Last Update 25 Jan 26

Fair value Increased 0.51%OKTA: Cybersecurity Demand And 90 Day Catalyst Watch Will Support Premium Performance

Narrative Update on Okta

Our analyst price target for Okta edges higher by about US$1, supported by slightly lower discount rate assumptions and steady growth and profitability expectations that align with recent research pointing to durable cybersecurity demand and potential near term bookings strength.

Analyst Commentary

Recent Street research on Okta reflects a mix of optimism about growth and execution along with caution around near term expectations and valuation sensitivity ahead of key earnings events.

Bullish Takeaways

- Bullish analysts highlight durable demand for identity and cybersecurity solutions, which they see as supportive for Okta's bookings and revenue trajectory.

- The addition of an upside 90 day catalyst watch signals that some expect upcoming events to be supportive for the share price, tied to potential strength in fiscal 2026 bookings.

- Expectations for Okta to close fiscal 2026 strongly, with bookings outperformance that could lift revenue estimates, point to confidence in the company’s execution on sales and pipeline conversion.

- The recent upgrade to a more positive rating stance reflects growing comfort with Okta's ability to sustain growth and progress on profitability, which feeds into higher target valuations for the stock.

Bearish Takeaways

- Some bearish analysts are keeping more neutral stances and have trimmed price targets, suggesting sensitivity around Okta's valuation relative to its growth profile.

- The reset of one target to US$95 from US$112 ahead of the December earnings report indicates caution that near term results or guidance could limit upside if expectations are already high.

- Modeling Q3 remaining performance obligation, or RPO, growth at 10% year over year shows conservative assumptions for forward demand, even if an upside case of 13% is also considered.

- The presence of neutral ratings alongside positive commentary on catalysts suggests that some see a balanced risk reward, where strong execution is already partially reflected in the current share price.

What's in the News

- The Trump administration is reported to be weighing whether to enlist private companies in potential cyberwarfare efforts, highlighting the role of commercial cybersecurity providers like Okta in broader national security discussions (New York Times).

- Okta's Board of Directors authorized a share repurchase plan. The company announced a program to buy back up to US$1.0b of Class A common stock, funded with existing cash and cash flow from operations, with no fixed expiration date.

- Okta issued earnings guidance for the fourth quarter of fiscal 2026, with expected total revenue of US$748 million to US$750 million and current remaining performance obligations (RPO) of US$2.445b to US$2.450b.

- For full year fiscal 2026, Okta guided to total revenue of US$2.906b to US$2.908b.

- Okta announced new in-country platform tenants in India and a new Canadian cell, both aimed at supporting data residency, compliance needs and disaster recovery, while also addressing identity security for both human and AI agent use cases in those markets.

Valuation Changes

- Fair Value: The analyst fair value estimate edges up slightly from US$113.02 to US$113.60 per share.

- Discount Rate: The discount rate assumption is slightly lower, moving from 9.01% to 8.93%.

- Revenue Growth: The long term revenue growth assumption is essentially unchanged at about 8.98%.

- Net Profit Margin: The long term net profit margin assumption remains effectively stable at about 11.53%.

- Future P/E: The future P/E multiple assumption moves marginally higher from 64.95x to 65.14x.

Key Takeaways

- Okta benefits from growing demand for unified cloud identity platforms and rising security needs amid complex digital transformations, driving durable revenue and larger contracts.

- Expansion into AI-driven security and broadening platform offerings increases cross-sell opportunities, supporting margin improvement and long-term profitability.

- Intensifying competition, integration risks, limited new customer growth, selective international focus, and evolving technologies threaten Okta's revenue growth, pricing power, and long-term margins.

Catalysts

About Okta- Operates as an identity partner in the United States and internationally.

- Okta is positioned to capture expanding demand as enterprises globally accelerate cloud migration and digital transformation, with increasing complexity and fragmentation in identity systems driving large organizations to consolidate onto a unified, cloud-native platform-supporting multi-year revenue growth and larger average contract values (ACV).

- The proliferation of AI agents and nonhuman identities is creating new, urgent security use cases that require sophisticated identity governance, privileged access management, and policy controls-areas where Okta is innovating (Cross App Access, Auth0 for AI Agents, Axiom acquisition), opening incremental growth avenues and potential margin expansion through higher value and differentiated products.

- The rising frequency and sophistication of cyberattacks, combined with tightening regulatory mandates (especially in the public sector and large enterprises), are establishing identity as a mission-critical, recurring investment category; this aligns with Okta's increased penetration in federal and enterprise verticals, which enhances revenue durability and long-term earnings visibility.

