Key Takeaways

- Heavy reliance on Bitcoin mining and supply chain vulnerabilities expose IREN to volatile revenues, regulatory risks, and potential project delays.

- Intensifying competition, rapid tech evolution, and stricter regulations threaten future margins, making revenue and profitability increasingly difficult to sustain.

- IREN's integrated AI cloud infrastructure, execution capability, strategic partnerships, and scalable business model position it for strong growth, profitability, and market leadership amidst surging demand.

Catalysts

About IREN- Operates in the vertically integrated data center business.

- Intensifying global regulatory scrutiny on energy use and emissions could lead to stricter requirements and increased operating costs, particularly for high-energy activities like Bitcoin mining and AI data centers. These regulatory changes are likely to pressure both net margins and long-term earnings by forcing IREN to invest heavily in mitigation or face operational constraints.

- Persistent supply chain disruptions-including potential semiconductor shortages or escalating trade tensions-threaten IREN's ability to secure crucial GPUs and infrastructure for both AI and mining operations. These interruptions may delay deployment of major growth projects, directly hampering revenue growth and compromising the company's ambitious scaling plans.

- IREN remains highly exposed to the volatility of cryptocurrency markets, with the majority of current EBITDA and cash flows still rooted in Bitcoin mining at a time when halving events and rising network difficulty will steadily lower mining rewards industry-wide. This dependency creates a material risk of significant future declines in revenue and profitability as core economics inevitably deteriorate.

- The rapid pace of innovation in data center technology and semiconductors favors larger, more diversified and capital-rich players, putting IREN at sustained risk of technological obsolescence and dramatically higher capital expenditure requirements to maintain competitiveness. This dynamic could erode future margins and drastically increase the risk of negative free cash flow.

- Heightened competition from both established hyperscalers and new AI-focused infrastructure entrants is likely to compress returns on both cloud and colocation business models. IREN's capital-intensive expansion undertaken today may face diminishing marginal returns, resulting in lower-than-anticipated revenue and persistent margin pressure from price-based competition as industry capacity eventually catches up to demand.

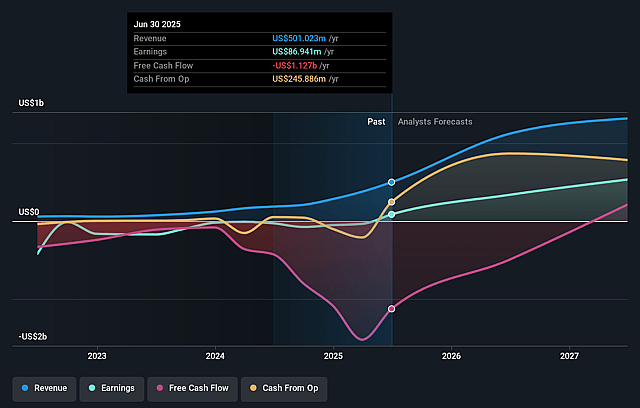

IREN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on IREN compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming IREN's revenue will grow by 47.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 17.4% today to 48.0% in 3 years time.

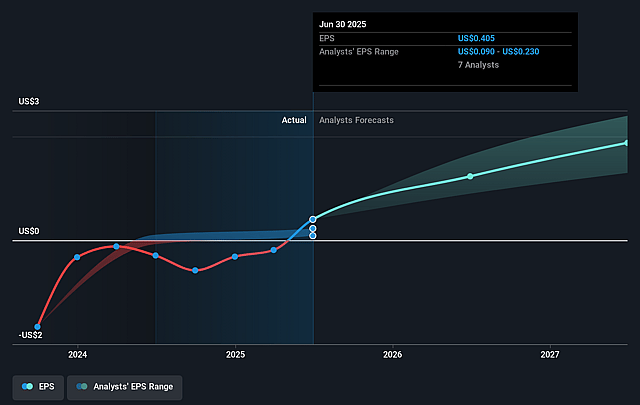

- The bearish analysts expect earnings to reach $774.5 million (and earnings per share of $2.34) by about September 2028, up from $86.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, down from 81.7x today. This future PE is lower than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.23%, as per the Simply Wall St company report.

IREN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating enterprise adoption of AI solutions and a severe global shortage in high-density, GPU-ready data center capacity have positioned IREN as an in-demand compute infrastructure provider, creating significant long-term revenue growth opportunities as its AI cloud footprint rapidly expands.

- Proven ability to execute large-scale power and data center developments, with a pipeline expanding to 3 gigawatts and plans for over 600,000 GPUs deployed, means IREN can capture outsized market share as the secular demand for infrastructure supporting AI, cloud, and digital transformation continues to outpace supply, driving both revenue and net earnings higher.

- Strategic designation as an NVIDIA Preferred Partner secures access to next-generation GPUs and attracts high-value customers, supporting strong contract visibility and higher margins for the AI cloud service, while minimizing supply chain risk and enabling continued operational scale.

- Vertical integration across power procurement, data center construction, and cloud/colocation services allows IREN to operate with power usage effectiveness well below industry averages, translating into lower cost per compute, higher gross margins, and resilient operating cash flows.

- Flexible business model, funding through a mix of strong operating cash flow and competitively-priced asset-backed GPU financing, ensures IREN can scale AI and cloud operations without excessive shareholder dilution or balance sheet stress, underpinning higher long-term earnings and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for IREN is $16.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IREN's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $774.5 million, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of $26.13, the bearish analyst price target of $16.0 is 63.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on IREN?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.