🛍️Business Overview

Founded in 1994 as an online bookstore, Amazon has grown into a global tech powerhouse. Its business is now highly diversified, with improving margins largely driven by the rapid expansion of Amazon Web Services (AWS), its high-margin cloud segment.

💵Revenue Exposure & Diversification

The revenues are geographically diversified over the following geographic segments:

- United States: 68.66%

- 1-Year Revenue Growth = 10.71%

- Germany: 6.40%

- 1-Year Revenue Growth = 8.69%

- United Kingdom: 5.93%

- 1-Year Revenue Growth = 12.69%

- Japan: 4.30%

- 1-Year Revenue Growth = 5.38%

- Rest of World: 14.71%

- 1-Year Revenue Growth = 14.47%

Its also diversified across several business segments:

- Retail: 66.52%

- 1-Year Revenue Growth = 8.28%

- AWS: 16.86%

- 1-Year Revenue Growth = 18.51%

- Advertising: 8.81%

- 1-Year Revenue Growth = 19.84%

- Subscriptions (e.g., Prime): 6.96%

- 1-Year Revenue Growth = 10.36%

- Other: 0.85%

- 1-Year Revenue Growth = 9.42%

🎯Key Insights & Assumptions

- Operating Margin: 5-Year Avg: 6.25% | Last Year: 10.87%

- Expected to improve toward ~20% as AWS scales, given its higher 30–40% margin profile.

- Return on Invested Capital (ROIC): 5-Year Avg: 10.79% | Last Year: 15.71%

- Projected to rise into the 15–20% range as capital efficiency improves.

- Revenue Growth (CAGR): 5-Year Avg: 13.38% | Last Year: 10.99%

- Growth is expected to moderate to 8–10% as Amazon matures. Analyst consensus aligns around 9–10%. This estimates can also be on the conservative side, given the growth potential of its cloud business.

- Free Cash Flow Growth (CAGR): 5-Year Avg: 6.13% | Last Year: 2.05%

- FCF growth has been volatile over the last years, due to Covid and capital expenditures. However I expect it to stabilize and improve over time.

📈Business Valuation

For valuing Amazon's business I'll use DCF as the valuation method:

- Discounted Cash Flow (DCF) - Intrinsic value is estimated by projecting Amazon’s free cash flows over the next 10 years and discounting them to present value.

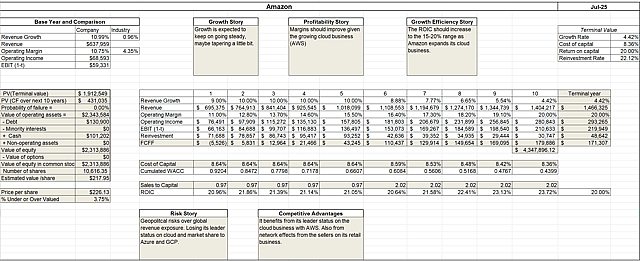

Discounted Cash Flow

📌 Key Assumptions

- Revenue Growth (CAGR) is estimated to be around 9% in Year 1, 10% in Years 2-5 , tapering to 4.42% (risk-free rate) in perpetuity.

- Operating Margin expanding gradually to ~20% , driven by the higher margins of AWS.

- Cost Of Capital at ~8.64% considering its global revenue exposure and Moody's credit rating of A1.

- ROIC terminal value will be set to ~20% (higher than its ~11% 5-Year Avg), given the increased efficiency of its growing cloud business.

💰 Fair Value Estimate

Based on the DCF model, Amazon's estimated fair value is $217.95, suggesting the stock is currently trading near its intrinsic value.

Have other thoughts on Amazon.com?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user andre_santos has a position in NasdaqGS:AMZN. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.