Key Takeaways

- Unique supply capabilities, energy-efficient infrastructure, and vertically integrated renewable power make IREN a top ESG partner, enabling premium pricing and superior margins.

- Asset-light expansion, innovative financing, and a diversified client base support rapid, low-risk growth and sustained, industry-leading profitability.

- Heavy exposure to crypto cycles, rising energy costs, ESG pressures, aggressive capex, and intensifying competition threaten IREN's profitability, liquidity, and long-term growth prospects.

Catalysts

About IREN- Operates in the integrated data center business.

- While analyst consensus highlights IREN's position to benefit from rising AI and digital infrastructure demand, the actual scale of demand severely outpaces current and planned supply, and IREN uniquely holds the ability to deploy up to 80,000 cutting-edge GPUs at British Columbia alone and over 600,000 at Sweetwater, giving line of sight to exponential revenue expansion beyond current market forecasts.

- Whereas analyst consensus acknowledges IREN's integration of proprietary renewable energy as a margin driver, they are underestimating IREN's ability to further grow its vertically integrated, low-cost, carbon-neutral power portfolio at scale, supporting not only industry-leading net margins but also making IREN the partner of choice for ESG-conscious hyperscalers and global AI leaders, accelerating share gains and premium pricing.

- IREN's move to combine cloud and colocation offerings across highly flexible next-generation powered shell campuses enables them to capture a dramatically broader customer base-from blue-chip hyperscalers to fast-scaling AI start-ups-enhancing contracted revenue visibility and improving both revenue quality and risk-adjusted returns.

- Their increasingly asset-light, capex-efficient ramp enabled by full-coverage, multi-year, non-dilutive GPU financing at single-digit rates allows for rapid, low-risk infrastructure scaling while sustaining significant positive operating cash flow, ensuring capital availability for continuous growth and driving sustained earnings compounding even during hardware upgrade cycles.

- IREN's operational scale, relentless delivery on project milestones, and first-mover advantage as an NVIDIA preferred partner position them to set industry standards in energy efficiency and rack density (PUE of 1.1 to 1.2), driving persistent technology leadership, lowering costs even further, and supporting structurally superior long-term return on invested capital.

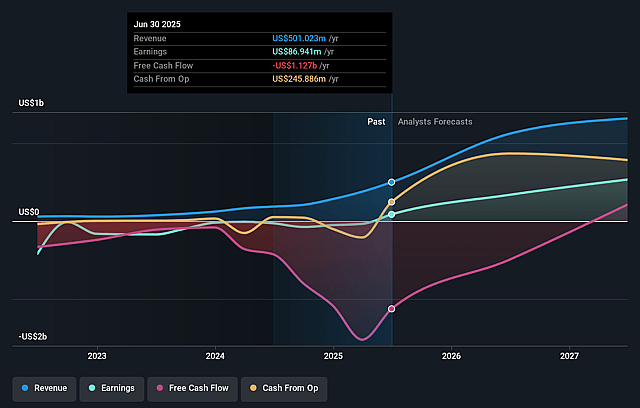

IREN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on IREN compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming IREN's revenue will grow by 47.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 17.4% today to 75.7% in 3 years time.

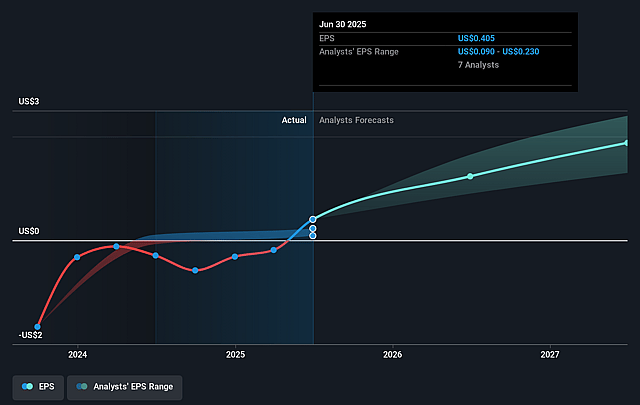

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $3.94) by about September 2028, up from $86.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, down from 94.4x today. This future PE is lower than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.2%, as per the Simply Wall St company report.

IREN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IREN's continued significant exposure to Bitcoin mining means its revenue and EBITDA remain highly sensitive to cryptocurrency market cycles, including anticipated Bitcoin halving events that will lower mining rewards and could reduce segment profitability and cash flow over time.

- The company's expansion in energy-intensive data centers and AI cloud services puts it at risk from rising global energy costs and volatility, particularly if regulatory changes, carbon taxation, or energy shortages increase operational expenses and erode net margins.

- Increasing environmental and ESG pressures may negatively impact IREN's access to affordable capital and could impose higher compliance costs, especially if the transition to exclusively renewable energy sources lags or requires substantial additional investment, thus constraining future earnings and valuation.

- IREN's aggressive capital expenditure programs to scale mining and AI infrastructure create ongoing high fixed-cost obligations and financing risk; any slowdown in demand for AI compute, tightening credit markets, or cost overruns in major projects could strain liquidity and depress profitability.

- As competition intensifies in both mining and high-density AI hosting, advancements in hardware efficiency and the entry of larger, better-capitalized rivals could compress operating margins for IREN, and failure to rapidly adopt next-generation technology may diminish revenue growth and long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for IREN is $40.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IREN's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $30.19, the bullish analyst price target of $40.0 is 24.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives