Last Update 11 Dec 25

FWRD: Stable Margins And Buyback Support Will Drive Future Share Price Recovery

Analysts have nudged their price target on Forward Air slightly higher to reflect stable fair value at $34.00, modestly improved long term profit margin expectations, and only minor adjustments to forecast growth and earnings multiples.

What's in the News

- Forward Air shares dropped about 15% to $17.05 after an Axios Pro report indicated that a private equity deal for the company is not imminent (Axios Pro)

- The company reported no share repurchases between July 1, 2025 and September 30, 2025, despite having an authorized buyback program (company filing)

- Forward Air has completed repurchasing 3,651,380 shares, representing 13.39% of its outstanding shares, for a total of $302.47 million under the buyback program announced on February 7, 2019 (company filing)

Valuation Changes

- Fair Value Estimate, unchanged at $34.00 per share, indicating no revision to the core valuation anchor.

- Discount Rate, stable at 12.5%, reflecting no change in the assumed risk profile or cost of capital.

- Revenue Growth, effectively unchanged at about 4.7% per year, with only an immaterial numerical refinement in the model.

- Net Profit Margin, risen slightly from about 4.66% to 4.66%, reflecting a modest improvement in long term profitability assumptions.

- Future P/E, edged down slightly from about 12.0x to 12.0x, implying a marginally lower earnings multiple applied in the forward valuation.

Key Takeaways

- Recovery in freight volumes, premium services, and focus on e-commerce position the company for future revenue growth and stronger operating margins.

- Integration of Omni Logistics and technology investments are driving synergies, cost savings, and margin expansion, supporting sustained earnings growth.

- Prolonged freight market weakness, reliance on cost controls over organic growth, and costly strategic changes could constrain Forward Air's revenue, margins, and earnings stability.

Catalysts

About Forward Air- Operates as an asset-light freight and logistics company in the United States, Mexico, Europe, Asia, and Canada.

- The normalization and anticipated recovery of freight volumes, along with Forward Air's premium service offering in expedited freight and final-mile logistics, position the company to capitalize on the sustained growth in e-commerce and demand for time-definite delivery solutions-likely supporting future top-line revenue growth and improving operating leverage as volumes rebound.

- Integration of Omni Logistics has driven meaningful synergy gains, cost savings, and commercial opportunities, with the combined network enabling new business wins and enhanced cross-selling, supporting higher consolidated EBITDA margins and long-term earnings growth as integration shifts toward operational transformation.

- Ongoing investment in pricing analytics and network optimization has materially improved segment margins even in a soft market, and positions the company to expand net margins further as market conditions improve and incremental volume is absorbed with minimal additional SG&A expense.

- Forward Air's focus on technology-streamlining systems, optimizing network operations, and improving cost modeling-should drive continued reduction in cost per shipment and improved margin profile, supporting sustainable earnings expansion.

- As domestic supply chains become more complex and customers demand greater resiliency and agility, Forward Air's flexible service offerings and track record for high service levels are likely to enhance customer retention, enable pricing discipline, and improve net revenue stability, particularly as supply chain trends accelerate toward nearshoring and regionalization.

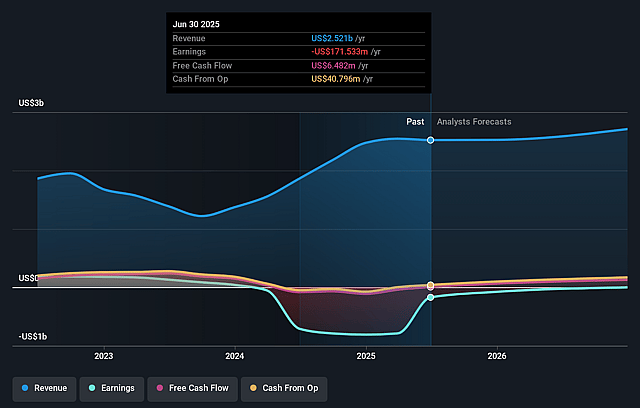

Forward Air Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Forward Air's revenue will grow by 4.7% annually over the next 3 years.

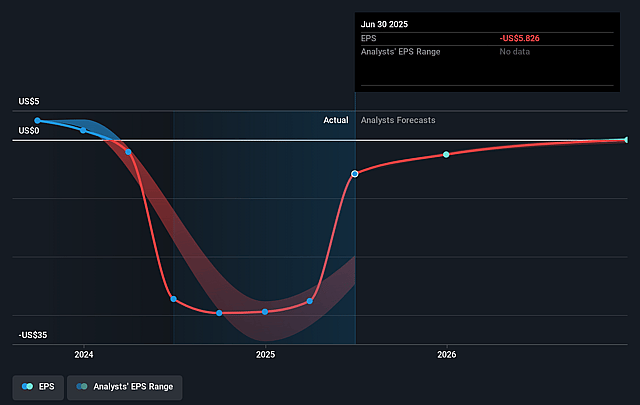

- Analysts are not forecasting that Forward Air will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Forward Air's profit margin will increase from -6.8% to the average US Logistics industry of 4.7% in 3 years.

- If Forward Air's profit margin were to converge on the industry average, you could expect earnings to reach $136.9 million (and earnings per share of $3.7) by about September 2028, up from $-171.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, up from -5.4x today. This future PE is lower than the current PE for the US Logistics industry at 16.8x.

- Analysts expect the number of shares outstanding to grow by 6.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.25%, as per the Simply Wall St company report.

Forward Air Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing softness and unpredictability in global freight volumes, referenced as a "current freight recession" with "muted" demand and macroeconomic uncertainty (including tariff and consumer confidence risks), could last longer than expected; if persistent, this would constrain Forward Air's revenue growth and limit margin expansion for an extended period.

- The Expedited Freight segment experienced an 11.5% year-over-year revenue decline on a 12.7% drop in tonnage, with management emphasizing that margin improvement has come from pricing discipline and cost-cutting rather than organic volume growth; without volume recovery, headwinds could emerge for both top-line revenue and sustained profitability.

- Despite successful initial integration, management acknowledged that future margin improvement in key segments relies on network operating leverage and higher shipment volume (i.e., growth in a "tighter" market), implying that if the overall industry shifts toward nearshoring/regionalization, or if automation reduces demand for long-haul LTL services, long-term revenue and net margins may be pressured.

- The company's strategic review and possible portfolio adjustments introduce uncertainty, and while management asserts "the whole is greater than the sum of the parts," any missteps in further transformation, potential divestitures, or acquisition integration could increase operating costs and earnings volatility.

- Continuous need for significant investment in service, technology, and cost optimization (highlighted as "costly and time-consuming"), especially to meet increasing customer service expectations and adapt to changing logistics technology, may create sustained upward pressure on SG&A and capex; if these investments do not translate to proportionate revenue gains, overall earnings and return on capital could decline.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.667 for Forward Air based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $43.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $136.9 million, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 12.2%.

- Given the current share price of $29.99, the analyst price target of $36.67 is 18.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Forward Air?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.