- Australia

- /

- Metals and Mining

- /

- ASX:CHN

3 ASX Penny Stocks With Market Caps Up To A$700M

Reviewed by Simply Wall St

Australian shares have recently experienced a slight decline, reflecting cautious investor sentiment amid a backdrop of previous strong advances and upcoming key financial reports. For those willing to explore beyond the established giants, penny stocks—often representing smaller or newer companies—remain an intriguing investment area. Despite their vintage label, these stocks can offer surprising value and growth potential when backed by solid financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.445 | A$127.53M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.39 | A$112.74M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.405 | A$77.22M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.99 | A$461M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.77 | A$3.16B | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.12 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| Bravura Solutions (ASX:BVS) | A$1.925 | A$862.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.37 | A$135.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.62 | A$219.22M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.82 | A$146.59M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 451 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market capitalization of approximately A$657.59 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration and evaluation company.

Market Cap: A$657.59M

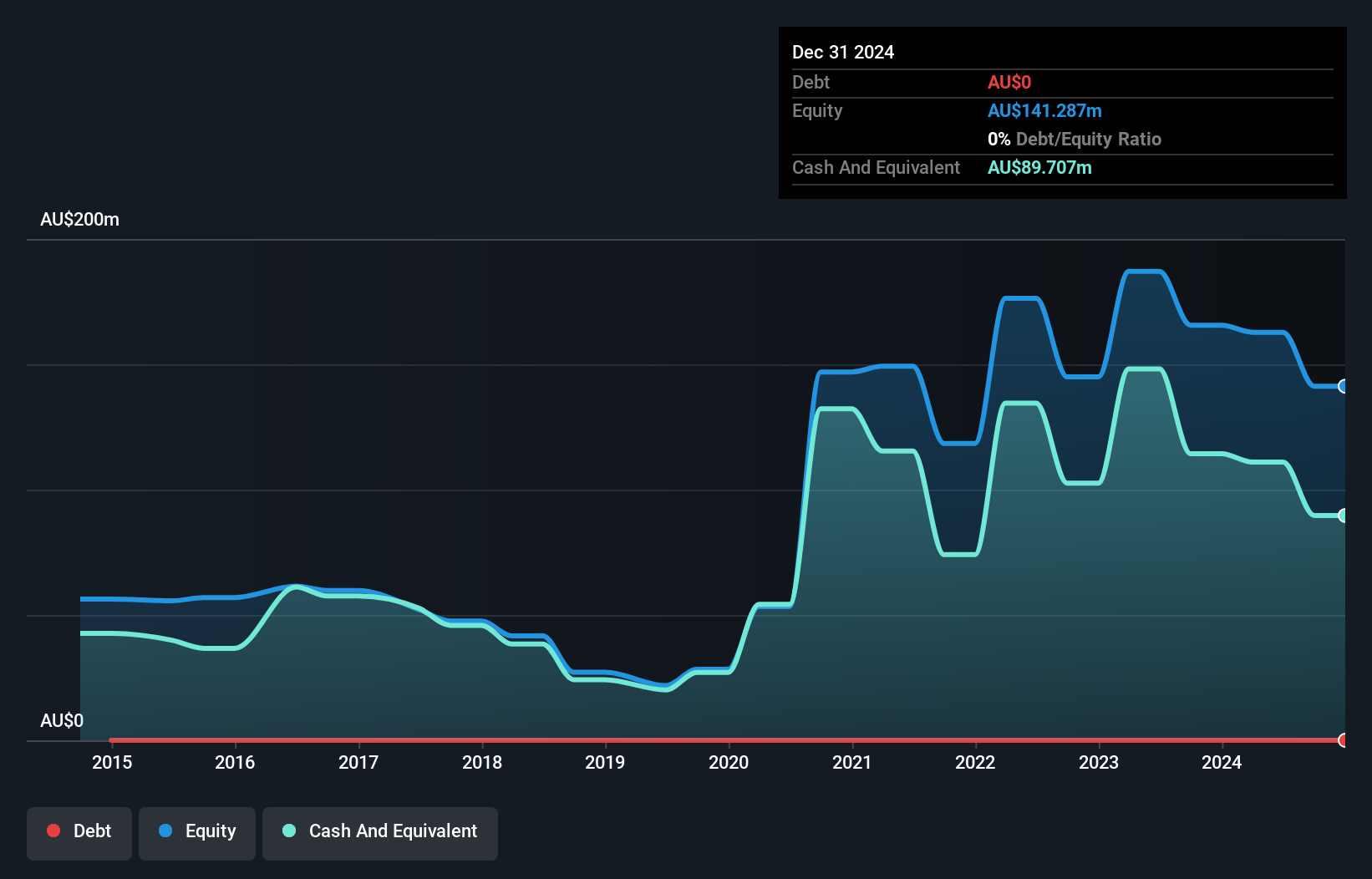

Chalice Mining, with a market cap of approximately A$657.59 million, is a pre-revenue company in the mineral exploration sector. Despite being unprofitable and having increased losses over the past five years, it remains debt-free and has not meaningfully diluted shareholders recently. The company benefits from an experienced board and management team, maintaining sufficient cash runway for over three years based on current free cash flow levels. While revenue growth is forecasted at 53.44% annually, profitability isn't expected within the next three years. Short-term assets significantly exceed liabilities, providing some financial stability amidst high volatility.

- Click to explore a detailed breakdown of our findings in Chalice Mining's financial health report.

