 million, reflecting consistent profitability amidst market fluctuations.

- Click to explore a detailed breakdown of our findings in VERBUND's dividend report.

- Our valuation report here indicates VERBUND may be undervalued.

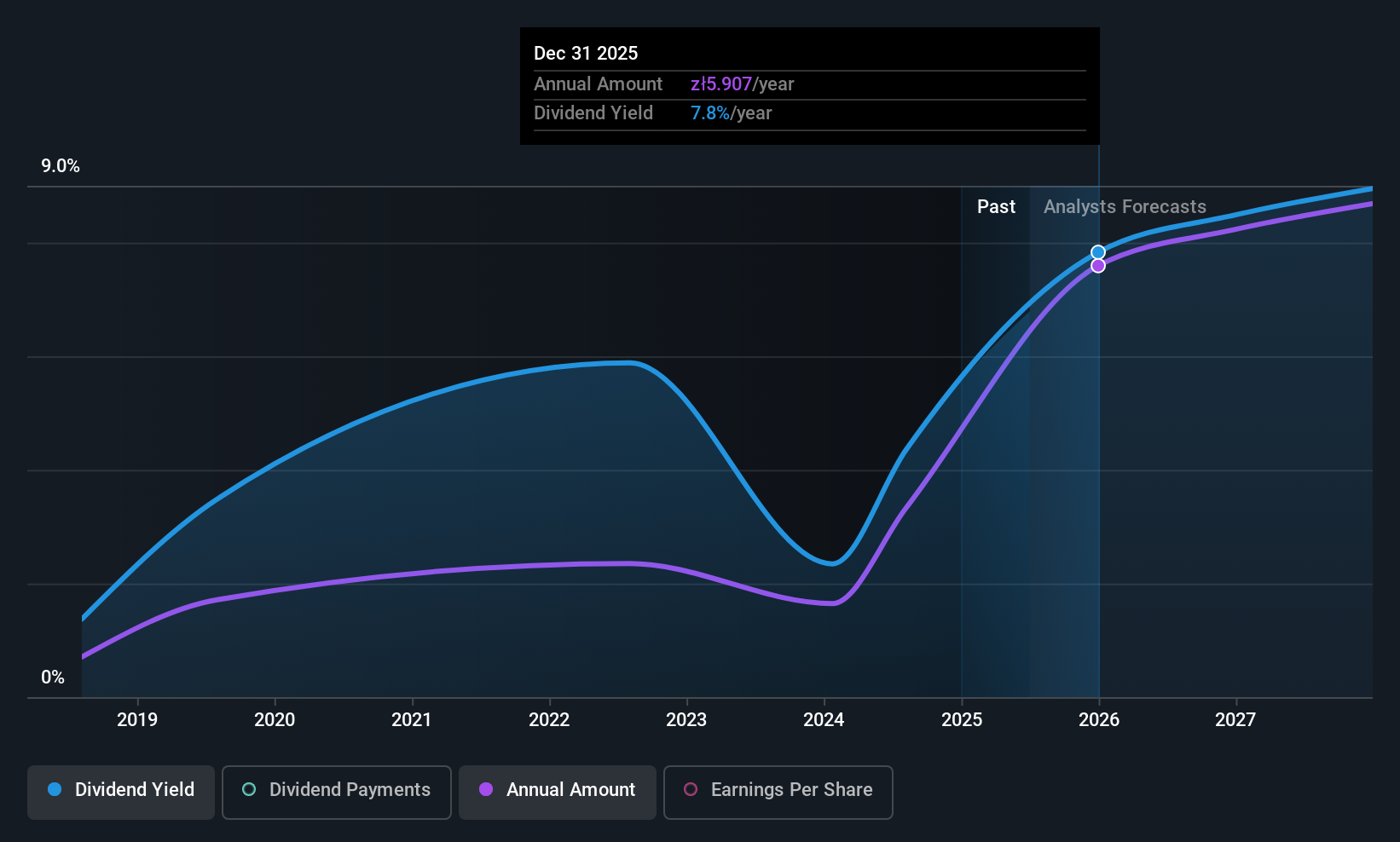

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna (WSE:PKO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna offers a range of banking products and services in Poland and abroad, with a market cap of PLN91.60 billion.

Operations: Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna generates revenue primarily from its Retail Segment, which contributes PLN21.96 billion, and the Corporate and Investment Segment, which adds PLN7.98 billion.

Dividend Yield: 7.5%

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna's dividend is among the top 25% in Poland, though it has experienced volatility over the past decade. The payout ratio of 68.2% suggests dividends are adequately covered by earnings now and in three years. Despite high bad loans at 3.7%, recent financials show strong net interest income growth to PLN 12.15 billion for H1 2025, indicating robust profitability supporting future dividend payments amidst an unstable track record.

- Delve into the full analysis dividend report here for a deeper understanding of Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna.

- Our comprehensive valuation report raises the possibility that Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna is priced lower than what may be justified by its financials.

Make It Happen

- Explore the 223 names from our Top European Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PKO

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna

Provides various banking products and services in Poland and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)