Last Update 10 Nov 25

Fair value Increased 18%IREN: Surging AI Cloud Demand And Major Contracts Will Drive Re-Rating

IREN's analyst price target has been significantly raised from $62.75 to $74.17. Analysts cite accelerating AI cloud business momentum, new strategic partnerships, and increased sector confidence as key drivers for the more optimistic outlook.

Analyst Commentary

Analysts have issued a wide range of commentary following IREN’s recent results and strategic announcements, reflecting both increased optimism and ongoing caution about the company’s outlook in the competitive AI cloud sector.

Bullish Takeaways- Bullish analysts have significantly raised their price targets, in some cases more than doubling previous estimates. They cite IREN’s expanding AI cloud business and strong demand for high-performance computing infrastructure as key factors.

- Recent partnerships with major technology companies and new data center deals are viewed as lending credibility to IREN’s growth narrative and establishing the company as a credible hyperscaler partner.

- Analysts note IREN’s focus on building its own vertically integrated AI cloud business, rather than relying solely on co-location models, as supporting higher capital expenditure and long-term value creation.

- There is a belief among optimists that IREN’s extensive access to power, land, and data center expertise positions it uniquely to benefit as demand for AI infrastructure continues to escalate.

- Bearish analysts remain cautious about IREN’s ambitious revenue guidance. They highlight high execution and financing risks as the company ramps up its AI cloud activities.

- Concerns have been raised about potential volatility in client demand, particularly for white-label services, and the risk that current supply-side advantages could erode in a competitive market.

- There is skepticism regarding IREN’s ability to deliver on large-scale AI data center projects, given the capital-intensive nature of the business and increasing competition from better-established hyperscalers and neocloud leaders.

- Some analysts note that while IREN’s shares have experienced significant gains, the company still trades at a discount to its peer group on key metrics, and closing this gap will require sustained performance and successful expansion.

What's in the News

- IREN signed a multi-year GPU cloud services contract with Microsoft, providing access to NVIDIA GB300 GPUs over five years for approximately $9.7 billion, including a 20% prepayment. GPU deployments will take place at the Childress, Texas campus, supported by new data centers and funded via existing cash, customer prepayments, and additional financing. (Key Developments)

- The company announced additional multi-year cloud services contracts with leading AI companies for NVIDIA Blackwell GPU deployments and expects to surpass $500 million in annualized run-rate revenue from 23,000 GPUs by the end of Q1 2026. (Key Developments)

- IREN completed a follow-on equity offering totaling nearly $1 billion, issuing over 66 million ordinary shares through at-the-market transactions. (Key Developments)

- IREN expanded its AI Cloud capacity to 23,000 GPUs after purchasing 12,400 new units, including AMD MI350Xs and NVIDIA Blackwell GPUs, to meet growing demand and further diversify its hardware offerings. (Key Developments)

- Anthony Lewis was appointed Chief Financial Officer, transitioning from Chief Capital Officer and succeeding Belinda Nucifora, who is departing after 3.5 years as CFO. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has increased from $62.75 to $74.17, reflecting higher market optimism regarding IREN’s growth prospects.

- Discount Rate has risen slightly from 8.08% to 8.11%, indicating a marginally higher risk premium applied to future cash flows.

- Revenue Growth projections have climbed notably from 62.74% to 72.60%, suggesting stronger expected top-line expansion.

- Net Profit Margin is now forecast to fall significantly from 27.18% to 11.27%. This points to expectations of tighter profitability, potentially due to increased investments and competition.

- Future P/E ratio has surged from 44.94x to 74.40x. This implies a higher valuation multiple based on anticipated future earnings.

Key Takeaways

- Vertical integration and strategic partnerships strengthen IREN's growth in AI cloud and data center markets, supporting higher margins and future competitiveness.

- Flexible business model and efficient financing provide resilience, enabling shifts to higher-margin sectors and sustaining earnings amid industry changes.

- Heavy reliance on debt-funded expansion, volatile revenues, rising energy costs, competitive pressures, and regulatory risks threaten profitability, cash flow stability, and long-term growth.

Catalysts

About IREN- Operates in the integrated data center business.

- Rapid expansion into AI cloud services, fueled by IREN's vertical integration and direct-to-chip liquid cooling data centers, positions the company to capitalize on accelerating demand for AI infrastructure; this is expected to significantly boost long-term revenue growth and improve EBITDA margins due to recurring, high-margin AI cloud contracts.

