Key Takeaways

- Okta's innovation and ecosystem strength position it as a foundational identity control point in the evolving AI and cloud-driven security market.

- Growing enterprise adoption, regulatory demand, and efficient sales execution fuel sustained revenue and market leadership, outpacing slower legacy competitors.

- Intensifying competition, customer consolidation, regulatory pressures, and slow product diversification threaten Okta's growth, market position, and ability to sustain long-term client retention.

Catalysts

About Okta- Operates as an identity partner in the United States and internationally.

- While analyst consensus expects Okta to benefit from cloud migration and identity consolidation, the accelerating replacement of legacy and fragmented identity systems at global enterprises could drive an even more dramatic expansion in Okta's average contract values and multi-year revenue growth, as live proof points for rapid, large-scale migrations multiply and reinforce Okta's position as the universal identity standard.

- Analysts broadly agree AI proliferation creates incremental security demand; however, Okta's first-mover advantage in securing AI agents, combined with the strong early adoption and ecosystem buy-in for innovations like Cross App Access and Auth0 for Agents, positions the company as a foundational control point for both human and nonhuman identity in the AI era-potentially unlocking an entirely new, high-margin identity category and sustaining rapid earnings growth as AI becomes ubiquitous.

- Okta's commercial momentum in the US federal sector and among large enterprises is likely to accelerate as mounting regulatory mandates and cyber risk force governments and critical industries to standardize on modern, independently operated identity platforms, driving higher retention, durable revenue, and the possibility for outsized share gains in mission-critical, compliance-driven markets.

- The ongoing specialization and realignment of Okta's salesforce, combined with proven gains in productivity and record pipeline generation, is enabling both deeper penetration of existing customers with cross-sell/upsell as well as more effective new customer acquisition-directly supporting faster top-line expansion and driving sustained operating leverage for margin outperformance.

- With an outsized cash balance, proven track record for tuck-in M&A, and a growing product portfolio, Okta may rapidly out-innovate slower-moving incumbents and bundled security vendors, consolidating leadership as the standard for zero trust and identity-centric security-opening pathways for faster international expansion and new suite monetization, which could accelerate both revenue and free cash flow beyond current market expectations.

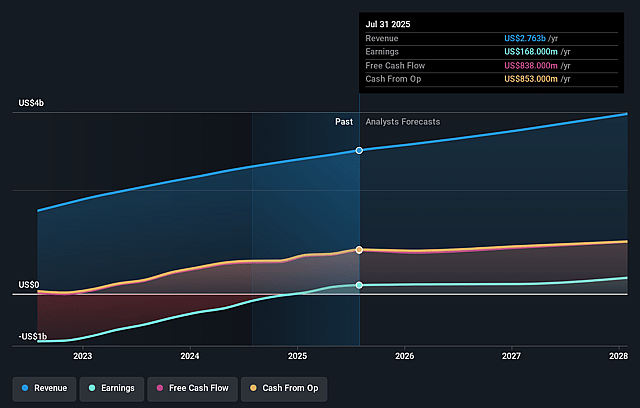

Okta Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Okta compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Okta's revenue will grow by 13.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.1% today to 16.5% in 3 years time.

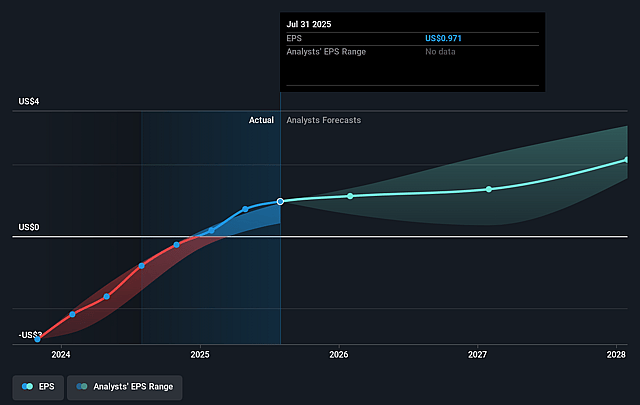

- The bullish analysts expect earnings to reach $665.7 million (and earnings per share of $3.48) by about September 2028, up from $168.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 54.4x on those 2028 earnings, down from 98.5x today. This future PE is greater than the current PE for the US IT industry at 29.0x.

- Analysts expect the number of shares outstanding to grow by 3.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.97%, as per the Simply Wall St company report.

Okta Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Okta faces rising risk from large platform vendors such as Microsoft and Google, who are aggressively bundling identity and access management products with their broader cloud and security suites, which could erode Okta's market share and put downward pressure on pricing, potentially impacting future revenue growth.

- Buyers continue to consolidate IT spending and often prefer comprehensive security platforms that combine multiple solutions, so Okta's position as a stand-alone specialist may not be sustainable if the market continues to favor platform convergence, limiting Okta's ability to capture incremental wallet share and hurting long-term renewal rates and net retention.

- A reliance on enterprise customers leaves Okta exposed to volatility from elongated sales cycles, contract restructurings, and lumpy public sector demand, which can weigh on top-line growth and create instability in revenue forecasts, especially during economic downturns or periods of budgetary restraint.

- The segment continues to experience significant regulatory and compliance complexity as privacy and security mandates grow stricter (such as GDPR and government-specific requirements), which could raise operational costs, increase customer friction in adoption, and negatively affect net margins over time.

- Okta's path to product diversification remains a challenge, as innovation beyond core identity management has yet to demonstate sustained traction, potentially capping cross-sell opportunities, limiting net expansion rates, and hindering long-term earnings growth if customers increasingly seek integrated, full-suite security solutions elsewhere.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Okta is $142.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Okta's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $142.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $665.7 million, and it would be trading on a PE ratio of 54.4x, assuming you use a discount rate of 9.0%.

- Given the current share price of $93.85, the bullish analyst price target of $142.0 is 33.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.