Last Update13 Oct 25Fair value Increased 11%

IREN's analyst price target has increased significantly, climbing from approximately $44 to $49. Analysts cite accelerating AI cloud revenue growth, strong GPU investments, and improving visibility on the company's expansion strategy as key factors.

Analyst Commentary

Recent Street research highlights a surge in optimism around IREN, with numerous price target upgrades reflecting stronger confidence in the company's growth prospects and execution in the AI cloud domain. However, some analysts are expressing caution in light of the company’s substantial rally and evolving business mix.

Bullish Takeaways- Bullish analysts are increasingly raising price targets, some by more than triple. They cite IREN's pivot to AI cloud and acceleration in recurring revenue growth as key factors.

- The company’s significant investment in building its own AI cloud vertical, rather than relying solely on partnerships, is viewed as a strategic differentiator that supports higher valuations.

- Multiple upgrades reflect confidence in IREN's ability to scale its GPU infrastructure and secure valuable partnerships, including preferred status with leading hardware providers. This is expected to drive further growth.

- Improving execution on large-scale data center projects, combined with the flexibility to deploy power assets for optimal return, signals long-term potential for revenue and margin expansion.

- Bearish analysts are turning more cautious following a rapid stock price increase. They note the risk of IREN transitioning from capital-intensive bitcoin mining to the equally demanding AI infrastructure buildout.

- Questions persist around the sustainability of current demand from "white-label" AI cloud clients. This raises the prospect that some growth may prove transitory if sector trends shift.

- Ongoing concerns exist about competitive pressures from established hyperscaler and cloud providers, which could challenge IREN’s execution and market share ambitions.

- As the company leans into full-stack AI cloud services, analysts warn of supply-side risks and the possibility of eroding advantages, especially if expansion outpaces the company's ability to maintain its edge.

What's in the News

- IREN signed additional multi-year cloud services contracts with leading AI companies for NVIDIA Blackwell GPU deployments, securing customer commitments for 11,000 of its 23,000 GPUs and targeting over $500 million in annualized AI Cloud revenue by Q1 2026 (Client Announcements).

- The company expanded its AI Cloud capacity to 23,000 GPUs, including new purchases of NVIDIA B300s, B200s, and AMD MI350Xs worth approximately $674 million. This highlights robust demand and ongoing customer discussions for multi-thousand GPU clusters (Business Expansions).

- Anthony Lewis was appointed as Chief Financial Officer, succeeding Ms. Belinda Nucifora. Lewis will continue to oversee capital markets and financial operations, reflecting a leadership transition (Executive Changes: CFO).

- For July 2025, IREN reported an average operating hashrate of 45.4 EH/s and mined 728 Bitcoin (Announcement of Operating Results).

Valuation Changes

- Consensus Analyst Price Target has risen from approximately $44 to about $49. This reflects a modest increase in perceived fair value.

- Discount Rate has decreased slightly, moving from 8.17% to 8.08%. This suggests marginally lower perceived risk or cost of capital.

- Revenue Growth expectations have increased significantly, from 52.7% to 62.7% year-over-year. This indicates higher anticipated top-line expansion.

- Net Profit Margin has declined from 43.6% to 36.2%. This marks a notable reduction in expected profitability.

- Future P/E Ratio has risen from 23.8x to 26.1x. This suggests the stock is now valued at a higher multiple of forward earnings.

Key Takeaways

- Vertical integration and strategic partnerships strengthen IREN's growth in AI cloud and data center markets, supporting higher margins and future competitiveness.

- Flexible business model and efficient financing provide resilience, enabling shifts to higher-margin sectors and sustaining earnings amid industry changes.

- Heavy reliance on debt-funded expansion, volatile revenues, rising energy costs, competitive pressures, and regulatory risks threaten profitability, cash flow stability, and long-term growth.

Catalysts

About IREN- Operates in the integrated data center business.

- Rapid expansion into AI cloud services, fueled by IREN's vertical integration and direct-to-chip liquid cooling data centers, positions the company to capitalize on accelerating demand for AI infrastructure; this is expected to significantly boost long-term revenue growth and improve EBITDA margins due to recurring, high-margin AI cloud contracts.

