Catalysts

About Porch Group

Porch Group operates an integrated home services and insurance platform that leverages proprietary property data, software and partnerships to deliver high margin insurance and home solutions.

What are the underlying business or industry changes driving this perspective?

- Although the company has built a substantial surplus position at the reciprocal that can support materially higher premium volumes, slower than anticipated expansion into new states and cautious pricing decisions could delay the realization of the implied capacity and cap near term revenue growth and EBITDA expansion.

- While industry wide digital transformation and the adoption of data driven underwriting support demand for Porch Group's Home Factors and AI enabled analytics, extended carrier testing cycles and slower commercialization could temper the contribution from data licensing and limit incremental high margin Software and Data revenue in 2026 and beyond.

- Although the structural shift toward outsourced vertical SaaS in the housing ecosystem positions the software portfolio for operating leverage when housing activity recovers, a prolonged trough in U.S. housing transactions or only a muted rebound would constrain transaction based volumes and slow improvement in segment level net margins.

- While the company has demonstrated the ability to drive industry leading loss ratios through granular property insights and selective risk appetite, relying too heavily on ultra low loss ratios rather than judiciously trading some margin for growth could underutilize surplus and result in flatter long term earnings growth than its capital base would otherwise support.

- Although expanding agency appointments and partnerships with large national distributors create a broader top of funnel aligned with growing consumer reliance on intermediated insurance distribution, execution risk in ramping agent productivity and managing incentive structures could limit premium scale and keep consolidated earnings below the potential implied by current distribution breadth.

Assumptions

This narrative explores a more pessimistic perspective on Porch Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

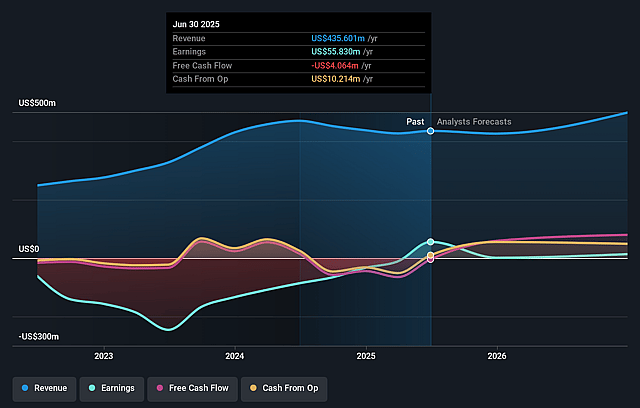

- The bearish analysts are assuming Porch Group's revenue will grow by 13.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.9% today to 4.4% in 3 years time.

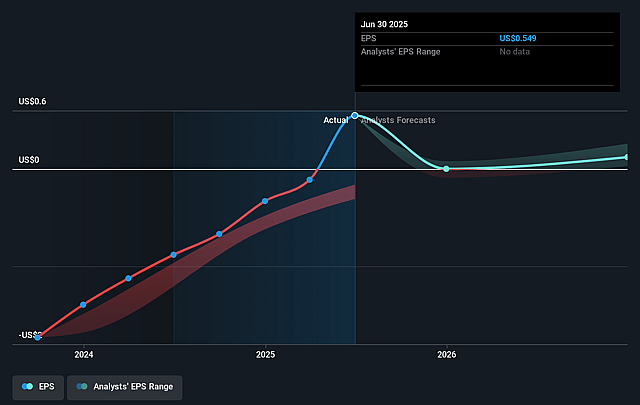

- The bearish analysts expect earnings to reach $28.7 million (and earnings per share of $0.21) by about December 2028, down from $30.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $86.2 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 50.5x on those 2028 earnings, up from 34.2x today. This future PE is greater than the current PE for the US Software industry at 32.9x.

- The bearish analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.5%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The strategy of prioritizing surplus generation at the reciprocal over faster premium growth could delay scaling written premiums. If competitive conditions or regulation later constrain pricing power, Porch may miss the optimal window for expansion, putting long term revenue and earnings growth at risk.

- Insurance Services profitability is heavily dependent on exceptionally low gross and attritional loss ratios. If climate trends, severe weather patterns or competitive pressure force Porch to relax underwriting standards or cut prices more aggressively, loss ratios may normalize and compress segment net margins and consolidated earnings.

- Software and Data and Consumer Services remain tied to a trough U.S. housing market and per transaction models. If the expected housing recovery is weaker or more drawn out than anticipated, transaction volumes may stay subdued, limiting diversification away from insurance and slowing consolidated revenue growth and margin expansion.

- The Home Factors and broader data licensing opportunity relies on carriers adopting AI enabled, data driven underwriting. If long sales cycles, integration complexity or slower than expected commercialization persist, high margin data revenue may ramp more slowly than planned, restraining future gross margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Porch Group is $13.0, which represents up to two standard deviations below the consensus price target of $18.12. This valuation is based on what can be assumed as the expectations of Porch Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $647.9 million, earnings will come to $28.7 million, and it would be trading on a PE ratio of 50.5x, assuming you use a discount rate of 9.5%.

- Given the current share price of $9.92, the analyst price target of $13.0 is 23.7% higher. Despite analysts expecting the underlying business to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Porch Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.