- Okta's expanding platform breadth beyond workforce IAM-including customer identity, security posture management, threat protection, and suites-improves cross-sell and upsell opportunities, supporting top-line acceleration and leveraging existing sales channels for improved operating leverage and net margin improvement as specialization in go-to-market teams boosts sales productivity.

- Global adoption of Zero Trust security frameworks and the movement toward SaaS-native security stacks favor independent, extensible platforms with broad integration ecosystems, allowing Okta's neutral, open approach to capture wallet share as customers seek to avoid vendor lock-in from larger, bundled security suites-sustaining long-term revenue growth and profitability.

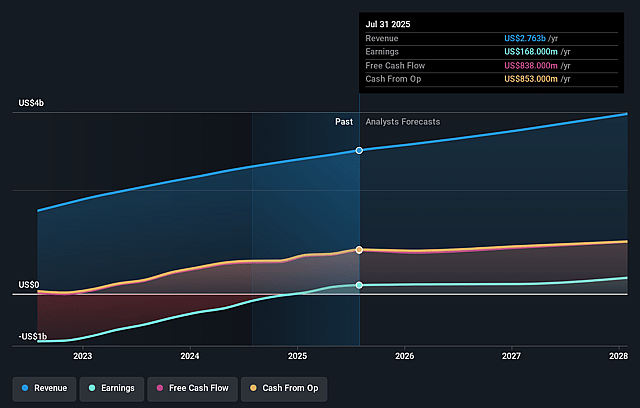

Okta Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Okta's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.1% today to 11.4% in 3 years time.

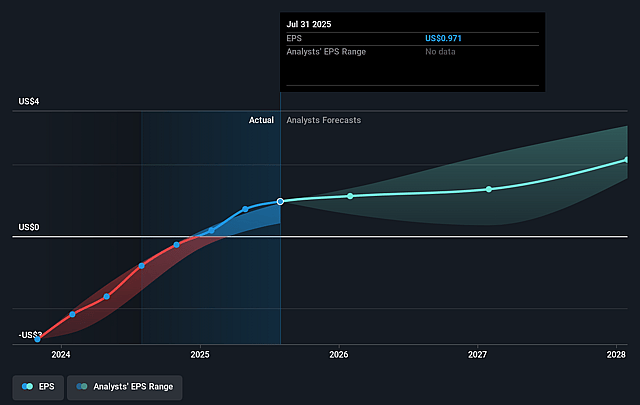

- Analysts expect earnings to reach $414.2 million (and earnings per share of $2.51) by about September 2028, up from $168.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $592.1 million in earnings, and the most bearish expecting $34 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 74.3x on those 2028 earnings, down from 94.2x today. This future PE is greater than the current PE for the US IT industry at 32.4x.

- Analysts expect the number of shares outstanding to grow by 3.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.89%, as per the Simply Wall St company report.

Okta Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing consolidation of the cybersecurity and identity markets-exemplified by platform companies like Palo Alto entering the space-could pressure Okta's market share and negotiating leverage, especially if large enterprises increasingly prefer integrated multi-function security suites over independent identity specialists; this trend risks long-term revenue growth and may impact Okta's ability to maintain pricing power.

- Okta's strategy of frequent product expansion (e.g., acquisition of Axiom Security and rapid feature rollout) introduces elevated product integration and execution risk; difficulties integrating new technologies and teams or falling behind in essential innovations (such as passwordless authentication or AI agent management) could erode Okta's competitive differentiation, putting downward pressure on revenue growth and gross margins.

- The continued focus on upsell and cross-sell to existing large enterprise and public sector customers, rather than driving robust new customer growth, may signal potential limitations in Okta's addressable market expansion; if new customer pipeline falters or churn increases due to past breaches or competitive switching, recurring revenue and long-term earnings durability could be negatively affected.

- International market expansion is being prioritized only in select top-10 countries to avoid spreading resources too thin; however, if Okta encounters increased regulatory complexity, data localization requirements, or stiffer competition from local or global players (especially with tightening global privacy laws), international growth may underperform, constraining total revenue and operating margin expansion opportunities.

- The rise of decentralized identity technologies (such as blockchain-based identity) and the growing commoditization of identity and access management tools via open-source or low-cost solutions could increase price-based competition and reduce Okta's revenue per customer; failure to differentiate sufficiently in this evolving landscape may suppress average contract values and compress net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $120.917 for Okta based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $142.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $414.2 million, and it would be trading on a PE ratio of 74.3x, assuming you use a discount rate of 8.9%.

- Given the current share price of $89.82, the analyst price target of $120.92 is 25.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Okta?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.