Key Takeaways

- Margin expansion is set to outpace expectations through cost optimization, premium service focus, and technology-driven operational leverage as demand recovers.

- Omni Logistics integration unlocks transformative growth through network expansion, cross-selling, and digital capabilities, positioning Forward Air for sustained outperformance.

- Weak freight demand, integration challenges, technological lag, and elevated debt expose Forward Air to operational risks, margin pressure, and limited revenue growth in a tough macro environment.

Catalysts

About Forward Air- Operates as an asset-light freight and logistics company in the United States, Mexico, Europe, Asia, and Canada.

- While analyst consensus expects Forward Air to demonstrate margin improvement and moderate top-line recovery as freight demand rebounds, they likely understate the magnitude of potential operating leverage: the combination of improved pricing, cost rationalization, streamlined networks, and the shift to higher-quality freight positions Forward Air to achieve margin expansion at a rate comparable to or exceeding top-tier LTL peers, potentially driving segment EBITDA margins toward the high end of the industry range and accelerating earnings growth as volumes return.

- Analyst consensus acknowledges synergy gains from the Omni Logistics integration, but the full transformative potential is greater; the integration of Omni's global reach, contract logistics expertise, and advanced digital capabilities provides a platform for outsized network expansion, significant cross-sell opportunities, and the potential for substantial new business wins that could drive step-change revenue growth well in excess of legacy run-rates.

- Forward Air is uniquely positioned to benefit from the accelerating complexity of supply chains and the rapid rise in North American nearshoring: its integrated, time-definite network and focus on high-value expedited freight make it the preferred partner for manufacturers and 3PLs requiring flexible, reliable regionalized logistics, paving the way for sustained outperformance in revenue growth and customer acquisition in coming years.

- The company's deep commitment and investments in technology–particularly in pricing analytics, automation, and shipment visibility tools–will continue to drive sustainable reductions in cost per shipment, enhance service reliability, and enable differentiated premium pricing, supporting both higher net margins and improved revenue retention even amid a volatile industry backdrop.

- The ongoing strategic alternatives review and demonstrated interest in Forward Air's unique asset base present the potential for further value-unlocking initiatives, such as accretive strategic transactions, targeted portfolio optimization, or disciplined bolt-on M&A, all of which could rapidly accelerate shareholder value creation via enhanced free cash flow and return on invested capital.

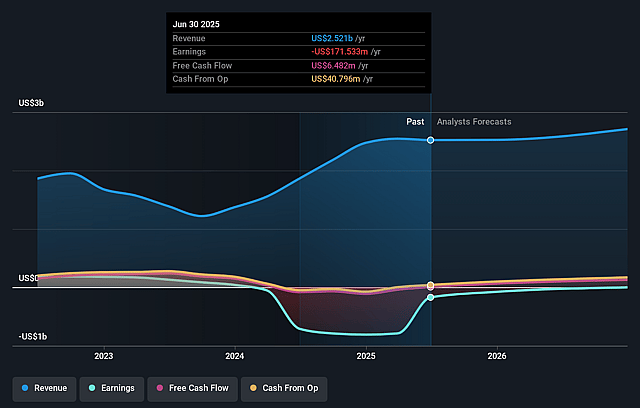

Forward Air Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Forward Air compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Forward Air's revenue will grow by 6.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -6.8% today to 1.9% in 3 years time.

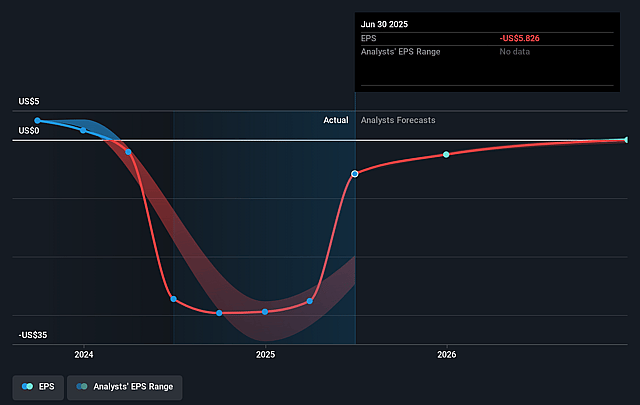

- The bullish analysts expect earnings to reach $57.0 million (and earnings per share of $1.4) by about September 2028, up from $-171.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.1x on those 2028 earnings, up from -5.3x today. This future PE is greater than the current PE for the US Logistics industry at 16.6x.

- Analysts expect the number of shares outstanding to grow by 6.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.88%, as per the Simply Wall St company report.

Forward Air Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing softness in global transportation volumes and persistent freight recession create significant uncertainty for Forward Air, with muted revenue growth and limited upside until the macro environment improves, directly suppressing top-line revenue and potential earnings expansion.

- Forward Air's core Expedited Freight segment reported a year-over-year revenue decline of over ten percent driven by a sustained double-digit fall in tonnage per day, highlighting vulnerability to secular shifts such as nearshoring, reshoring, and broader decreases in long-haul expedited freight demand, which can materially impair long-term revenue growth.

- Risks surrounding the successful full integration of the 2024 Omni Logistics acquisition remain, including the potential for continued customer attrition or cultural misalignment, which could lead to higher operating costs and lost synergies, ultimately impacting both revenues and net margins.

- The logistics industry is rapidly automating and digitizing, putting pressure on asset-heavy, traditional models; without accelerated investment in fleet and IT modernization, Forward Air faces a risk of falling behind more nimble, technology-driven competitors, driving margin compression and slower earnings growth.

- The company's increased leverage and significant semiannual interest obligations following recent acquisitions elevate Forward Air's financial risk, making future net earnings more sensitive to rising interest rates or economic downturns and threatening liquidity and cash flow stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Forward Air is $43.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Forward Air's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $43.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $57.0 million, and it would be trading on a PE ratio of 39.1x, assuming you use a discount rate of 11.9%.

- Given the current share price of $29.75, the bullish analyst price target of $43.0 is 30.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Forward Air?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.