Key Takeaways

- Increased competition and feature development pressure resources and net margins in the B2B space.

- Expanding international markets and new services require significant investment, impacting short-term earnings and margins.

- Shopify's international expansion, tech enhancements, and strategic partnerships suggest strong potential for sustained revenue growth and enhanced market engagement.

Catalysts

About Shopify- A commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America.

- Increased competition in the B2B space and the need to constantly develop new features may strain resources and put pressure on net margins.

- The expansion into international markets, while promising, could potentially lead to higher costs and resource allocation that may not immediately translate into increased revenue.

- The introduction of new financial services products such as Shopify Finance could require significant investment, impacting short-term earnings.

- Integrating AI advancements could increase R&D expenditure, affecting net margins, even as it aims to enhance the operational efficiency of the platform.

- The focus on integrating and partnering with external platforms like YouTube and PayPal may incur higher marketing and operational expenses that could pressure earnings.

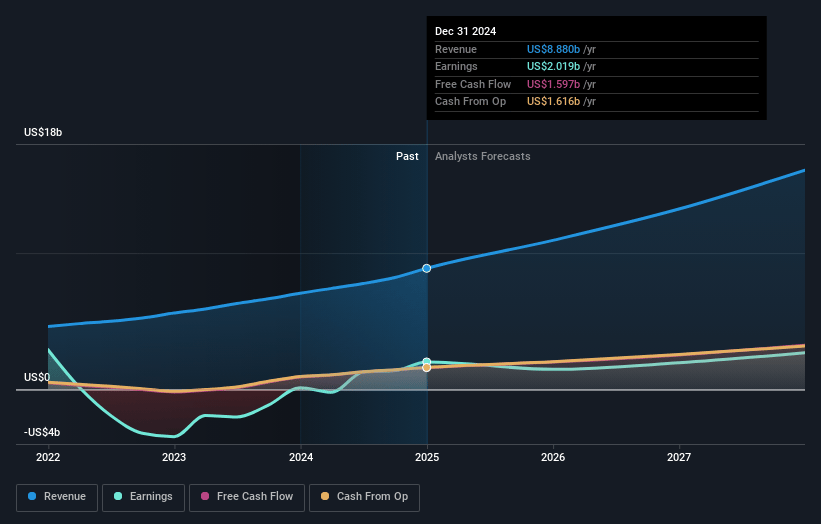

Shopify Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shopify's revenue will grow by 22.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.8% today to 15.3% in 3 years time.

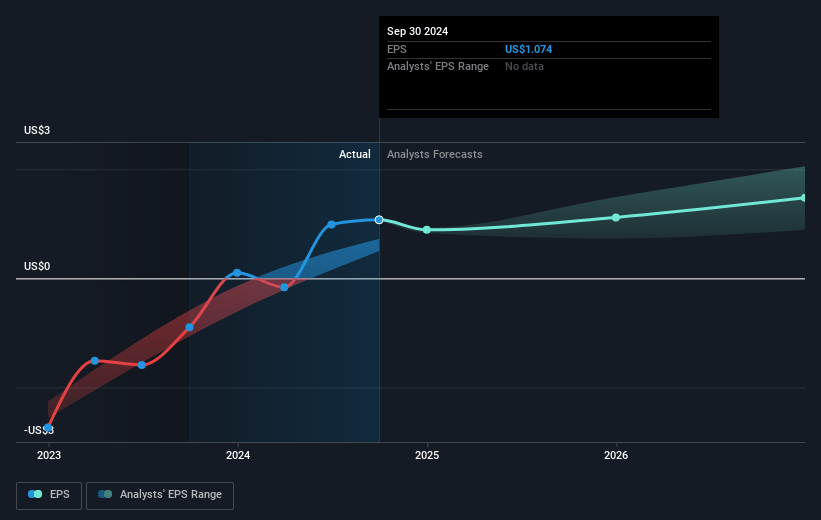

- Analysts expect earnings to reach $2.3 billion (and earnings per share of $1.53) by about December 2027, up from $1.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.7 billion in earnings, and the most bearish expecting $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 94.5x on those 2027 earnings, down from 109.7x today. This future PE is greater than the current PE for the US IT industry at 45.0x.

- Analysts expect the number of shares outstanding to grow by 5.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

Shopify Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Shopify's quarter showed strong revenue growth of 26%, driven by a combination of GMV growth, increased merchant numbers, and enhanced payment solutions, suggesting continued potential growth in revenue.

- The company expanded its offerings internationally with notable GMV growth outside North America (33% in Q3), demonstrating opportunities for revenue expansion and market penetration globally.

- Shopify's focus on enhancing its platform with AI and machine learning capabilities, like improved customer interaction via Shopify Inbox, could drive better conversion rates, ultimately boosting earnings.

- New product features and automation tools like Shopify Flow and Tax could improve merchant efficiency and satisfaction, likely contributing to improved net margins through operational productivity.

- Shopify's strategic partnerships, including recent enhancements with PayPal and integrations with YouTube and Roblox, strengthen its ecosystem, potentially increasing merchant engagement, funneling more revenue opportunities, and supporting sustainable financial growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $117.22 for Shopify based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $78.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $15.2 billion, earnings will come to $2.3 billion, and it would be trading on a PE ratio of 94.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of $117.37, the analyst's price target of $117.22 is 0.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

BU

Butter_Bat

Community Contributor

Continuing market dominance, long lasting tailwinds, great optionality, exceptional management and continuous innovation.

Shopify will continue to grow into this ever growing market cementing itself as the go to option to start up an online presence. E-commerce as a whole will continue to grow ~8-10% as consumers switch from in store to online experiences.

View narrativeUS$111.86

FV

15.6% overvalued intrinsic discount19.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

5 months ago author updated this narrative

GO

Equity Analyst

Large Brands and New Verticals to Push Revenues Higher But Cheap Ecomm Software Risks Remain

Key Takeaways Expanding the customer base with large brands via the Shopify Plus subscriptions is a profitable way to grow the business. In my view, Shopify has a $32B software, and $15.4B payments market opportunity.

View narrativeUS$39.00

FV

231.6% overvalued intrinsic discount18.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

8 months ago author updated this narrative