Last Update 11 Dec 25

PRCH: Reciprocal Model Will Support 30% Future EBITDA Margin Expansion

Analysts have raised their price target on Porch Group from $17 to $25 per share, citing expectations for sustained 20% to 25% annual premium growth, improved protection from weather related losses, expanding reciprocal take rates, and a path toward significantly higher EBITDA margins.

Analyst Commentary

Bullish analysts view the higher price target as a reflection of Porch Group's ability to sustain premium growth in the 20% to 25% range, arguing that this level of expansion supports a structurally higher revenue base and justifies multiple expansion. They point to the firm’s latest non deal roadshow as reinforcing confidence that the current growth trajectory is achievable with existing distribution partnerships and policy pipelines.

Analysts also highlight that the reciprocal structure appears largely insulated from typical weather volatility, noting that loss levels would need to return to the unusually severe 2023 storm environment before materially pressuring profitability. This reduced risk profile, in their view, strengthens the durability of earnings and supports a higher valuation relative to peers with more direct catastrophe exposure.

Another key theme from recent commentary is the potential for the reciprocal take rate to rise over time, which could lift unit economics without requiring a comparable increase in underlying policy counts. Bullish analysts believe this operating leverage, combined with scale benefits in technology and data, creates a credible pathway to meaningfully higher EBITDA margins.

These dynamics underpin forecasts that Porch Group can move from a mid teens EBITDA margin profile in the near term toward a 30% margin target over the longer term, provided management executes on pricing, retention, and cost discipline. The improved margin outlook is seen as a central driver of the revised price target, with upside potential if the margin ramp occurs faster than currently modeled.

While the tone of recent research is broadly constructive, some commentators emphasize that the stock's rerating now embeds higher expectations for growth durability and margin expansion. They caution that any stumble in policy growth, adverse weather surprises, or delays in achieving scale efficiencies could prompt investors to revisit the more optimistic scenarios currently reflected in valuation.

To balance these perspectives, investor focus is expected to remain on Porch Group's ability to consistently grow premiums within the guided range, demonstrate resilience through a full weather cycle, and show tangible progress toward its long term EBITDA margin ambitions. Execution against these milestones will likely determine whether the recent price target increase proves conservative or overly optimistic.

Bullish Takeaways

- Bullish analysts see 20% to 25% annual premium growth as sustainable, supporting a higher long term revenue base and justifying the revised price target.

- Perceived insulation of the reciprocal from typical weather volatility underpins confidence in more stable earnings and a premium valuation multiple.

- Room to increase the reciprocal take rate is viewed as a source of incremental margin expansion without requiring proportionate policy growth.

- The path from mid teens to 30% EBITDA margins is seen as credible, providing substantial upside to earnings power if management executes.

Bearish Takeaways

- Bearish analysts caution that the stock now discounts robust growth and margin assumptions, leaving less room for error in execution.

- Weather risk, while mitigated, is not eliminated, and a repeat of 2023 level storm activity could still pressure profitability and sentiment.

- Delays in scaling policies or raising the reciprocal take rate could push out the timing of the margin inflection, challenging the current valuation.

- Any slowdown in premium growth toward the low end or below the targeted range may lead investors to reassess the durability of Porch Group's growth story.

What's in the News

- Raised 2025 Porch Shareholder Interest revenue guidance to a range of $410 million to $420 million, narrowing and slightly lifting the prior $405 million to $425 million outlook. This signals improved visibility into growth and profitability drivers (Corporate Guidance).

- Expanded the Home Factors property intelligence platform with new and enhanced attributes, including electrical panel and sub-panel location, roof life stage segment, and updated plumbing material indicators. This moves the platform closer to a goal of more than 100 attributes covering about 90% of U.S. homes (Product Announcement).

- Highlighted that new Home Factors data points, such as electrical panel location and roof life stage, are designed to help carriers sharpen underwriting, pricing, and risk selection. These enhancements support stronger risk models and more accurate decisioning (Product Announcement).

- Emphasized plumbing material indicators within Home Factors, flagging PVC and CPVC usage to better assess long term durability and potential risk, reinforcing Porch Group's data driven value proposition to insurance partners (Product Announcement).

Valuation Changes

- Fair Value: Unchanged at $18.13 per share, indicating no revision to the core intrinsic value estimate.

- Discount Rate: Risen slightly from 9.45% to about 9.53%, reflecting a modest increase in the assumed risk profile or cost of capital.

- Revenue Growth: Effectively unchanged at roughly 13.14% annualized, signaling stable long term top line growth expectations.

- Net Profit Margin: Essentially flat at about 6.19%, indicating no material update to long run profitability assumptions.

- Future P/E: Nudged higher from approximately 50.3x to 50.4x, suggesting a marginally richer valuation multiple on expected future earnings.