- Secured expansion of grid-connected power and proprietary data centers (now at nearly 3GW and 810MW of operational capacity), enables IREN to serve both the digital currencies mining and AI compute sectors, offering flexibility to pivot toward higher-margin segments as market opportunities evolve; this bodes well for future revenue visibility and capital efficiency.

- Strengthened cost position through low all-in cash mining costs ($36,000/Bitcoin) and access to low-cost, renewable power ($0.035/kWh), puts IREN at an advantage in a consolidating industry, supporting robust net margins and sustainable earnings even as weaker miners exit post-halving.

- Strong institutional partnerships and designation as an NVIDIA preferred partner unlock access to next-generation GPU supply and broaden IREN's customer pipeline, positioning the company to benefit from greater institutional adoption of digital assets and advanced computing-supporting both topline growth and long-term competitiveness.

- Successful and capital-efficient financing strategies (e.g., 100% non-dilutive GPU financings at low rates, robust cash reserves), enable IREN to scale AI and data center business lines without undue leverage, securing the required capital for expansion and reducing future risk to net margins and cash flow.

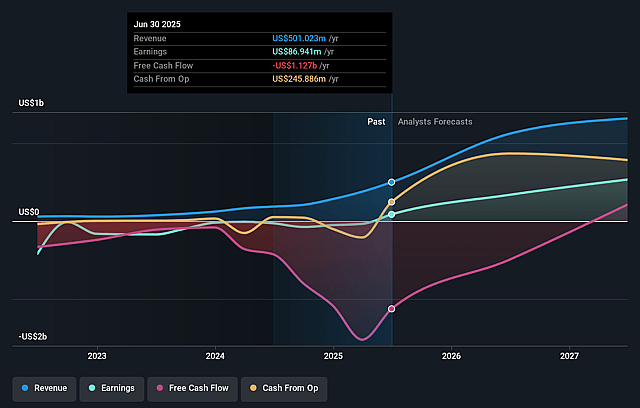

IREN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IREN's revenue will grow by 45.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.4% today to 66.6% in 3 years time.

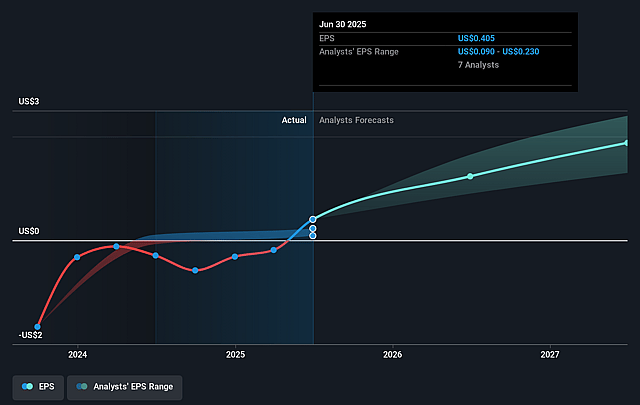

- Analysts expect earnings to reach $1.0 billion (and earnings per share of $3.31) by about September 2028, up from $86.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 88.3x today. This future PE is lower than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

IREN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IREN's heavy capital expenditures for rapid data center and GPU expansion, funded by significant debt and lease financing, risk outpacing operating cash flows-potentially leading to higher leverage, reduced free cash flow, and downward pressure on net margins if market conditions become less favorable.

- The company's revenues remain highly reliant on Bitcoin mining and, increasingly, short-term AI cloud contracts; continued earnings stability may be threatened by Bitcoin price volatility, future block reward halvings, and the relatively short contract duration for AI compute services, impacting revenue predictability and long-term cash flow.

- Rising global energy prices and potential scarcity or cost volatility in key energy markets (e.g., West Texas and British Columbia) could drive higher operating expenses and erode IREN's low-cost advantage, negatively affecting gross and net margins over time.

- The introduction of new, more efficient GPUs and ASICs from competitors, coupled with increasing customer demand for more flexible or lower-density rack configurations, could materially shorten equipment life cycles and raise the ongoing capital intensity of IREN's infrastructure, pressuring profit margins and necessitating continual high investment.

- The rapid scaling and geographic concentration of data center assets increase exposure to regulatory, environmental, and permitting risks (including ESG pressures on energy use and emissions), which may result in added compliance costs or restrictions-ultimately reducing profitability and increasing execution risk on planned expansions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.727 for IREN based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $28.21, the analyst price target of $28.73 is 1.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives