- Australia

- /

- Capital Markets

- /

- ASX:HM1

Hearts and Minds Investments And 2 More ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian stock market has shown resilience, climbing back above the 7,800 points level despite mixed signals from global markets. Penny stocks may be an outdated term, but they continue to offer intriguing opportunities for investors seeking growth at lower price points. By focusing on companies with strong balance sheets and solid fundamentals, investors can uncover hidden gems that could provide both stability and potential upside in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$122.48M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.10 | A$154.99M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.58 | A$74.53M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.35 | A$362.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.84 | A$475.28M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.19 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.795 | A$603.41M | ✅ 4 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.47 | A$1.13B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.3825 | A$44.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 984 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian-listed investment company with a market cap of A$618.25 million, focusing on generating long-term capital growth by investing in high-conviction ideas from leading fund managers.

Operations: The company generates revenue of A$191.25 million from its investment activities.

Market Cap: A$618.25M

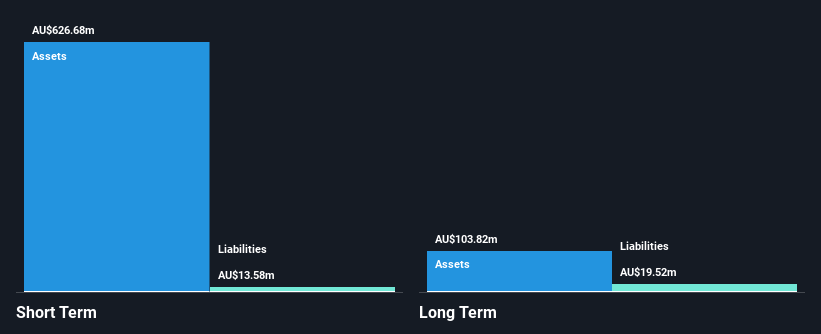

Hearts and Minds Investments has demonstrated significant earnings growth, reporting A$137.51 million in revenue for the half-year ending December 2024, a substantial increase from the previous year's A$25.99 million. The company is debt-free with short-term assets significantly exceeding liabilities, providing financial stability. Despite a low return on equity at 16.1%, its price-to-earnings ratio of 4.8x indicates potential undervaluation compared to the broader Australian market average of 17.1x. However, concerns about dividend sustainability exist as current payouts are not well covered by free cash flows, and management's relatively short tenure may impact strategic continuity.

- Get an in-depth perspective on Hearts and Minds Investments' performance by reading our balance sheet health report here.

- Examine Hearts and Minds Investments' past performance report to understand how it has performed in prior years.

OM Holdings (ASX:OMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OM Holdings Limited is an investment holding company involved in the mining, smelting, trading, and marketing of manganese ores and ferroalloys globally, with a market cap of A$263.69 million.

Operations: The company's revenue is primarily derived from its Smelting segment, which generated $528.01 million, and its Marketing and Trading segment, which contributed $675.00 million.