Key Takeaways

- Porch Group's shift to a fee-based insurance model and formation of PIRE create a higher-margin, more predictable earnings structure.

- Strategic investments in software, data, and new geographies aim to boost future revenue and EBITDA growth, leveraging products like Home Factors.

- Porch Group faces potential revenue volatility and execution risks due to delayed initiatives and a transition to a commission-based model, impacting future earnings and growth.

Catalysts

About Porch Group- Operates a vertical software and insurance platform in the United States.

- Porch Group's transition to a fee-based, higher-margin model in insurance services should enhance gross margins to about 80% in 2025, making earnings more predictable and less impacted by weather volatility, thereby improving net margins.

- The formation of the Porch Insurance Reciprocal Exchange (PIRE) and the sale of Homeowners of America (HOA) Insurance Carrier into PIRE create a more predictable and higher-margin financial model, which could lead to improved earnings.

- Porch Group's strategic plans include reopening geographies and reactivating distribution partners, contributing to expected growth in gross written premiums, which could drive revenue and adjusted EBITDA growth.

- The company is investing in expanding its Vertical Software and data businesses, with initiatives such as new product launches and increased sales and product investments poised to drive faster revenue growth in 2026 and beyond.

- The introduction and expected growth of Home Factors, a data product which aids in risk selection and pricing, present new revenue opportunities and could significantly enhance the value of Porch Group's data segment, thereby impacting future revenue growth.

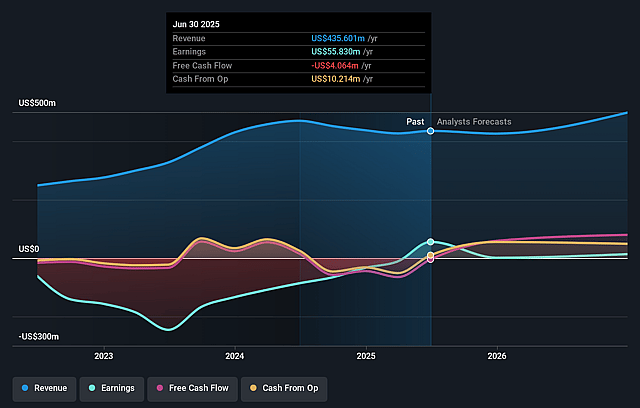

Porch Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Porch Group's revenue will grow by 4.1% annually over the next 3 years.

- Analysts are not forecasting that Porch Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Porch Group's profit margin will increase from -2.6% to the average US Software industry of 13.2% in 3 years.

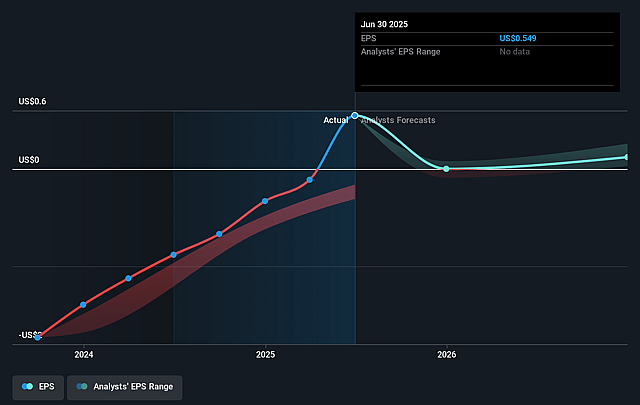

- If Porch Group's profit margin were to converge on the industry average, you could expect earnings to reach $63.9 million (and earnings per share of $0.58) by about July 2028, up from $-11.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, up from -124.7x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Porch Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Porch Group's revenue in Q4 2024 decreased by 12% year-over-year due to nonrecurring items and the sale of their legacy agency, EIG, which could indicate potential volatility in future revenues.

- The formation of the Porch Insurance Reciprocal Exchange (PIRE) and sale of their Homeowners of America Insurance Carrier were delayed longer than anticipated, signaling potential execution risks which may impact revenue predictability.

- The company’s transition to a commission and fee-based insurance services model could result in lower revenue year-over-year, suggesting potential challenges in offsetting the reduction with higher margins.

- While Porch Group’s strategic price increases in their Vertical Software business showed a 6% growth, it could face challenges in maintaining these growth levels if the housing market does not stabilize, which could impact net margins.

- Porch's ambitious targets for growth in the homeowners insurance market and the new Home Factors product depend heavily on execution and adoption by third-party carriers. Delays or difficulties in realization of these strategies could adversely impact earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.167 for Porch Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $482.4 million, earnings will come to $63.9 million, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 8.7%.

- Given the current share price of $13.38, the analyst price target of $13.17 is 1.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Porch Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.