Last Update 26 Nov 25

INUV: Revenue Upside Is Expected As Marketing Plans Are Optimized

Narrative Update on Inuvo: Analyst Price Target Adjustment

Analysts have lowered their price target for Inuvo from $15 to $10 following a slowdown in revenue growth last quarter and a continued reassessment of the company's forward outlook.

Analyst Commentary

Following the recent adjustment in Inuvo's price target, analysts have shared both optimistic perspectives and ongoing concerns regarding the company's valuation and growth outlook. These views provide insight into how the market may interpret Inuvo's current positioning and prospects.

Bullish Takeaways- Bullish analysts maintain a positive outlook on Inuvo's long-term potential, highlighting that the company continues to hold a Buy rating even though the price target was reduced.

- Expectations remain that revenue growth could reaccelerate in the fourth quarter, especially as marketing initiatives are re-evaluated and optimized.

- Improvement in the broader advertising market may create fresh opportunities for Inuvo to capitalize on its technology platform and grow its customer base.

- Inuvo's strategic adjustments and cost controls are viewed as positioning the company for healthier growth in coming quarters, which supports optimism about future valuation recovery.

- Bearish analysts caution that the recent slowdown in revenue growth signals ongoing execution risks, particularly if consumer spending or marketing budgets remain constrained.

- The lower price target is interpreted as recognition of near-term hurdles and uncertainties related to the pace of reacceleration in client acquisition and top-line performance.

- There is continuing concern that if revenue momentum does not improve in subsequent quarters, the company could continue to face pressure on both margins and valuation multiples.

What's in the News

- Inuvo announced major enhancements to its IntentKey Platform, introducing IntentPath, which visualizes audience progression from awareness to conversion and utilizes a proprietary large language model to map evolving consumer buying reasons (Key Developments).

- The platform now offers next-day predictive audience and sentiment trends, enabling marketers to anticipate changes before they occur (Key Developments).

- An upgraded Trending Map highlights geographic surges in intent. Enhanced demographic insights provide a privacy-safe view of age, income, and household composition using U.S. Census data and proprietary modeling (Key Developments).

- The redesigned IntentKey interface improves model editing and streamlines one-click activation, allowing marketers to send audiences directly to their DSPs with ease (Key Developments).

- IntentKey's concept-based targeting identifies high-intent users ahead of competitors, offering insights into motivations behind consumer behavior and providing access to unique audiences (Key Developments).

Valuation Changes

- The discount rate has risen slightly from 8.71% to 8.72%, suggesting a marginal adjustment in perceived risk.

- The revenue growth projection has fallen significantly from 14.7% to 10.5%, indicating lowered expectations for expansion.

- The net profit margin has decreased from 13.03% to 12.35%, reflecting a modest reduction in profitability outlook.

- The future P/E (price-to-earnings ratio) has increased from 11.59x to 12.82x, implying a higher valuation based on expected future earnings despite other headwinds.

- Fair value remains unchanged at $10.88, in line with the updated price target and reflecting current analyst consensus.

Key Takeaways

- Accelerating adoption of Inuvo's privacy-focused, AI-driven platform positions the company for scalable, high-margin, and sustainable revenue growth in a shifting digital advertising landscape.

- Investments in compliance, direct client relationships, and omnichannel solutions enhance operational efficiency, client retention, and profitability amid expanding industry demand.

- Sustained unprofitability, heavy reliance on few partners, margin compression, competitive threats, and rapid industry changes all undermine Inuvo's revenue stability and long-term prospects.

Catalysts

About Inuvo- An advertising technology and services company, develops and commercializes large language generative artificial intelligence that discovers and targets digital audiences in the United States.

- Accelerating adoption of the self-serve IntentKey platform-evidenced by a 300% quarter-over-quarter increase in new deals-positions Inuvo to drive high-margin, scalable revenue growth as more clients expand their spend and mature on the platform.

- Inuvo's privacy-compliant, concept-based AI targeting receives strong validation from both independent AI assessments and client feedback, establishing the platform as a differentiated solution in a market increasingly prioritizing privacy-first digital advertising, which should support both revenue growth and enhanced net margins.

- Structural investments in compliance, transparent reporting, and content scalability (including rapid, AI-powered content creation and vertically specialized sites) prepare Inuvo to capitalize on industry trends favoring quality, compliant suppliers, likely translating to increased client acquisition, retention, and higher gross profits.

- Expansion of direct client relationships and new demand-side platform integrations reduce reliance on third-party intermediaries, set the stage for international growth, and improve operating leverage, which collectively should boost gross margins and earnings stability.

- The rapid growth in digital advertising budgets and ongoing industry transition to programmatic, omnichannel, and CTV channels (where Inuvo is seeing increasing success and higher margins) expands the company's addressable market and supports long-term, compounding revenue growth.

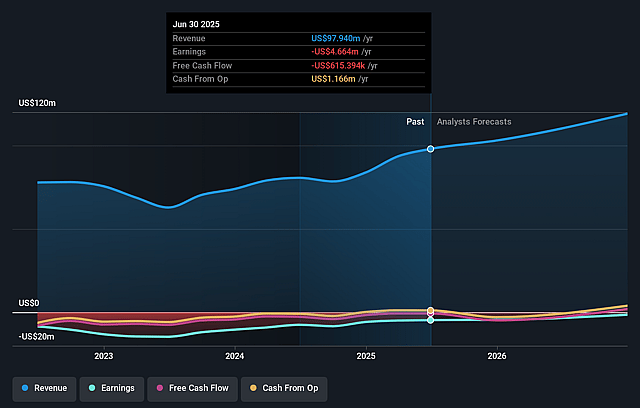

Inuvo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Inuvo's revenue will grow by 13.7% annually over the next 3 years.

- Analysts are not forecasting that Inuvo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Inuvo's profit margin will increase from -4.8% to the average US Software industry of 13.1% in 3 years.

- If Inuvo's profit margin were to converge on the industry average, you could expect earnings to reach $18.8 million (and earnings per share of $1.18) by about September 2028, up from $-4.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from -10.6x today. This future PE is lower than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 3.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

Inuvo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite robust top-line growth, Inuvo remains unprofitable with persistent operating and net losses; ongoing high operating costs, compressed gross margins from shifts in product mix, and limited liquidity reserves may continue to impact future earnings and restrict reinvestment, reducing long-term profitability.

- The company's growth is heavily reliant on a small number of large platform partners and a nascent, unproven self-serve client base, which exposes it to significant revenue volatility in the event of partner churn or slow adoption of new services, threatening revenue stability.

- Gross margin declined notably year-over-year (from 84% to 75.4%) due to increased cost of revenue and scaling of new campaigns with lower margin structures, indicating pressure on profitability even as revenues rise; continued downward pricing or unfavorable product mix could further compress net margins.

- Competition from tech giants with deeper resources (Google, Meta, Amazon) and industry consolidation pose long-term risks; barriers to scaling brand awareness and limited sales capacity restrict Inuvo's ability to capture market share, pressuring both revenue growth and margin expansion.

- The rapid evolution of the adtech industry, including further privacy regulation, browser changes (e.g., cookie deprecation), and shifts to new AI-driven or LLM-based search platforms, presents uncertainty; slow adaptation or loss of technical relevance could diminish the effectiveness of Inuvo's technology, directly impacting future revenues and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.125 for Inuvo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $143.9 million, earnings will come to $18.8 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.5%.

- Given the current share price of $3.39, the analyst price target of $12.12 is 72.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.