Market Cap: A$263.69M

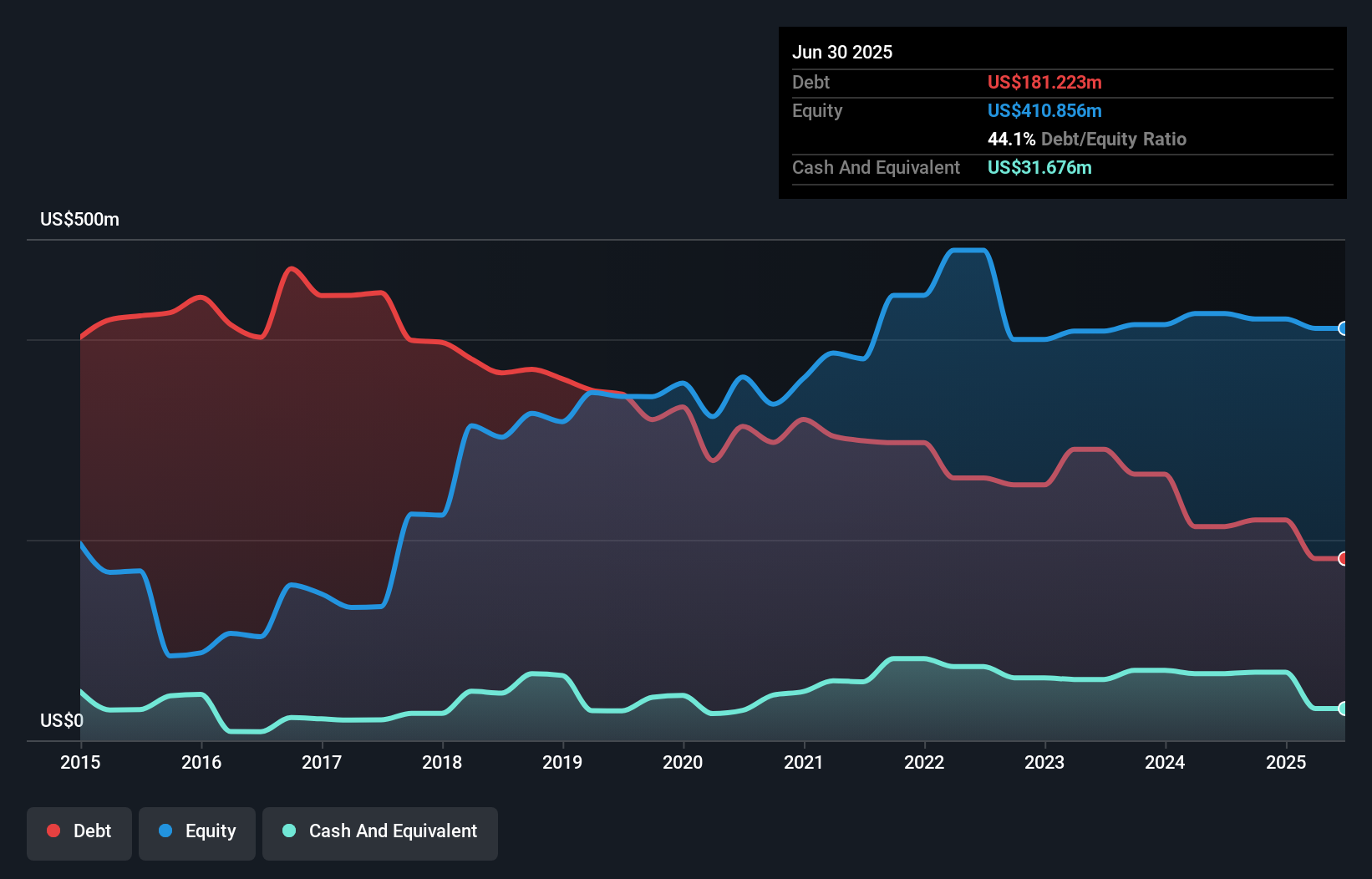

OM Holdings Limited, with a market cap of A$263.69 million, recently reported full-year sales of US$654.27 million and net income of US$9.3 million, reflecting a decrease from the previous year. Despite low return on equity at 2.3%, its debt management is satisfactory with a net debt to equity ratio of 36.1%. Short-term assets exceed liabilities, ensuring liquidity stability; however, profit margins have declined to 1.4% from 3.1%. The company announced an annual dividend of A$0.0040 per share and forecasts production growth in ferrosilicon and manganese alloys for 2025 amidst stable weekly volatility at 7%.

- Take a closer look at OM Holdings' potential here in our financial health report.

- Learn about OM Holdings' future growth trajectory here.

Renascor Resources (ASX:RNU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Renascor Resources Limited is involved in the exploration, development, and evaluation of mineral properties in Australia, with a market cap of A$170.32 million.

Operations: Renascor Resources generates revenue from its exploration activities focused on graphite, copper, gold, uranium, and other minerals, amounting to A$0.075 million.

