Key Takeaways

- Rapid adoption of Inuvo's AI-driven targeting and retention strategies could trigger exponential growth, increased margins, and expanded market share across multiple client segments.

- Strategic positioning in premium channels and scalable automation poises Inuvo for sustained global expansion, recurring revenue, and long-term margin improvement.

- Regulatory pressure, reliance on large clients, resource constraints, and industry shifts threaten Inuvo's data-driven ad business, competitive stance, and ability to sustain growth.

Catalysts

About Inuvo- An advertising technology and services company, develops and commercializes large language generative artificial intelligence that discovers and targets digital audiences in the United States.

- While analyst consensus believes rapid self-serve IntentKey adoption will steadily scale high-margin revenue, the ongoing 300%+ quarter-over-quarter deal growth and successful client retention signals the potential for a far steeper adoption curve, which could catalyze exponential top-line growth and substantial near-term net margin expansion.

- Analysts broadly agree that Inuvo's AI-powered, privacy-compliant targeting is a clear differentiator in a shifting regulatory landscape, but with recent, simultaneous validation as best-in-class by multiple leading AI systems-and growing client conviction in measurable conversion lifts-IntentKey could quickly win major direct enterprise and multinational contracts, dramatically increasing market share and accelerating operating leverage.

- Inuvo's accelerating lead generation volume-over 60% quarter-over-quarter-paired with deliberate constraints on onboarding and enhanced quality control is building outsized pent-up demand, laying the groundwork for a rapid revenue inflection as new capacity is unleashed and high-value advertisers seek trusted supply.

- The proliferation of connected devices and international CTV expansion, where Inuvo's solutions rank among the highest margin channels, uniquely position the company to capture multi-channel and global budgets from both agencies and businesses, driving sustained, compounding revenue growth and improving earnings visibility.

- As small and mid-sized advertisers flock to accessible, automated platforms and the industry migrates away from legacy, cookie-based targeting, Inuvo's singular combination of scalable AI, verticalized content, and automated optimizations provides a rare high-growth pathway into the vast SMB market, supporting durable, recurring revenue and long-term margin enhancement.

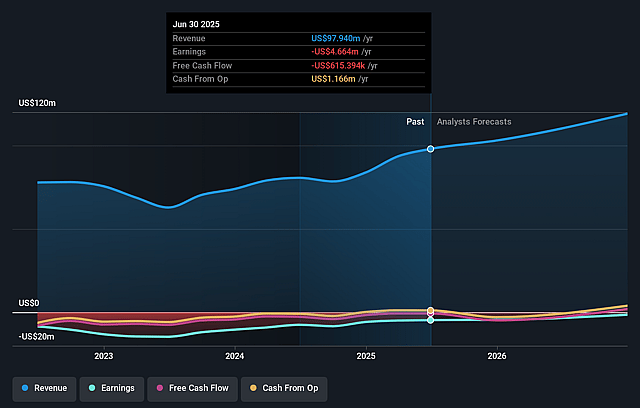

Inuvo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Inuvo compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Inuvo's revenue will grow by 16.5% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Inuvo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Inuvo's profit margin will increase from -4.8% to the average US Software industry of 12.7% in 3 years.

- If Inuvo's profit margin were to converge on the industry average, you could expect earnings to reach $19.6 million (and earnings per share of $1.22) by about September 2028, up from $-4.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from -10.9x today. This future PE is lower than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 3.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.44%, as per the Simply Wall St company report.

Inuvo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and privacy restrictions could materially harm Inuvo's ability to collect and leverage user data for digital advertising, undermining the company's targeting capabilities and reducing future top-line revenue growth.

- The accelerating shift of digital ad budgets towards dominant platforms like Google, Meta, and Amazon creates major headwinds for smaller firms such as Inuvo, making long-term competition for clients and pricing power difficult, thereby exerting persistent pressure on revenue and profit margins.

- Structural operating losses and a limited cash balance restrict Inuvo's ability to invest aggressively in research and development or ramp its sales force, limiting innovation and go-to-market reach that are vital for long-term earnings growth and competitive positioning.

- Heavy dependence on a small number of large platform clients represents significant revenue concentration risk; the loss or downsizing of one or more major clients would likely cause sharp drops in quarterly revenue and threaten recurring earnings.

- The industry-wide shift away from third-party cookies and towards first-party, consent-driven data challenges Inuvo's traditional ad targeting models, and there is no assurance that IntentKey's privacy-compliant positioning will be enough to sustain demand or protect gross margin and recurring revenue streams in the face of evolving competitive technologies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Inuvo is $15.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Inuvo's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $154.7 million, earnings will come to $19.6 million, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 8.4%.

- Given the current share price of $3.49, the bullish analyst price target of $15.0 is 76.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.