Last Update 25 Feb 26

Fair value Decreased 7.09%PRCH: Recent Upgrade Will Support Confidence In Future Margin Expansion Potential

Analysts have adjusted their fair value estimate for Porch Group from $17.63 to $16.38, citing updated assumptions on growth, margins, discount rate, and future P/E following recent price target increases and an upgrade highlighted in Street research.

Analyst Commentary

Recent Street research around Porch Group has focused on valuation assumptions and the rationale behind the updated fair value estimate, using the latest price target move and upgrade as key reference points.

Bullish Takeaways

- Bullish analysts point to the recent upgrade as a sign of improving confidence in Porch Group’s ability to execute on its business plan, which they factor into higher supported valuation multiples over time.

- The higher price target is framed as consistent with updated views on growth and profitability potential, which feeds into assumptions around the company’s future P/E and long term earnings power.

- Supportive research commentary suggests that recent developments around the business model and revenue mix help justify refining margin expectations in the valuation work.

- Overall, bullish analysts see enough progress and clarity on the company’s direction to warrant a fair value that remains relatively close to the Street price targets, even after the modest trim in the formal estimate.

Bearish Takeaways

- Some cautious analysts highlight that the reduction in fair value from US$17.63 to US$16.38 reflects a more measured stance on growth, margins, and discount rate assumptions despite the upgrade in Street research.

- The reliance on a future P/E framework means the valuation remains sensitive to execution risk, especially if earnings timing or scale does not match current assumptions.

- There is an implicit acknowledgment that, while price targets have moved up, the risk profile around achieving the underlying financial targets still warrants a degree of restraint in the fair value estimate.

- Cautious analysts also flag that adjustments to key inputs such as discount rate can materially affect the model, which may make the valuation more reactive to changes in perceived risk or funding conditions.

What's in the News

- Porch Group issued earnings guidance for 2026, with projected revenue in a range of US$475m to US$490m. (Key Developments)

- The 2026 revenue guidance is set against an expected US$419m in revenue for 2025, which gives investors a reference point for the company’s forward outlook. (Key Developments)

Valuation Changes

- Fair Value: trimmed from $17.63 to $16.38, reflecting a modest reduction in the central valuation estimate.

- Discount Rate: adjusted slightly from 9.79% to 9.74%, indicating a small change in the assumed risk profile used in the model.

- Revenue Growth: brought down from 12.74% to 10.09%, implying more measured expectations for future top line expansion.

- Net Profit Margin: increased from 5.43% to 7.70%, pointing to higher assumed profitability on future earnings.

- Future P/E: reduced from 56.88x to 50.21x, signaling a lower multiple being applied to projected earnings in the updated framework.

Key Takeaways

- Porch Group's shift to a fee-based insurance model and formation of PIRE create a higher-margin, more predictable earnings structure.

- Strategic investments in software, data, and new geographies aim to boost future revenue and EBITDA growth, leveraging products like Home Factors.

- Porch Group faces potential revenue volatility and execution risks due to delayed initiatives and a transition to a commission-based model, impacting future earnings and growth.

Catalysts

About Porch Group- Operates a vertical software and insurance platform in the United States.

- Porch Group's transition to a fee-based, higher-margin model in insurance services should enhance gross margins to about 80% in 2025, making earnings more predictable and less impacted by weather volatility, thereby improving net margins.

- The formation of the Porch Insurance Reciprocal Exchange (PIRE) and the sale of Homeowners of America (HOA) Insurance Carrier into PIRE create a more predictable and higher-margin financial model, which could lead to improved earnings.

- Porch Group's strategic plans include reopening geographies and reactivating distribution partners, contributing to expected growth in gross written premiums, which could drive revenue and adjusted EBITDA growth.

- The company is investing in expanding its Vertical Software and data businesses, with initiatives such as new product launches and increased sales and product investments poised to drive faster revenue growth in 2026 and beyond.

- The introduction and expected growth of Home Factors, a data product which aids in risk selection and pricing, present new revenue opportunities and could significantly enhance the value of Porch Group's data segment, thereby impacting future revenue growth.

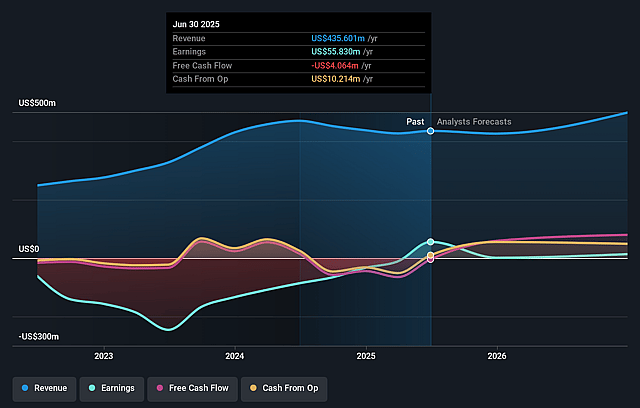

Porch Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Porch Group's revenue will grow by 4.1% annually over the next 3 years.

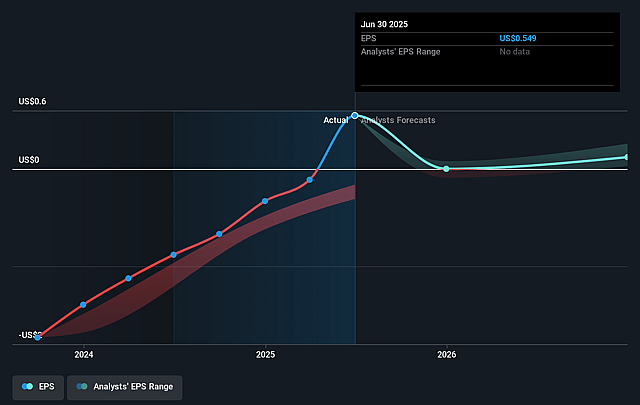

- Analysts are not forecasting that Porch Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Porch Group's profit margin will increase from -2.6% to the average US Software industry of 13.2% in 3 years.

- If Porch Group's profit margin were to converge on the industry average, you could expect earnings to reach $63.9 million (and earnings per share of $0.58) by about July 2028, up from $-11.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, up from -124.7x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Porch Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Porch Group's revenue in Q4 2024 decreased by 12% year-over-year due to nonrecurring items and the sale of their legacy agency, EIG, which could indicate potential volatility in future revenues.

- The formation of the Porch Insurance Reciprocal Exchange (PIRE) and sale of their Homeowners of America Insurance Carrier were delayed longer than anticipated, signaling potential execution risks which may impact revenue predictability.

- The company’s transition to a commission and fee-based insurance services model could result in lower revenue year-over-year, suggesting potential challenges in offsetting the reduction with higher margins.

- While Porch Group’s strategic price increases in their Vertical Software business showed a 6% growth, it could face challenges in maintaining these growth levels if the housing market does not stabilize, which could impact net margins.

- Porch's ambitious targets for growth in the homeowners insurance market and the new Home Factors product depend heavily on execution and adoption by third-party carriers. Delays or difficulties in realization of these strategies could adversely impact earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.167 for Porch Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $482.4 million, earnings will come to $63.9 million, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 8.7%.

- Given the current share price of $13.38, the analyst price target of $13.17 is 1.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Porch Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.