- Assess Chalice Mining's future earnings estimates with our detailed growth reports.

IPD Group (ASX:IPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPD Group Limited is an Australian company that distributes electrical infrastructure, with a market cap of A$386.78 million.

Operations: The company generates revenue from its Products Division, which accounts for A$325.32 million, and its Services Division, contributing A$21.30 million.

Market Cap: A$386.78M

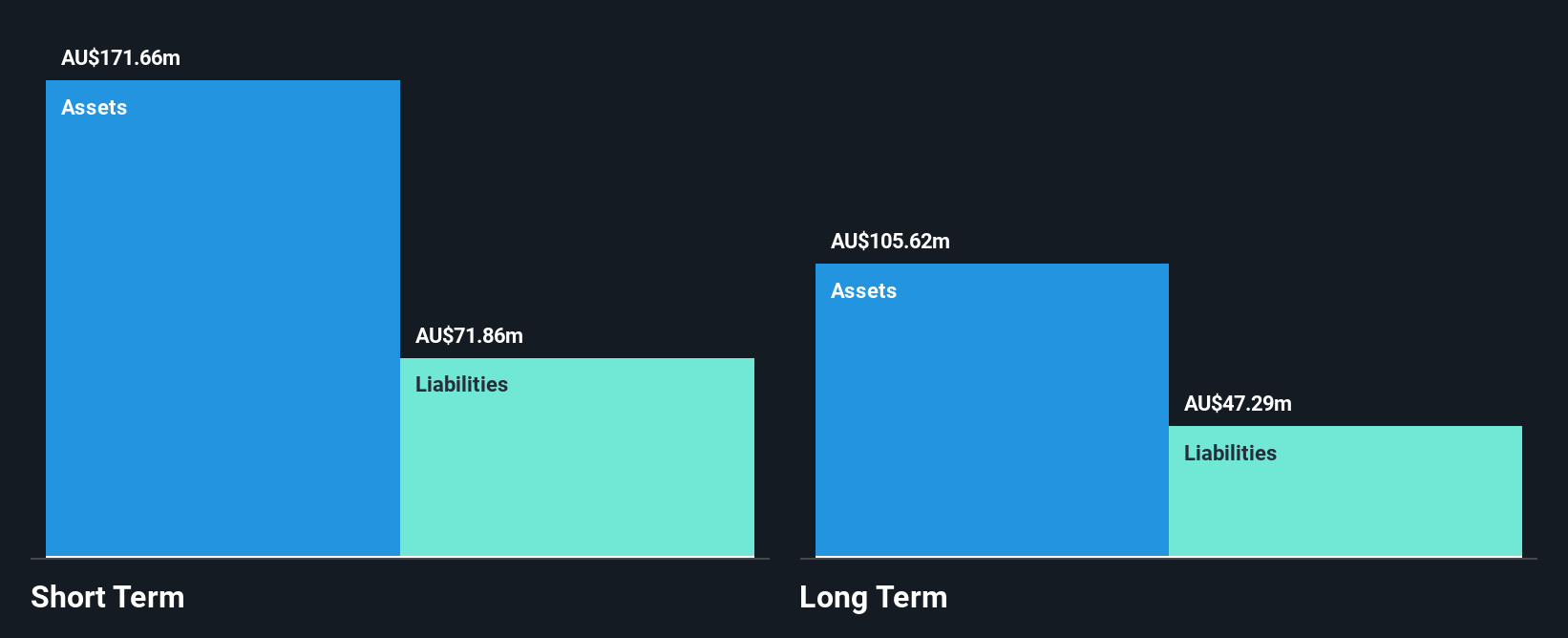

IPD Group, with a market cap of A$386.78 million, demonstrates financial stability through its substantial revenue streams from both Products (A$325.32 million) and Services Divisions (A$21.30 million). The company's short-term assets of A$171.7 million comfortably cover both short-term and long-term liabilities, enhancing its liquidity position. IPD's debt is well-managed, with operating cash flow covering 125% of it, while interest payments are adequately covered by EBIT at 20.8 times over. Earnings have shown impressive growth at 48.7% in the past year and are projected to continue growing annually by 4.86%, although Return on Equity remains low at 16.5%.

- Navigate through the intricacies of IPD Group with our comprehensive balance sheet health report here.

- Gain insights into IPD Group's future direction by reviewing our growth report.

Retail Food Group (ASX:RFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Retail Food Group Limited is a food and beverage company that manages a multi-brand retail food and beverage franchise both in Australia and internationally, with a market cap of A$138.45 million.

Operations: The company's revenue is derived from two primary segments: QSR Systems, contributing A$17.34 million, and Café, Coffee & Bakery, generating A$126.53 million.

Market Cap: A$138.45M

Retail Food Group, with a market cap of A$138.45 million, has recently achieved profitability, marking a significant turnaround. The company's revenue is primarily driven by its Café, Coffee & Bakery segment (A$126.53 million) and QSR Systems (A$17.34 million). Despite a low Return on Equity at 4.1%, the company trades at 70.4% below its estimated fair value and maintains satisfactory net debt to equity at 1.6%. While short-term assets cover short-term liabilities comfortably, they fall short against long-term liabilities. Debt management is robust with operating cash flow covering 78.4% of debt obligations effectively.

- Click here to discover the nuances of Retail Food Group with our detailed analytical financial health report.

- Explore Retail Food Group's analyst forecasts in our growth report.

Seize The Opportunity

- Investigate our full lineup of 451 ASX Penny Stocks right here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CHN

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion