Key Takeaways

- Growth potential from e-commerce and service expansion is hampered by weak freight demand, competitive pressures, and higher labor and compliance costs.

- Margin improvements and integration successes may be offset by ongoing operational expenses and the need for continued investment, limiting future earnings upside.

- Prolonged freight demand weakness, integration challenges, and evolving shipping patterns threaten Forward Air's revenue growth, profit margins, and competitive positioning against tech-driven rivals.

Catalysts

About Forward Air- Operates as an asset-light freight and logistics company in the United States, Mexico, Europe, Asia, and Canada.

- While Forward Air's expansion into e-commerce-driven expedited logistics and value-added services positions it well to tap growth from continued online retail adoption and heightened demand for time-definite deliveries, muted freight volumes and a sluggish macro environment continue to weigh on revenue growth, limiting the company's ability to realize these secular tailwinds in the near-term.

- Although ongoing investments in network optimization, automation, and digitalization have improved cost structures and EBITDA margins, further margin improvement is likely to be constrained if persistent labor shortages and rising wage pressure across the logistics sector drive up operational expenses faster than Forward Air can offset them with technology, pressuring net margins in the long run.

- While the successful integration of Omni Logistics and the realization of synergy savings have improved operational efficiency and cross-selling opportunities-evidenced by recent margin gains in Omni-achieving sustained, step-change revenue and EBITDA growth will depend on the company's ability to consistently win new business and grow volumes despite an increasingly competitive landscape with technology-enabled disruptors.

- Ongoing rationalization of poorly priced freight and disciplined pricing strategies have helped stabilize and improve segment-level profitability; however, with tonnage still down year-over-year and the LTL network highly sensitive to muted demand, the path to scalable operating leverage and improved earnings remains uncertain, particularly if market normalization is delayed.

- While Forward Air's diversified offerings in high-value, healthcare, and sustainable logistics provide levers for long-term growth from favorable demographic and regulatory trends, elevated compliance costs and the need for significant ongoing investment in greener fleets and advanced technology could erode any incremental EBITDA gains, limiting free cash flow expansion and returns to shareholders over time.

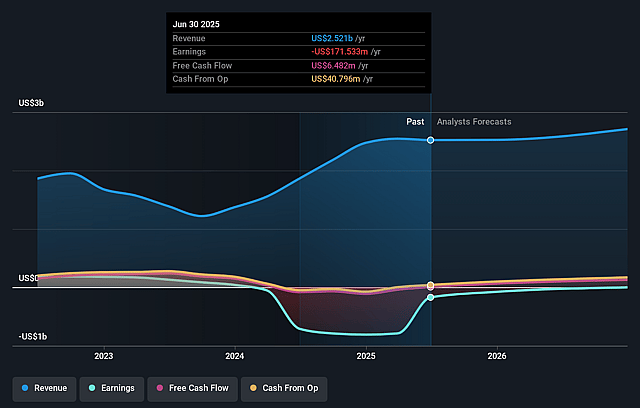

Forward Air Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Forward Air compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Forward Air's revenue will grow by 4.9% annually over the next 3 years.

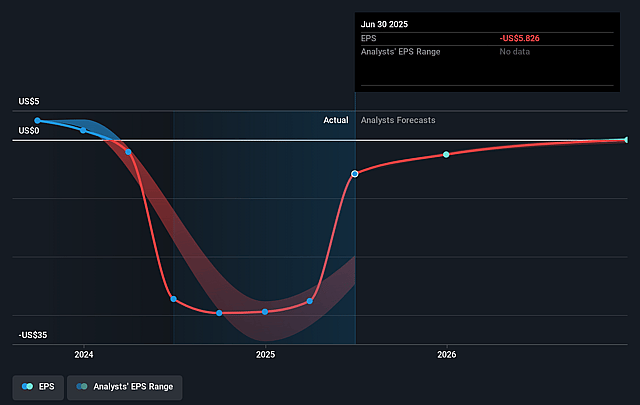

- The bearish analysts are not forecasting that Forward Air will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Forward Air's profit margin will increase from -6.8% to the average US Logistics industry of 4.7% in 3 years.

- If Forward Air's profit margin were to converge on the industry average, you could expect earnings to reach $137.8 million (and earnings per share of $3.72) by about September 2028, up from $-171.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from -5.3x today. This future PE is lower than the current PE for the US Logistics industry at 17.2x.

- Analysts expect the number of shares outstanding to grow by 6.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.78%, as per the Simply Wall St company report.

Forward Air Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing freight recession, muted transportation volumes, and persistent uncertainty in global freight flows are significantly impacting Forward Air's ability to grow revenue, and these subdued demand trends may weigh on top-line performance for a prolonged period.

- The Expedited Freight segment experienced an 11.5 percent year-over-year revenue decline due largely to a 12.7 percent decrease in tonnage per day, which raises concerns about Forward Air's ability to recapture volume as secular trends such as regionalization and changing shipping patterns potentially reduce demand for their traditional LTL service, directly impacting revenue growth.

- Tight cost management and pricing discipline have temporarily improved segment margins despite falling volumes, but long-term risks remain if Forward Air cannot rebuild shipment volume and operating leverage, as sustained volume weakness will ultimately limit profit growth and constrain net margins.

- The company's strategy of integrating and transforming its business following the Omni Logistics acquisition creates operational complexity and execution risk, with potential for long-lasting inefficiencies or cost overruns that can depress consolidated earnings and result in higher than expected ongoing integration expenses.

- Forward Air's continued emphasis on customer service and maintaining a broad logistics network is resource-intensive, and failure to sufficiently invest in automation, digitalization, or sustainability initiatives may make it vulnerable to technology-first competitors, threatening future competitiveness and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Forward Air is $32.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Forward Air's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $43.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $137.8 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 11.8%.

- Given the current share price of $29.74, the bearish analyst price target of $32.0 is 7.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.