Key Takeaways

- Shifting payment technologies, including mobile ecosystems and blockchain, threaten to erode Global Payments' market share, revenue base, and relevance without significant innovation.

- Heightened competition, regulatory scrutiny, and integration risks from acquisitions are likely to compress margins and increase operational challenges, jeopardizing long-term profitability.

- Expanding digital payments and successful product launches, operational efficiency, strategic acquisitions, and disciplined capital allocation collectively position the company for accelerated growth and enhanced shareholder returns.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- Global Payments faces a persistent threat from the accelerating shift toward direct-to-consumer and embedded payment capabilities within mobile platforms, which could bypass traditional payment processors. As tech giants and super-apps continue to expand proprietary payment ecosystems, Global Payments' transaction volumes and addressable market risk significant long-term erosion, pressuring core revenue growth over the next decade.

- The rapid advancement and adoption of decentralized finance and blockchain-based transaction alternatives present a structural risk to legacy payment rails like those operated by Global Payments. If merchants and consumers increasingly utilize blockchain networks for settlements and cross-border transactions, the company could experience disruption in transaction flows and a declining revenue base without adequate offset from digital asset offerings.

- Heavy dependence on large-scale mergers and acquisitions, including the Worldpay acquisition, compounds integration and execution risks. As the business becomes increasingly complex, future operational disruptions, cost overruns, or the failure to realize expected revenue and cost synergies could lead to material impairment charges and sustained net margin compression.

- Elevated competition from both agile fintech startups and global technology companies is expected to drive further commoditization of core payment processing services. Sustained downward pressure on transaction fees and loss of pricing power may be exacerbated by Global Payments' slower pace of product innovation or inability to compete against well-funded disruptors, resulting in long-term revenue stagnation and erosion of gross profit.

- Intensifying regulatory scrutiny around security, privacy, and cross-border payments-especially as authorities ramp up oversight of payment data-will drive continued escalation in compliance and cybersecurity costs. As Global Payments spreads across more jurisdictions with complex requirements, earnings will be squeezed by higher ongoing operating expenditures and possible penalties, further eroding profitability.

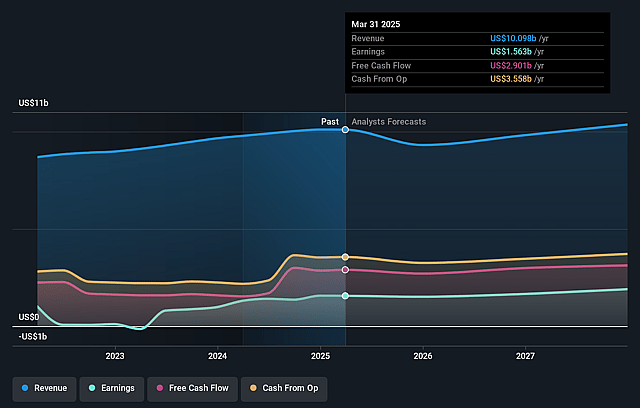

Global Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Global Payments compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Global Payments's revenue will decrease by 0.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 14.6% today to 13.1% in 3 years time.

- The bearish analysts expect earnings to reach $1.3 billion (and earnings per share of $6.71) by about September 2028, down from $1.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, down from 14.0x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 4.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid global adoption of digital and electronic payments, combined with resilient consumer spending and ongoing e-commerce growth, is expanding Global Payments' addressable market and supporting healthy constant-currency adjusted net revenue growth and adjusted EPS performance.

- The successful launch and early momentum of the Genius unified POS platform in both restaurants and retail, alongside aggressive international expansion plans, create significant cross-sell and front-book acquisition opportunities, which are likely to boost both revenue growth and operating margins for several years.

- Effective execution of large-scale operational transformation, including sales force modernization, sales productivity gains, automation, and the integration of acquired technologies, is driving sustainable operating income benefits and free cash flow conversion, supporting higher shareholder returns and margin expansion.

- The upcoming Worldpay acquisition, with clear synergy targets, complementary global scale, and broad capabilities across omni-channel commerce, is expected to result in meaningful revenue synergies, increased distribution, and enhanced product offerings, which could accelerate long-term growth and earnings.

- Strong capital allocation discipline, with $7.5 billion in total capital returns projected between 2025 and 2027, consistent free cash flow conversion above ninety percent, and a substantial levered free cash flow uplift post-Worldpay integration, enhances the ability to invest in innovation and further shareholder distributions, supporting future share price appreciation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Global Payments is $65.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Global Payments's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $194.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $10.2 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 9.2%.

- Given the current share price of $85.08, the bearish analyst price target of $65.0 is 30.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.