Last Update 19 Jan 26

EVGO: Kroger Charging Expansion Will Drive 2025 Revenue Outlook Higher

Analysts have kept their price target for EVgo broadly in line with prior views, with a modest adjustment that reflects slightly higher assumed discount rates, a small uplift in long term profit margin expectations, and a marginally lower future P/E multiple.

What's in the News

- EVgo plans to build at least 150 fast charging stalls a year through 2035 at Kroger Family of Stores locations across the U.S., expanding an existing collaboration that began in 2022 (Key Developments).

- The expanded Kroger program targets up to 16 high power fast charging stalls at select sites, with new locations identified in Arizona, California, Florida, Georgia, Texas, Washington and other states, and the first new site already operating in Salt Lake City, Utah (Key Developments).

- Charging stations in the Kroger collaboration are set to use high power EVgo chargers that can provide a full charge in as little as 15 minutes, aiming to match typical grocery visit times and support nearby retail traffic (Key Developments).

- EVgo announced the appointment of Keefer Lehner as Chief Financial Officer, succeeding Paul Dobson, who plans to retire from the CFO role in January 2026 and stay on as an adviser through March 2026 (Key Developments).

- EVgo reiterated total revenue guidance for 2025 of US$350 million to US$365 million, after previously updating guidance to reflect a baseline range of US$350 million to US$365 million and a Baseline plus ancillary upside range of US$350 million to US$405 million (Key Developments).

Valuation Changes

- Fair Value: Fair value per share is unchanged at 6.54444.

- Discount Rate: The discount rate has risen slightly from 9.145277% to 9.150573%.

- Revenue Growth: The revenue growth assumption is effectively unchanged, moving from 31.476263% to 31.47626317489984%.

- Net Profit Margin: The long-term net profit margin has increased slightly from 4.877956% to 4.940178599%.

- Future P/E: The future P/E multiple has edged lower from 32.256925x to 31.855280888066474x.

Key Takeaways

- Improved capital efficiency, strategic financing, and technology investments are driving operating leverage, gross margin growth, and positioning for long-term earnings gains.

- Expansion into higher-frequency segments and slower-than-market stall buildout enhances network utilization, supports recurring revenue, and advances market share capture.

- Heavy reliance on government incentives, operational reliability challenges, execution risks, and intensifying competition threaten EVgo's margins, growth prospects, and long-term business model sustainability.

Catalysts

About EVgo- Owns and operates a direct current fast charging network for electric vehicles in the United States.

- EVgo has dramatically lowered its net CapEx per stall (down 28% versus initial 2025 projections) through a combination of improved contractor pricing, material sourcing, use of prefabricated skids, and by capturing more state grants and utility incentives-enabling higher projected returns on capital, improved net margins, and stronger long-term earnings growth.

- Robust industry demand, as evidenced by forecasts showing U.S. electric vehicles in operation set to quadruple by 2030, while the pace of DC fast charging stall buildouts remains more modest, positions EVgo to benefit from an increasing number of EVs per fast charger, resulting in higher utilization rates, revenue per stall, and improved operating leverage.

- Strategic partnerships and expansion into dedicated ultra-fast charging hubs for rideshare, autonomous vehicles, and NACS/Tesla-ready chargers are unlocking new customer segments with high charging frequency and large addressable markets, supporting higher recurring revenue, ancillary revenue growth, and stronger long-term earnings visibility.

- The recently secured $225 million+ commercial bank loan facility (expandable to $300 million) and $1.25 billion DOE loan provide EVgo with flexible, low-cost, non-dilutive capital, enabling accelerated network buildout and stall deployment, increased scale, and the ability to capture market share and operating efficiencies – all reinforcing EBITDA and earnings growth.

- Ongoing investment in proprietary software, AI-driven customer acquisition/retention, dynamic pricing, and next-gen vertically integrated charging architecture is driving both higher customer satisfaction (e.g., increased throughput, 95%+ success rates) and operating efficiencies, supporting gross margin expansion and further EBITDA improvement over time.

EVgo Future Earnings and Revenue Growth

Assumptions

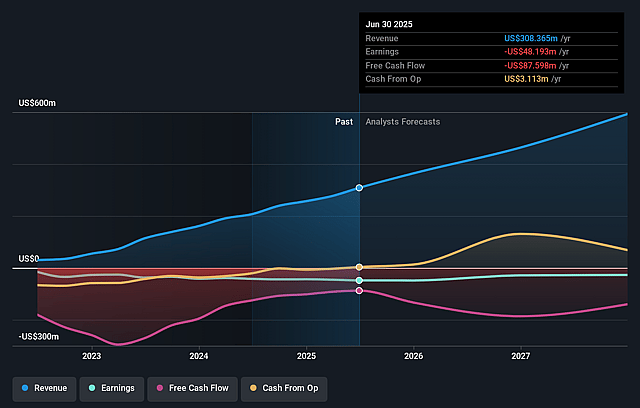

How have these above catalysts been quantified?- Analysts are assuming EVgo's revenue will grow by 29.6% annually over the next 3 years.

- Analysts are not forecasting that EVgo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate EVgo's profit margin will increase from -15.6% to the average US Specialty Retail industry of 4.7% in 3 years.

- If EVgo's profit margin were to converge on the industry average, you could expect earnings to reach $31.9 million (and earnings per share of $0.08) by about September 2028, up from $-48.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 95.6x on those 2028 earnings, up from -10.7x today. This future PE is greater than the current PE for the US Specialty Retail industry at 19.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

EVgo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued reliance on substantial government grants, state incentives, and federal programs for capital offsets exposes EVgo to regulatory risk-should these incentives be reduced or discontinued, future stall build economics and project returns could rapidly deteriorate, pressuring margins and net earnings.

- Ongoing industry-wide hardware and software issues, as evidenced by the recent costly firmware and legacy charger maintenance event, highlight operational reliability risks and may result in elevated maintenance expenses or reputational drag, reducing gross margin and customer retention in the long term.

- The company's aggressive build schedule, with much of the growth and capital deployment back-half weighted toward 2028–2029, creates significant execution risk; any delays, supply chain bottlenecks, or permitting hurdles could prevent full realization of projected revenue and cash flow targets, constraining long-term EBITDA growth.

- Increased competition from better-capitalized companies, especially as larger players enter the DCFC market with competing networks or as vertically integrated automakers (e.g., Tesla) continue to innovate, could compress utilization rates or provoke price wars, directly impacting revenue growth and sustained market share.

- The business model's long-term viability is tied to sustained growth in public fast charging demand; secular threats such as higher EV battery ranges, improved battery technology, increased adoption of at-home charging, and potential new charging paradigms (like battery swapping or utility-driven integrations) could dampen utilization, capping revenue per stall and challenging overall top-line growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.34 for EVgo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $671.6 million, earnings will come to $31.9 million, and it would be trading on a PE ratio of 95.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of $3.82, the analyst price target of $6.34 is 39.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on EVgo?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.