Key Takeaways

- Strong capital position and cost advantages support rapid network expansion, improving margins and securing a dominant, defensible share as demand accelerates in urban markets.

- Proprietary data, AI-driven pricing, and high-speed charger deployment enable superior revenue optimization and utilization, driving operating leverage and long-term growth ahead of rivals.

- Reliance on heavy upfront spending, government incentives, and exposure to rising competition and changing EV charging trends threaten EVgo's growth, margins, and profitability.

Catalysts

About EVgo- Owns and operates a direct current fast charging network for electric vehicles in the United States.

- Analysts broadly agree that EVgo is well-funded to expand its network, but consensus underestimates the impact of recent capital raises and CapEx offsets-these give EVgo the unique ability to quintuple annual stall installations by 2029, meaningfully outpacing all U.S. rivals and supporting both top-line revenue beats and an increasingly defensible market share.

- While analyst consensus expects margin improvement from cost reductions and network scaling, they do not fully price in EVgo's now demonstrated ability to reduce next-gen net CapEx per stall by close to 30% year-over-year and capture 45%+ in capital offsets, which together position EVgo for margin expansion and ROIC that could rival mature infrastructure businesses long before most expect.

- EVgo's rapidly advancing AI-driven marketing and real-time dynamic pricing capabilities-combined with superior data on location-based demand and user behavior-allow for revenue per kilowatt hour and customer retention optimization far beyond what the sector currently assumes, which can meaningfully raise long-term revenue per stall and EBITDA margins as adoption accelerates.

- The ongoing surge in multi-unit and urban residential EV adoption, where home charging is typically not viable, creates a structural shift toward public fast charging; EVgo's metro site concentration and pipeline flexibility allow it to capture this growing cohort, supporting both higher utilization rates and durable growth in throughput per stall.

- With the majority of new EVs enabling higher charging speeds and total EVs on U.S. roads expected to rise more than fourfold by 2030, EVgo's proactive deployment of 350kW+ chargers positions it to consistently benefit from the secular tailwind of rising throughput-per-session-a dynamic that can drive exponential revenue growth and operating leverage, particularly as competitors struggle to access capital.

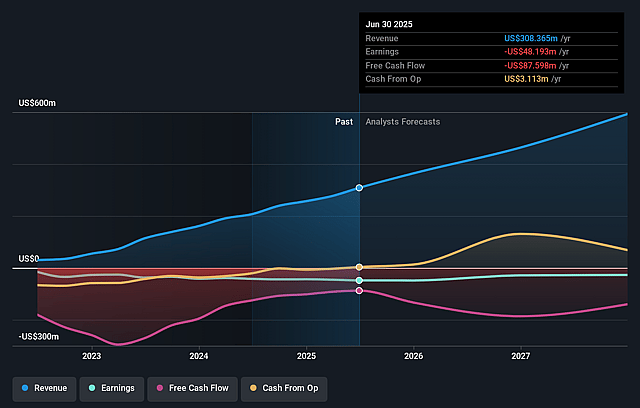

EVgo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on EVgo compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming EVgo's revenue will grow by 39.6% annually over the next 3 years.

- Even the bullish analysts are not forecasting that EVgo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate EVgo's profit margin will increase from -15.6% to the average US Specialty Retail industry of 4.8% in 3 years.

- If EVgo's profit margin were to converge on the industry average, you could expect earnings to reach $40.3 million (and earnings per share of $0.11) by about September 2028, up from $-48.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 131.8x on those 2028 earnings, up from -10.9x today. This future PE is greater than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

EVgo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing adoption of home and workplace charging, as well as potential advancements in battery technology that extend EV range, could substantially reduce demand for public fast charging, leading to lower long-term utilization and in turn pressuring EVgo's future revenue and earnings growth.

- EVgo's business model remains highly dependent on large upfront capital expenditures for network expansion, which, if not offset by sustained growth in high-margin utilization or grant support, could outpace revenue growth, erode margins, and constrain free cash flow.

- The company's heavy reliance on government incentives and state grants for capital efficiency introduces risk if such programs are reduced, delayed, or eliminated, potentially resulting in higher net CapEx per stall, weaker project returns, and long-term negative impacts to margins and profitability.

- EVgo faces intensifying competition from vertically integrated automakers and other charging networks, including those affiliated with Tesla, GM, and Ford, which may put pressure on pricing and market share, potentially depressing future revenues, utilization rates, and EBITDA margins.

- Slower-than-expected achievement of economies of scale or operational efficiencies-especially if maintenance, O&M, or utility costs remain elevated-could prolong negative net margins and delay the company's path to sustainable profitability and positive net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for EVgo is $11.06, which represents two standard deviations above the consensus price target of $6.34. This valuation is based on what can be assumed as the expectations of EVgo's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $838.8 million, earnings will come to $40.3 million, and it would be trading on a PE ratio of 131.8x, assuming you use a discount rate of 8.5%.

- Given the current share price of $3.9, the bullish analyst price target of $11.06 is 64.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.