Last Update04 Sep 25

Analysts remain divided on Global Payments, with some citing activist investor involvement and attractive valuation as upside catalysts while others maintain caution ahead of Q2 results, resulting in the consensus analyst price target remaining unchanged at $103.18.

Analyst Commentary

- Bullish analysts cite the recent sizable stake taken by activist investor Elliot Management as a key catalyst offering substantial upside, given Global Payments' status as one of the cheapest stocks in the S&P 500.

- Valuation uplift is expected if Global Payments trades at or near integrated payments sector median multiples.

- The anticipated solid earnings performance for the fintech sector, alongside recent underperformance, provides a favorable setup for price appreciation.

- Some analysts point to continued "stability amid uncertainty" in Global Payments' upcoming results as supporting a neutral or Hold stance.

- Corrections and downgrades reflect cautious sentiment ahead of Q2 results, with certain firms remaining neutral despite sector trends.

What's in the News

- Elliott Management has built a significant stake in Global Payments following its $24.2B acquisition of Worldpay, leading to a 6% pop in Global Payments' shares despite the activist fund's demands and stake size remaining undisclosed (Financial Times).

- Global Payments announced new multi-year partnerships as the payments provider for the NHL's Tampa Bay Lightning and MLB's Minnesota Twins, and renewed existing relationships with the Dallas Cowboys, reinforcing its leadership in high-traffic sports venues (Key Developments).

- The company and Banco Nacional de Mexico (Banamex) renewed and expanded their strategic alliance, furthering Global Payments' presence in the Mexican acquiring and banking services market via the EVO Payments platform (Key Developments).

- Global Payments reaffirmed 2025 guidance, projecting GAAP revenue growth of 0.5%-1.5% but guiding for a GAAP diluted loss per share of 14.5%-15.5% for the year (Key Developments).

- The company repurchased 3,043,484 shares ($229M) from April to June 2025, taking total buybacks since 2014 to 36.45% of outstanding shares valued at $9.1B, and launched its new Genius for Retail POS solution targeting small- and medium-sized businesses in the US (Key Developments).

Valuation Changes

Summary of Valuation Changes for Global Payments

- The Consensus Analyst Price Target remained effectively unchanged, at $103.18.

- The Consensus Revenue Growth forecasts for Global Payments remained effectively unchanged, at 7.0% per annum.

- The Future P/E for Global Payments remained effectively unchanged, at 16.57x.

Key Takeaways

- Integrated platforms, strategic acquisitions, and tech investments are enhancing Global Payments' growth, margin expansion, and competitive positioning in digital and cross-border payments.

- Strong demand from small and mid-sized businesses and operational transformations are expected to drive recurring revenues, improved client retention, and expanded market share.

- Ongoing divestitures, integration risks, and rising competition threaten revenue stability, margin expansion, and the company's ability to adapt amid regulatory and technological disruption.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- The expanding rollout of the Genius integrated POS platform across the US and international markets positions Global Payments to capitalize on the ongoing movement from cash to digital payments and e-commerce growth, likely supporting accelerating revenues and new market share wins.

- Robust demand for integrated payment and software bundles, especially for small and mid-sized businesses (SMBs), is expected to drive higher recurring SaaS-like revenue streams and improved net margins through operating leverage, as evidenced by increased sales productivity and strong ISV partner growth.

- Cross-border payment capabilities are being enhanced through acquisitions (e.g., APAC-focused digital wallet/QR software) and expanded international distribution, enabling Global Payments to address the rising need for real-time, frictionless payments in global trade-supporting future transaction volume and revenue growth.

- The Worldpay acquisition and operational transformation program are creating scale benefits, cost efficiencies, and significant cross-selling opportunities (e.g., selling Genius into Worldpay's merchant base); these are expected to boost earnings growth and margin expansion after integration.

- Investments in cloud-based infrastructure, AI-powered fraud prevention, marketing automation, and streamlined customer onboarding are reducing churn, improving client stickiness, and enabling faster product launches, which will likely aid both revenue growth and net margin improvement over the next several years.

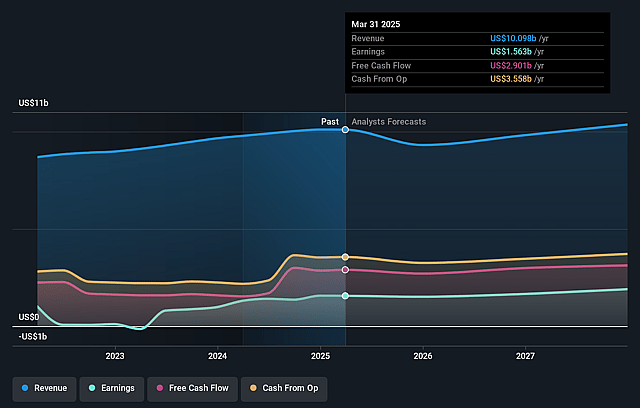

Global Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Global Payments's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.6% today to 13.8% in 3 years time.

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $8.47) by about September 2028, up from $1.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, up from 14.3x today. This future PE is about the same as the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 4.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on large-scale acquisitions like Worldpay, along with portfolio divestitures (e.g., payroll and issuer solutions), heightens integration and execution risk, which could potentially lead to operational disruption, integration challenges, and possible goodwill impairment-negatively impacting both revenue stability and long-term earnings growth.

- Increasing adoption of alternative, decentralized payment solutions and the rise of embedded finance models could erode merchant reliance on third-party payment processors, structurally compressing industry-wide fees and threatening future revenue and margin expansion.

- Margin pressures could intensify over time due to increased competition from fintech upstarts, legacy banks, and direct merchant network connections, particularly as merchants focus on optimizing payment acceptance costs, which may reduce net margins.

- Ongoing global regulatory changes and data privacy requirements across jurisdictions (such as strengthening data protection acts and emerging CBDCs/digital rails) could drive higher compliance costs and introduce uncertainty that would compress earnings and complicate international expansion.

- Sustained divestitures (over $550 million annualized revenue already divested and the potential for more post-Worldpay) and portfolio shifts may thin the company's long-term revenue base, lessen diversification, and increase exposure to secular risk in key verticals, challenging the company's ability to grow and maintain resilient free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $103.182 for Global Payments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $194.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.3 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 9.2%.

- Given the current share price of $86.91, the analyst price target of $103.18 is 15.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.