- Hong Kong

- /

- Consumer Services

- /

- SEHK:1830

3 Asian Penny Stocks With Market Caps Over US$300M

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainties, Asian markets have shown resilience, with investors keenly observing developments in trade policies and economic indicators. Penny stocks, though an older term, continue to captivate attention as they represent smaller or newer companies that may offer unique value propositions. This article will explore three Asian penny stocks that stand out for their financial strength and potential growth opportunities, appealing to those looking for promising investments beyond the mainstream.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| North East Rubber (SET:NER) | THB4.20 | THB7.76B | ✅ 5 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.87 | HK$3.23B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.47 | HK$51.18B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.21 | HK$2.02B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.15 | HK$1.79B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,177 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

NZX (NZSE:NZX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NZX Limited operates a stock exchange in New Zealand and has a market capitalization of approximately NZ$525.66 million.

Operations: The company's revenue segments include Regulation (NZ$4.00 million), Wealth Tech. (NZ$9.73 million), Funds Services (NZ$44.01 million), Secondary Markets (NZ$25.99 million), Corporate Services (NZ$0.10 million), Information Services (NZ$19.91 million), and Capital Markets Origination (NZ$17.02 million).

Market Cap: NZ$525.66M

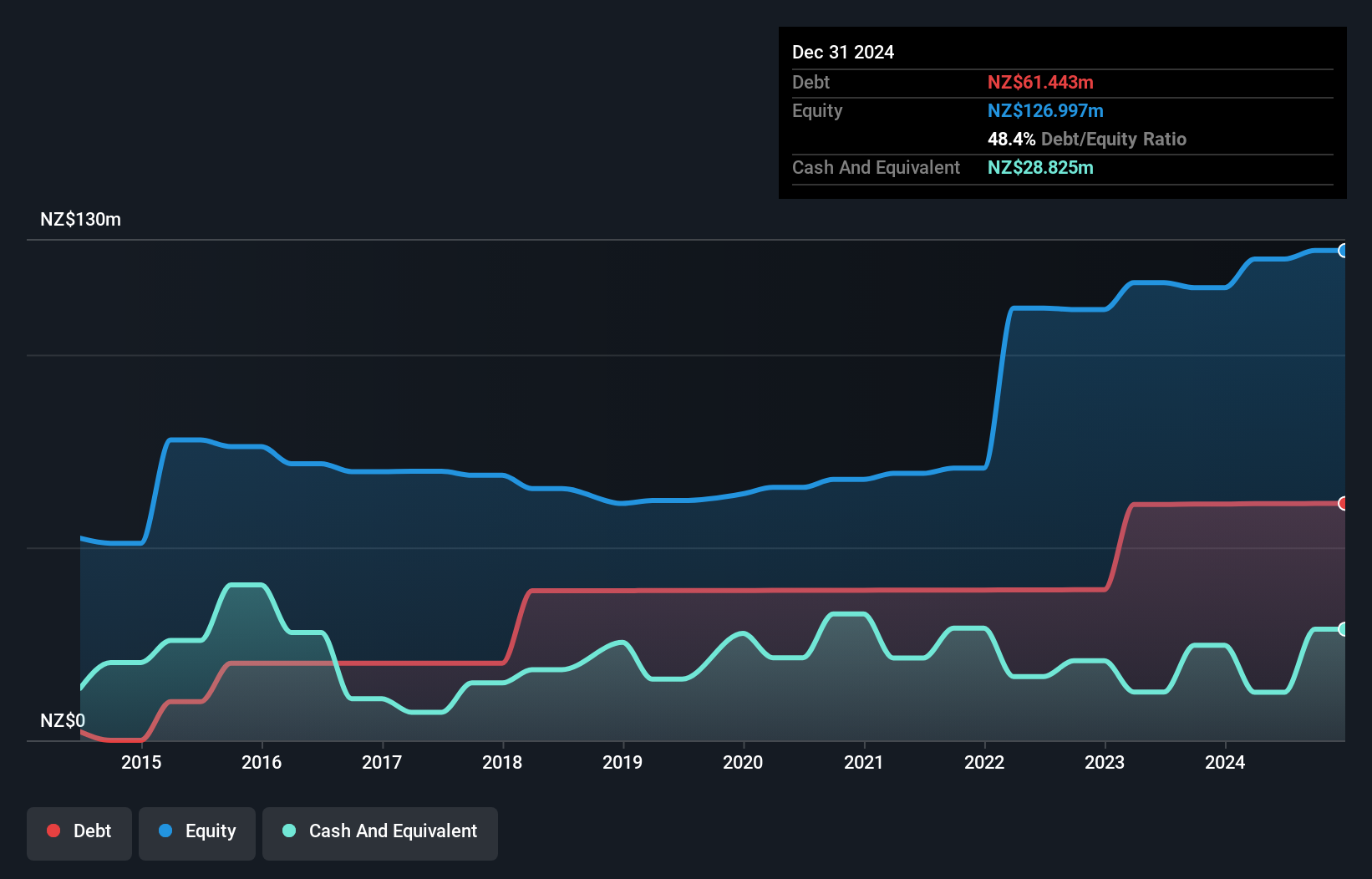

NZX Limited, with a market capitalization of approximately NZ$525.66 million, demonstrates financial stability and growth potential in the penny stock realm. Its diversified revenue streams include significant contributions from Funds Services (NZ$44.01 million) and Secondary Markets (NZ$25.99 million). The company has effectively reduced its debt to equity ratio from 60.8% to 48.4% over five years, with interest payments well covered by EBIT at 8.5 times coverage. Despite a large one-off gain impacting recent results, earnings have grown by 88.1% in the past year, outpacing industry averages and showcasing robust profit margins of 21.1%.

- Take a closer look at NZX's potential here in our financial health report.

- Assess NZX's future earnings estimates with our detailed growth reports.

Perfect Medical Health Management (SEHK:1830)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Medical Health Management Limited is an investment holding company that provides medical, aesthetic medical, and beauty and wellness services across Hong Kong, the People’s Republic of China, Macau, Australia, and Singapore with a market cap of HK$2.96 billion.

Operations: The company generates HK$1.30 billion in revenue from its services in medical, aesthetic medical, and beauty and wellness sectors.

Market Cap: HK$2.96B

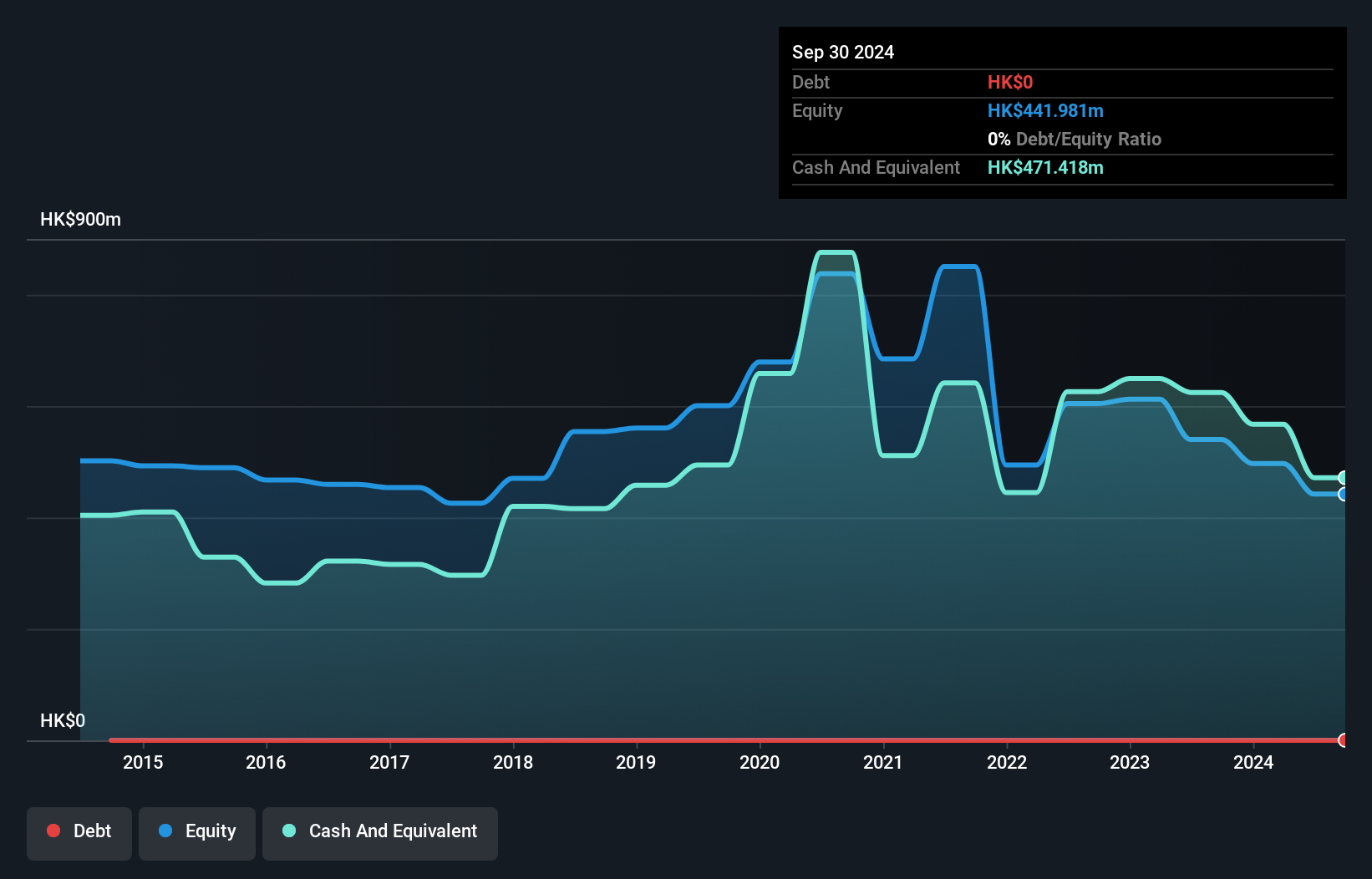

Perfect Medical Health Management, with a market cap of HK$2.96 billion, operates in the medical and wellness sectors across several regions. Despite trading at 71.2% below its estimated fair value, the company shows financial resilience with short-term assets exceeding both long- and short-term liabilities. Its management and board are seasoned, averaging over 13 years of experience each. Although earnings have declined by 2.7% annually over five years and recent profit growth is negative, its return on equity remains outstanding at 62.3%. However, the high dividend yield of 12.12% is not well supported by earnings or cash flow.

- Unlock comprehensive insights into our analysis of Perfect Medical Health Management stock in this financial health report.

- Learn about Perfect Medical Health Management's future growth trajectory here.

New Focus Auto Tech Holdings (SEHK:360)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New Focus Auto Tech Holdings Limited is an investment holding company involved in the manufacturing and sales of electronic and power-related automotive parts and accessories across China, the Americas, Europe, and the Asia Pacific, with a market cap of HK$895.28 million.

Operations: The company's revenue is primarily derived from two segments: CN¥382.78 million from the Manufacturing and Trading Business and CN¥135.73 million from the Automobile Dealership and Service Business.

Market Cap: HK$895.28M

New Focus Auto Tech Holdings, with a market cap of HK$895.28 million, faces challenges as its auditor expressed doubts about its ability to continue as a going concern. The company reported CN¥518.52 million in sales for 2024, down from the previous year, with a net loss of CN¥67.92 million. Despite reducing losses over five years and having satisfactory debt levels, short-term assets do not cover liabilities. While it maintains sufficient cash runway for over three years if free cash flow remains stable, the board's lack of experience and ongoing unprofitability present significant risks for investors in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of New Focus Auto Tech Holdings.

- Learn about New Focus Auto Tech Holdings' historical performance here.

Summing It All Up

- Dive into all 1,177 of the Asian Penny Stocks we have identified here.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1830

Perfect Medical Health Management

An investment holding company, engages in the provision of medical, aesthetic medical, and beauty and well services in Hong Kong, the People’s Republic of China, Macau, Australia, and Singapore.

Flawless balance sheet and good value.

Market Insights

Community Narratives