Market Cap: A$170.32M

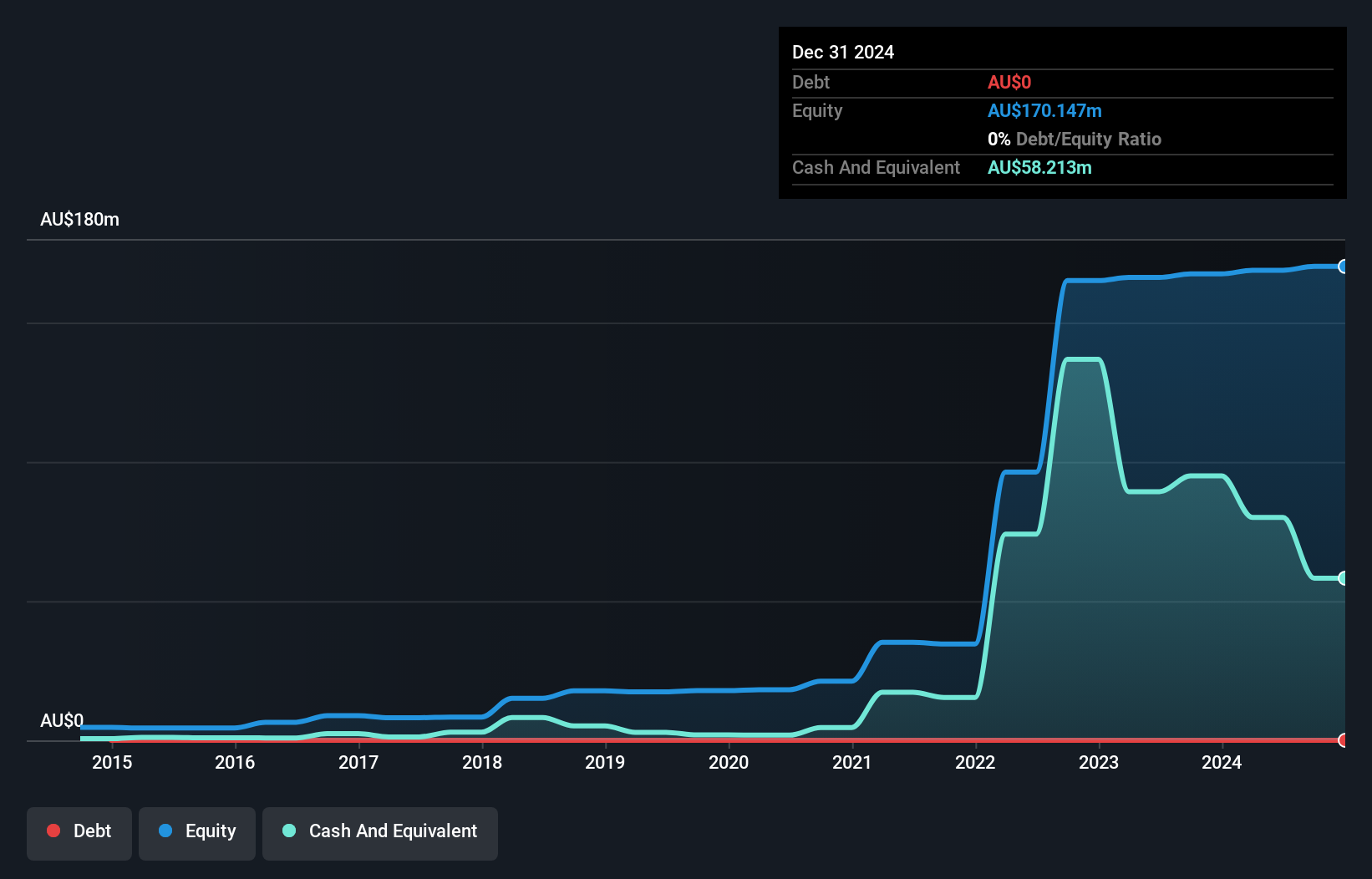

Renascor Resources Limited, with a market cap of A$170.32 million, operates as a pre-revenue entity focused on mineral exploration in Australia. Despite generating minimal revenue from its activities, the company has achieved profitability over the past five years, although recent earnings growth has been negative. The firm maintains a debt-free status and possesses strong liquidity with short-term assets significantly exceeding liabilities. Its seasoned board and management team add stability to its operations. While return on equity remains low at 1%, Renascor's financial position is bolstered by stable weekly volatility and no shareholder dilution in the past year.

- Jump into the full analysis health report here for a deeper understanding of Renascor Resources.

- Assess Renascor Resources' previous results with our detailed historical performance reports.

Key Takeaways

- Reveal the 984 hidden gems among our ASX Penny Stocks screener with a single click here.

- Contemplating Other Strategies? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hearts and Minds Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HM1

Hearts and Minds Investments

Flawless balance sheet with proven track record.

Market Insights

Community Narratives