- Secured expansion of grid-connected power and proprietary data centers (now at nearly 3GW and 810MW of operational capacity), enables IREN to serve both the digital currencies mining and AI compute sectors, offering flexibility to pivot toward higher-margin segments as market opportunities evolve; this bodes well for future revenue visibility and capital efficiency.

- Strengthened cost position through low all-in cash mining costs ($36,000/Bitcoin) and access to low-cost, renewable power ($0.035/kWh), puts IREN at an advantage in a consolidating industry, supporting robust net margins and sustainable earnings even as weaker miners exit post-halving.

- Strong institutional partnerships and designation as an NVIDIA preferred partner unlock access to next-generation GPU supply and broaden IREN's customer pipeline, positioning the company to benefit from greater institutional adoption of digital assets and advanced computing-supporting both topline growth and long-term competitiveness.

- Successful and capital-efficient financing strategies (e.g., 100% non-dilutive GPU financings at low rates, robust cash reserves), enable IREN to scale AI and data center business lines without undue leverage, securing the required capital for expansion and reducing future risk to net margins and cash flow.

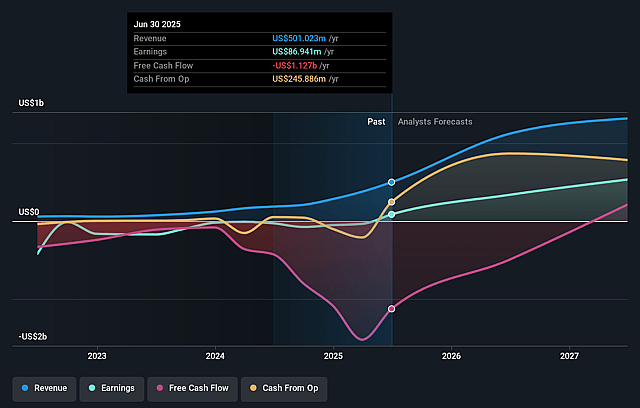

IREN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IREN's revenue will grow by 45.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.4% today to 66.6% in 3 years time.

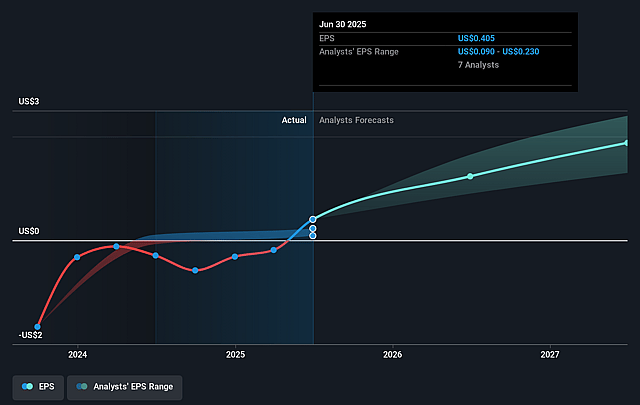

- Analysts expect earnings to reach $1.0 billion (and earnings per share of $3.31) by about September 2028, up from $86.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 88.3x today. This future PE is lower than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

IREN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IREN's heavy capital expenditures for rapid data center and GPU expansion, funded by significant debt and lease financing, risk outpacing operating cash flows-potentially leading to higher leverage, reduced free cash flow, and downward pressure on net margins if market conditions become less favorable.

- The company's revenues remain highly reliant on Bitcoin mining and, increasingly, short-term AI cloud contracts; continued earnings stability may be threatened by Bitcoin price volatility, future block reward halvings, and the relatively short contract duration for AI compute services, impacting revenue predictability and long-term cash flow.

- Rising global energy prices and potential scarcity or cost volatility in key energy markets (e.g., West Texas and British Columbia) could drive higher operating expenses and erode IREN's low-cost advantage, negatively affecting gross and net margins over time.

- The introduction of new, more efficient GPUs and ASICs from competitors, coupled with increasing customer demand for more flexible or lower-density rack configurations, could materially shorten equipment life cycles and raise the ongoing capital intensity of IREN's infrastructure, pressuring profit margins and necessitating continual high investment.

- The rapid scaling and geographic concentration of data center assets increase exposure to regulatory, environmental, and permitting risks (including ESG pressures on energy use and emissions), which may result in added compliance costs or restrictions-ultimately reducing profitability and increasing execution risk on planned expansions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.727 for IREN based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $28.21, the analyst price target of $28.73 is 1.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.