Key Takeaways

- IntentKey's privacy-first and AI strengths face challenges from evolving regulations, browser policies, and limited brand reach, threatening scalable growth and market share gains.

- Dependency on concentrated partners and rising investment needs, combined with historic operating losses, hinder scalable profitability despite operational improvements and expanding advertising markets.

- Persistent losses, low-margin product mix, and intense competition amid shifting industry trends threaten sustainable growth, market share, and long-term profitability.

Catalysts

About Inuvo- An advertising technology and services company, develops and commercializes large language generative artificial intelligence that discovers and targets digital audiences in the United States.

- Although Inuvo is benefiting from the industry shift toward privacy-first advertising, with its IntentKey platform specifically designed to perform well in a cookie-less environment, the company faces the risk that further tightening of global data privacy regulations or new privacy-centric browser policies could meaningfully reduce the effectiveness or scalability of its core targeting technology, putting future revenue growth and gross margins at risk.

- While the rapid proliferation of artificial intelligence in digital marketing plays directly to Inuvo's strengths and has supported a strong pipeline for its IntentKey solutions, the company's ability to fully capitalize on this trend remains constrained by limited brand recognition and a historically small sales team, which may restrict its ability to efficiently acquire clients at scale and limits the impact on long-term top-line expansion and market share.

- The ongoing expansion of programmatic and omnichannel advertising increases the total addressable market for Inuvo, but the digital advertising landscape is simultaneously consolidating around walled gardens and vertically integrated platforms, potentially shutting out independent players and jeopardizing Inuvo's access to high-quality inventory as well as future revenue diversification.

- Despite increased self-serve adoption and solid operational execution contributing to higher margin potential, Inuvo remains exposed to the risk that its growth is overly dependent on a handful of key partners and a concentrated set of programmatic campaigns; loss of any major partnership or failure to secure new, recurring clients could depress revenue stability and prevent sustainable improvements to net income.

- While Inuvo's scalable software infrastructure should provide operating leverage as revenues grow, persistent history of operating losses and negative cash flow, coupled with recent margin compression and ongoing requirements for increased investment in technology and marketing, may limit its ability to scale efficiently-ultimately constraining improvements in earnings and dampening the positive impact of industry tailwinds.

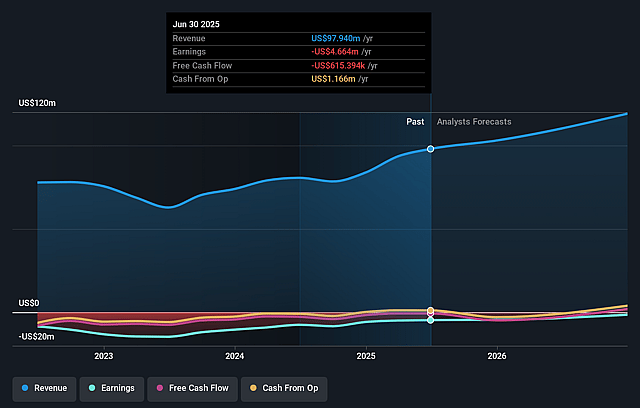

Inuvo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Inuvo compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Inuvo's revenue will grow by 13.2% annually over the next 3 years.

- The bearish analysts are not forecasting that Inuvo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Inuvo's profit margin will increase from -4.8% to the average US Software industry of 13.1% in 3 years.

- If Inuvo's profit margin were to converge on the industry average, you could expect earnings to reach $18.6 million (and earnings per share of $1.16) by about September 2028, up from $-4.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from -10.6x today. This future PE is lower than the current PE for the US Software industry at 35.7x.

- Analysts expect the number of shares outstanding to grow by 3.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

Inuvo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's consistent operating losses and negative cash flow, despite revenue growth, suggest ongoing difficulty in achieving profitability; this creates a risk that net income and ultimately share price could be pressured if expenses continue to rise faster than margins can expand.

- The self-serve IntentKey product, while high margin, currently contributes only a small portion of total revenue, and its client base consists mostly of small advertisers with uncertain growth trajectories, which could constrain top-line revenue expansion and limit the path to sustainable earnings.

- Intensifying competition from much larger adtech platforms and walled gardens like Google, combined with limited brand recognition and sales resources at Inuvo, poses a risk to the company's ability to capture market share and maintain pricing power, impacting revenue growth and margin stability.

- The decline in gross margin to 75.4 percent from 84 percent year-over-year, driven largely by product mix and increased marketing costs, highlights vulnerability to shifts in client demand and industry pricing, which could further compress margins and suppress future earnings.

- The evolving digital ad landscape and rise of AI-driven search and content experiences led by giants such as Google and emerging LLM-focused platforms, could alter how audiences are reached and monetized, potentially reducing the effectiveness and addressable market for Inuvo's solutions, thereby endangering long-term revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Inuvo is $10.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Inuvo's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $141.9 million, earnings will come to $18.6 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 8.5%.

- Given the current share price of $3.39, the bearish analyst price target of $10.0 is 66.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.