Last Update 05 Jan 26

Fair value Increased 14%EVGO: Higher 2025 Revenue Outlook Will Support Bullish Repricing

Analysts have raised their price target on EVgo to US$4.00 from US$3.50, citing updated assumptions that include a revised revenue growth outlook, an updated discount rate, modestly adjusted profit margin expectations, and a lower future P/E multiple in their models.

What's in the News

- EVgo reiterated its total revenue guidance for 2025, with a range of US$350 million to US$365 million. (Company guidance)

- EVgo updated its 2025 outlook to include a Baseline plus Ancillary Upside scenario, putting total revenue between US$350 million and US$405 million. (Company guidance)

- EVgo appointed Keefer Lehner as Chief Financial Officer, succeeding retiring CFO Paul Dobson, effective January 12, 2026. Dobson will stay on as an adviser through March 2026. (Executive announcement)

- Lehner joins EVgo with nearly 20 years of finance, operations and leadership experience, including roles at KLX Energy Services, Quintana Energy Services and Quintana Capital Group. (Executive announcement)

Valuation Changes

- The fair value estimate has moved from US$3.50 to US$4.00 per share, representing a moderate uplift in the analyst model output.

- The discount rate has shifted from 8.53% to 9.05%, indicating a slightly higher required return in the updated assumptions.

- The revenue growth assumption has been revised from 17.60% to 30.39%, indicating a higher modeled growth rate for future revenues.

- The profit margin expectation has been adjusted from 4.75% to 4.86%, representing a small change in projected profitability.

- The future P/E multiple has moved from 70.64x to 20.23x, reflecting a substantially lower valuation multiple applied in the new forecast.

Key Takeaways

- Revenue growth is threatened by slower EV adoption, shifting government policies, and intense competition from larger players and emerging technologies.

- Persistent low utilization rates and reliance on subsidies may drive cash burn, increasing risk of capital raises and margin pressure.

- Accelerating EV adoption, capital efficiency gains, rapid network expansion, technological upgrades, and high-margin ancillary services are set to boost EVgo's growth and profitability.

Catalysts

About EVgo- Owns and operates a direct current fast charging network for electric vehicles in the United States.

- The company's aggressive expansion is fundamentally dependent on projections that electric vehicle growth will vastly outpace charging infrastructure deployment; if EV adoption disappoints due to persistent consumer resistance, competing technologies, or flattening government mandates, EVgo's addressable market could stagnate or shrink, causing revenues by 2029 to fall well short of the $1.2–$1.5 billion target.

- EVgo's long-term financial success relies heavily on an ongoing stream of public and private incentives and low-cost project financing, but with heightened macroeconomic risk and the possibility of government policy shifts or cuts to subsidies, the company could face sharply increased CapEx and borrowing costs, delaying expansion plans and squeezing margins in out-years.

- Despite management's focus on operational leverage, persistently low stall utilization rates combined with multi-year net losses create a substantial risk of cash burn, pressuring the company to raise additional capital in the future and threatening both net margins and shareholder returns through dilution.

- The accelerating pace of network buildout and planned fivefold increase in annual stall deployment could exacerbate industry-wide risks of oversupply, price competition, and technological obsolescence as new charging solutions and battery technologies reduce reliance on public chargers, leading to lower-than-forecast throughput and flattening long-term earnings.

- EVgo's recurring revenue and customer growth are vulnerable as competition intensifies from both large, well-capitalized players (including Tesla and energy majors) and public-private initiatives, risking eroding market share, compressing gross margins, and undermining the projected 32–38 percent adjusted EBITDA margin by decade's end.

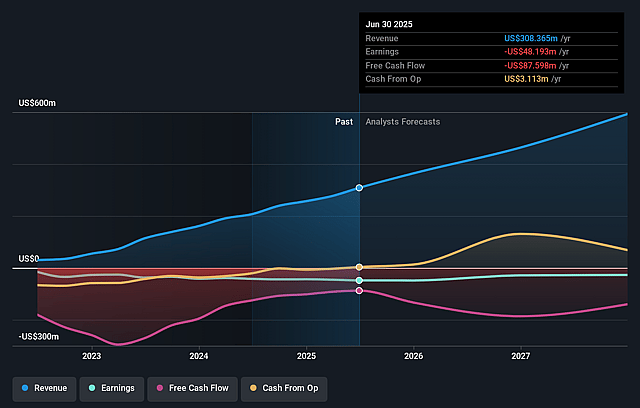

EVgo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on EVgo compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming EVgo's revenue will grow by 17.6% annually over the next 3 years.

- The bearish analysts are not forecasting that EVgo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate EVgo's profit margin will increase from -15.6% to the average US Specialty Retail industry of 4.7% in 3 years.

- If EVgo's profit margin were to converge on the industry average, you could expect earnings to reach $23.8 million (and earnings per share of $0.06) by about August 2028, up from $-48.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 70.6x on those 2028 earnings, up from -11.3x today. This future PE is greater than the current PE for the US Specialty Retail industry at 18.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

EVgo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating growth in electric vehicle adoption and a projected quadrupling of EVs in operation by 2030 is expected to significantly increase demand for DC fast charging, expanding EVgo's addressable market and driving revenue and throughput per stall.

- Substantial improvements in capital efficiency, such as a 28% reduction in net CapEx per stall for 2025 and increasingly high capital offsets from state grants and utility incentives, position EVgo for higher project returns and improved net margins over time.

- Robust access to non-dilutive, low-cost capital from both public (DOE) and private (commercial banks) sources allows EVgo to scale aggressively, with forecasts showing a network expansion to approximately 14,000 stalls by 2029, enabling greater operational leverage and EBITDA growth.

- Strategic technological advancements, including next-generation charging architecture, rapid deployment of 350-kilowatt chargers, and integration of NACS cables to attract Tesla drivers, are likely to enhance customer experience, boost network utilization, and support both top-line and bottom-line financials.

- High-margin ancillary revenue streams, such as dedicated hubs for autonomous vehicles, as well as increasing adoption of ridesharing and subscription plans, are expected to provide additional recurring revenues and further strengthen gross margin and EBITDA as these segments scale within the business.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for EVgo is $3.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of EVgo's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $501.5 million, earnings will come to $23.8 million, and it would be trading on a PE ratio of 70.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of $4.05, the bearish analyst price target of $3.5 is 15.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on EVgo?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.