- United States

- /

- Oil and Gas

- /

- NYSE:TNK

3 Dividend Stocks Yielding Up To 4.4% For Your Income Portfolio

Reviewed by Simply Wall St

As the U.S. stock market rebounds sharply from recent declines, driven by a tech sector rally, investors are closely watching for opportunities to bolster their portfolios with stable income sources. In such a dynamic environment, dividend stocks can offer appealing benefits by providing regular income streams and potential capital appreciation, making them an attractive option for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 6.14% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.80% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.81% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.42% | ★★★★★★ |

| Ennis (EBF) | 5.59% | ★★★★★★ |

| Employers Holdings (EIG) | 3.23% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 4.17% | ★★★★★☆ |

| Dillard's (DDS) | 5.55% | ★★★★★★ |

| CompX International (CIX) | 5.27% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.03% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Scholastic (SCHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scholastic Corporation, with a market cap of approximately $625 million, publishes and distributes children's books both in the United States and internationally.

Operations: Scholastic Corporation generates revenue from several segments, including Children's Book Publishing and Distribution ($963.90 million), Education Solutions ($309.80 million), International operations ($279.60 million), and Entertainment ($61 million).

Dividend Yield: 3.1%

Scholastic Corporation, despite its recent net loss of US$1.9 million, maintains a quarterly dividend of US$0.20 per share, supported by a low cash payout ratio of 27.8%, indicating coverage by cash flows rather than earnings. The company's dividends have been stable and growing over the past decade, but its yield is modest at 3.12%, below top-tier U.S. dividend payers' levels. Recent strategic initiatives aim to enhance profitability and shareholder value amidst board changes and revenue growth projections for fiscal 2026.

- Dive into the specifics of Scholastic here with our thorough dividend report.

- The valuation report we've compiled suggests that Scholastic's current price could be quite moderate.

Community Financial System (CBU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Community Financial System, Inc. is the bank holding company for Community Bank, N.A., with a market cap of $2.72 billion.

Operations: Community Financial System, Inc. generates its revenue primarily through its operations as the bank holding company for Community Bank, N.A., with a focus on providing comprehensive financial services.

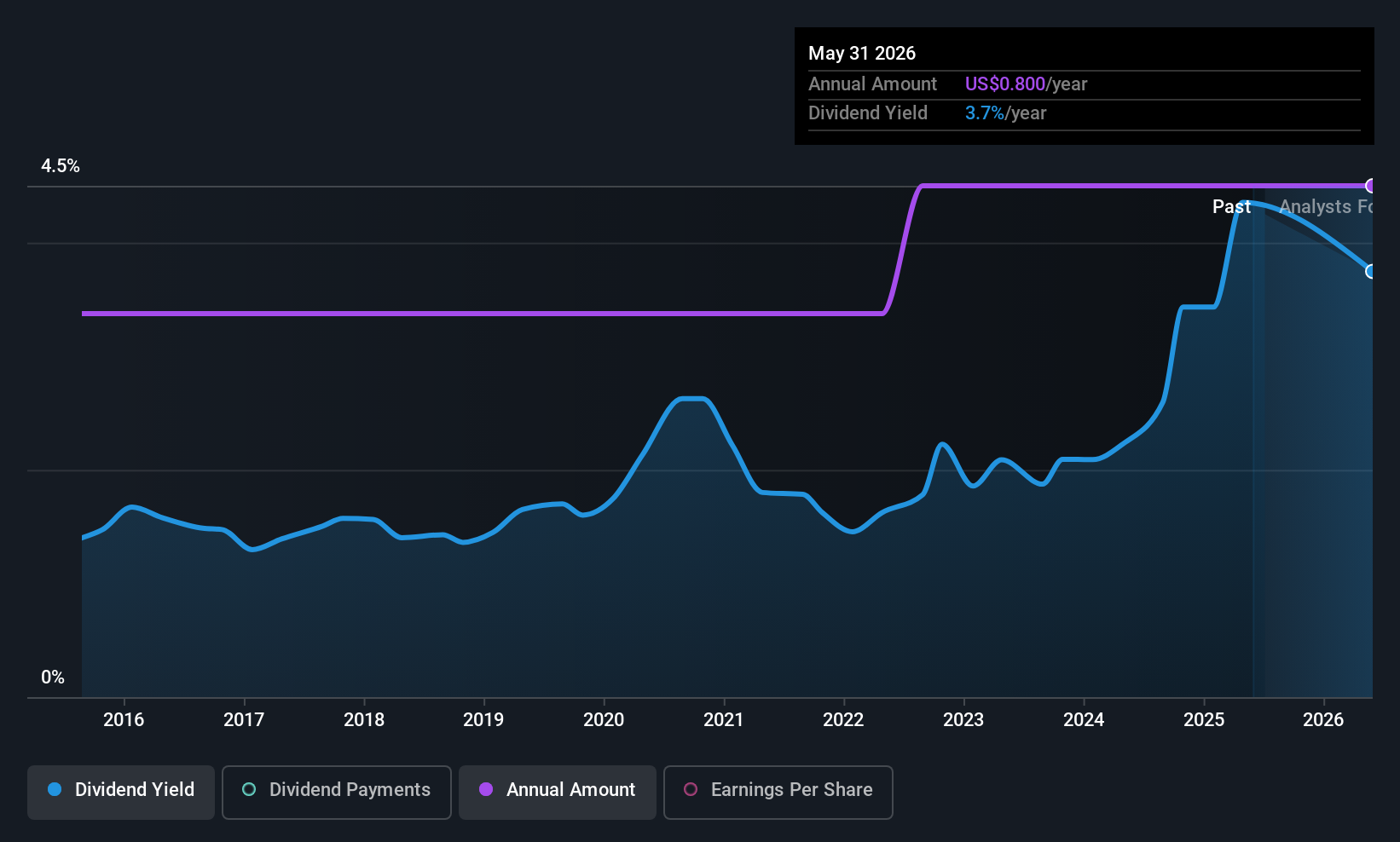

Dividend Yield: 3.6%

Community Financial System offers a stable dividend of US$0.47 per share, with a yield of 3.59%, which is below the top U.S. dividend payers but supported by a low payout ratio of 49.9%. Recent earnings show growth, with net income rising to US$51.33 million in Q2 2025 from US$47.92 million the previous year, despite increased net charge-offs of US$5.1 million this quarter, indicating potential risks to consider alongside its reliable dividend history and recent index inclusions.

- Click to explore a detailed breakdown of our findings in Community Financial System's dividend report.

- The analysis detailed in our Community Financial System valuation report hints at an deflated share price compared to its estimated value.

Teekay Tankers (TNK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teekay Tankers Ltd. offers marine transportation services to the oil industry both in Bermuda and globally, with a market cap of $1.47 billion.

Operations: Teekay Tankers Ltd. generates revenue primarily from its Tankers segment, which accounts for $869.50 million, and additionally from Marine Services and Other, contributing $127.80 million.

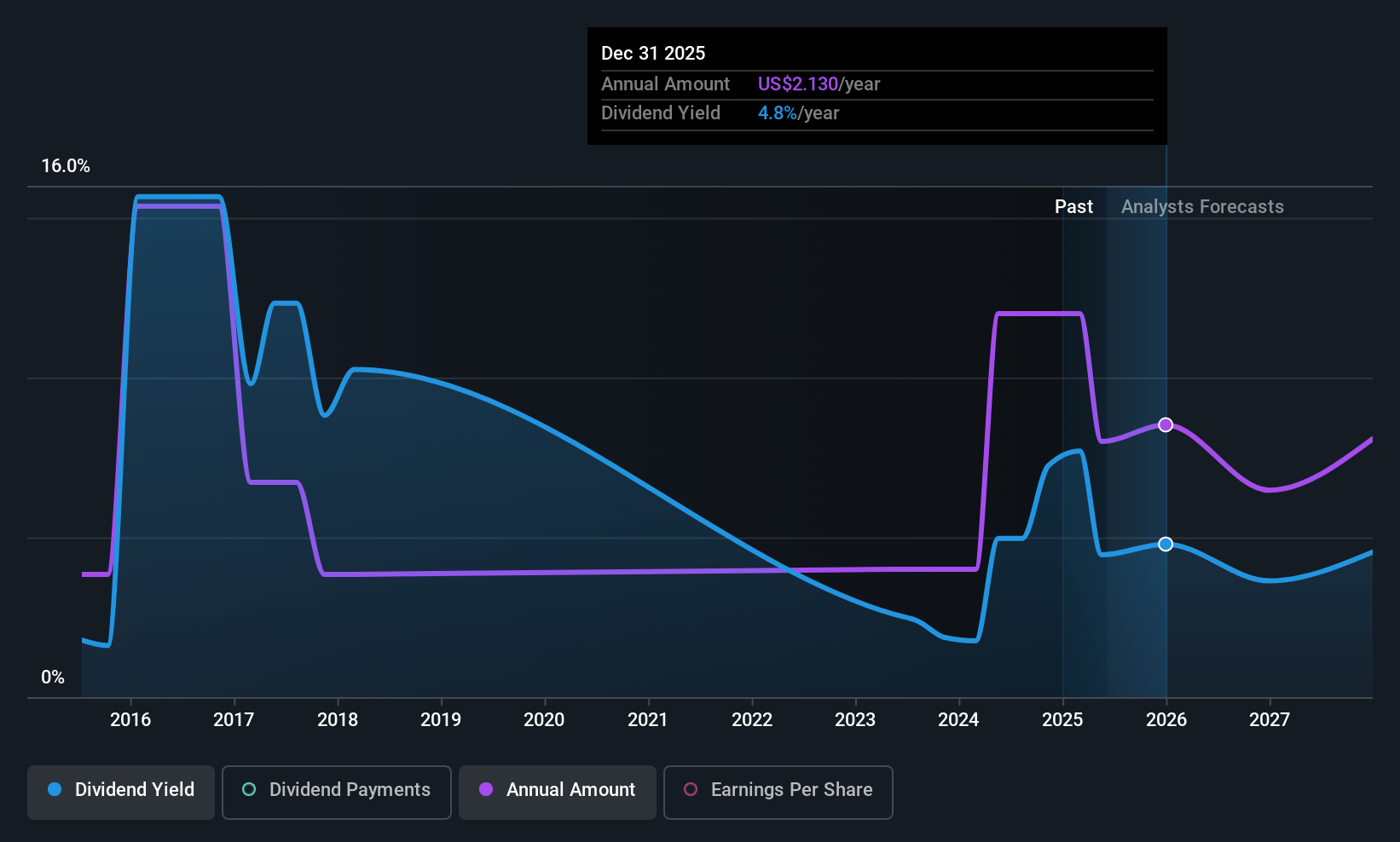

Dividend Yield: 4.4%

Teekay Tankers declared a consistent quarterly dividend of US$0.25 per share, alongside a special dividend of US$1.00 earlier this year. Despite recent earnings declines and volatile past dividends, the current payout is well-covered by both earnings and cash flows with a 36.7% payout ratio. However, its 4.43% yield remains below top-tier U.S. dividend payers, reflecting its relatively unstable dividend history despite trading at good value compared to industry peers.

- Click here to discover the nuances of Teekay Tankers with our detailed analytical dividend report.

- According our valuation report, there's an indication that Teekay Tankers' share price might be on the cheaper side.

Where To Now?

- Explore the 143 names from our Top US Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives