Key Takeaways

- Accelerated earnings growth is expected from successful integrations, synergy outperformance, and strong capital returns, potentially boosting EPS and shareholder value.

- Early international adoption of innovative payment platforms and ecosystem investments position the company for outsized organic growth and market share gains.

- Technological disruption, regulatory challenges, integration risks, and merchant attrition could erode Global Payments' revenue stability, margins, and long-term relevance in the payments industry.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- Analyst consensus expects substantial revenue and cost synergies from the Worldpay acquisition, but this could be conservative given management's record of exceeding synergy targets in prior integrations, suggesting the $650 million operating income benefit and $200 million in cross-sell revenue synergies could be outpaced, resulting in even greater margin expansion and accelerated earnings growth.

- While the consensus frames $7.5 billion in capital returns and improved leverage as value enhancers, Global Payments is on track to generate nearly 50% higher annual run-rate levered free cash flow by 2028 versus pre-Worldpay projections, which could result in much larger buybacks or dividends-materially boosting EPS and shareholder value.

- The successful launch and rapid international expansion of the Genius unified point-of-sale platform-supported by established distribution networks in Europe, Asia, and LatAm-give Global Payments first-mover advantage in capturing the secular shift toward digital and mobile payments, likely accelerating organic revenue growth beyond analyst models.

- The company's significant investments in AI-driven commerce enablement, embedded finance, and integrated developer platforms are evolving its offering into a full-stack, software-led ecosystem, which should drive long-term, high-margin recurring revenue streams and increase switching costs for clients, supporting sustainable net margin growth.

- Global Payments' ability to capitalize on greenfield markets with low POS penetration-including fast-growing emerging markets-plus its proven track record of cross-selling through both direct and channel partners, positions the company to benefit disproportionately from the ongoing global shift to e-commerce and contactless payments, leading to higher-than-expected revenue and market share gains.

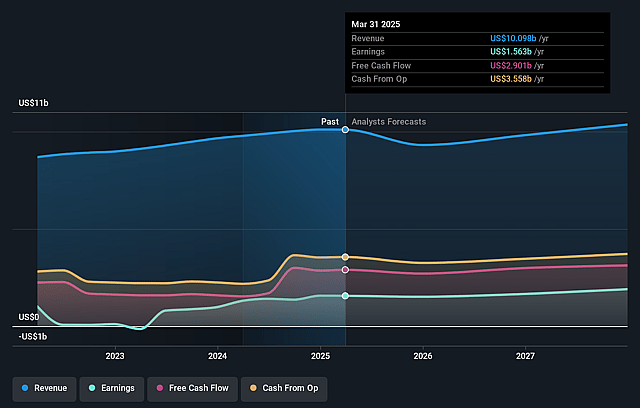

Global Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Global Payments compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Global Payments's revenue will grow by 3.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.6% today to 17.3% in 3 years time.

- The bullish analysts expect earnings to reach $1.9 billion (and earnings per share of $9.97) by about September 2028, up from $1.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, up from 14.3x today. This future PE is greater than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 4.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rise of embedded finance and invisible payments threatens to marginalize third-party processors like Global Payments, as large platform companies may internalize payment flows and bypass traditional intermediaries, which could reduce transaction volumes and compress revenue over time.

- Persistent technological innovation, such as blockchain-based payment rails and potential CBDC adoption, raises the risk of disintermediation, making legacy processors like Global Payments less relevant and placing long-term pressure on both overall revenue and transaction fee margins.

- Heightened global regulatory scrutiny-particularly regarding data privacy, cross-border data flows, and compliance requirements-will likely increase operational complexity and compliance costs, which could erode net margins and stall international growth.

- There is significant execution risk as Global Payments pursues large-scale acquisitions and integrations, such as the planned Worldpay deal; any missteps in integrating systems, harmonizing cultures, or realizing synergies could result in revenue dis-synergies, higher-than-anticipated one-time costs, and lower earnings growth.

- Merchant attrition remains a concern, as evolving product complexity and the need for constant omni-channel adaptation could increase churn rates, especially in volatile small business segments, threatening recurring revenue streams and the stability of future cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Global Payments is $155.63, which represents two standard deviations above the consensus price target of $103.18. This valuation is based on what can be assumed as the expectations of Global Payments's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $194.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $11.1 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 9.2%.

- Given the current share price of $86.91, the bullish analyst price target of $155.63 is 44.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.