Key Takeaways

- Scripps is positioned to lead industry consolidation post-deregulation, rapidly expand scale, and unlock significant efficiency and cash flow advantages over rivals.

- Strong financial discipline, digital ad leadership, and dominant political ad exposure set Scripps up for superior earnings, margin, and market share growth.

- Ongoing audience shifts, mounting digital competition, high debt, and reliance on political ads threaten sustainable growth, margin stability, and long-term advertising revenue.

Catalysts

About E.W. Scripps- Operates as a media enterprise through a portfolio of local television stations, national news, and entertainment networks in the United States.

- While analyst consensus expects that regulatory easing will lead to some consolidation and efficiency gains, a more aggressive view is that Scripps is poised to be a first mover and dominant acquirer post-deregulation, unlocking transformative scale advantages and potentially doubling the company's cash flow and EBITDA within a few years as industry fragmentation rapidly unwinds.

- Analysts broadly agree that refinancing and steady deleveraging will trim interest expense, but this could understate the magnitude-Scripps' accelerated timeline for reducing net leverage, combined with robust cash flow generation, sets up a scenario where the balance sheet not only de-risks but positions the company for aggressive capital return and high-ROIC acquisitions, maximizing earnings per share growth.

- Scripps' unique position as a major over-the-air and streaming network operator allows it to capitalize on the surging adoption of free Connected TV and FAST channels, where its rapidly growing 57 percent quarter-over-quarter CTV ad revenue and best-in-class multi-platform reach set the stage for materially outpacing peers in digital ad revenue and margin expansion.

- With core political advertising revenue historically outperforming the industry, Scripps stands to be a disproportionate beneficiary of escalating political ad cycles, particularly as its dual local-national footprint gives it unmatched exposure, potentially driving record revenue and segment profit in every major election cycle.

- The shift in digital ad efficiency and AI-driven changes in content discovery could accelerate advertiser flight to brand-building channels like CTV and local broadcast, where Scripps' targeted networks and sports strategy position it to capture outsized share gains, translating directly to higher long-term revenue and net margin growth.

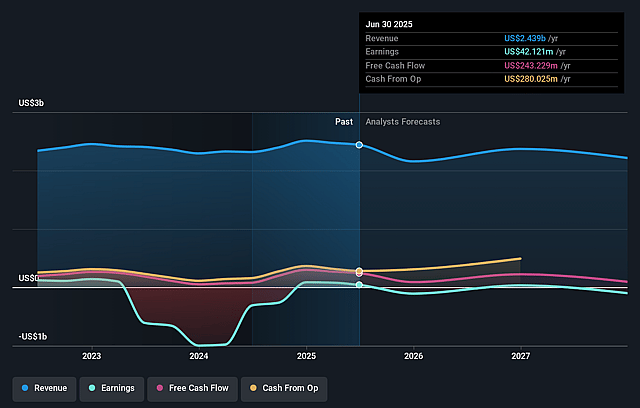

E.W. Scripps Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on E.W. Scripps compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming E.W. Scripps's revenue will decrease by 2.4% annually over the next 3 years.

- Even the bullish analysts are not forecasting that E.W. Scripps will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate E.W. Scripps's profit margin will increase from 1.7% to the average US Media industry of 9.9% in 3 years.

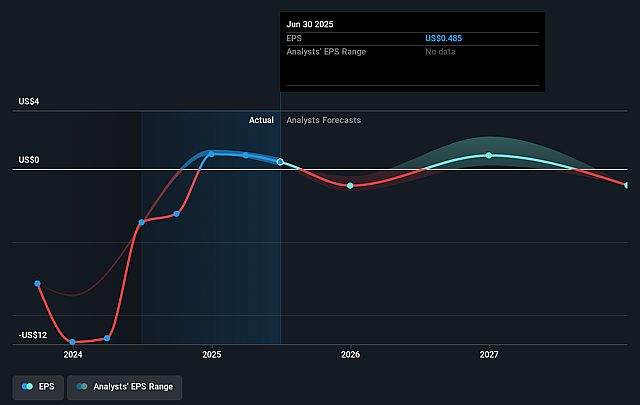

- If E.W. Scripps's profit margin were to converge on the industry average, you could expect earnings to reach $225.2 million (and earnings per share of $2.4) by about August 2028, up from $42.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.9x on those 2028 earnings, down from 6.1x today. This future PE is lower than the current PE for the US Media industry at 20.7x.

- Analysts expect the number of shares outstanding to grow by 2.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

E.W. Scripps Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing trend of cord-cutting and migration of audiences away from traditional television threatens to reduce Scripps' viewership and drive declines in high-margin linear advertising and retransmission revenues over time, resulting in pressure on revenue and net margins.

- Scripps remains overexposed to cyclical swings in political advertising, causing heightened volatility in revenue and earnings between election and non-election years, which undermines the predictability and sustainability of its long-term earnings growth.

- Advertising budgets continue to shift toward digital platforms controlled by national tech giants, while local ad markets remain soft with key categories like automotive showing persistent weakness, increasing the risk of stagnant or declining core advertising revenue across both Local Media and Networks divisions.

- Scripps' elevated debt and leverage from prior acquisitions, now carrying a weighted average interest rate close to 10 percent, strain operating cash flow and net income, especially if revenue remains pressured or macro conditions worsen, possibly restricting investment in growth areas.

- The company faces intensifying competition from ad-supported streaming, FAST channels, and social media platforms for both audiences and advertiser dollars, and while its streaming and sports initiatives have shown some growth, there is no clear evidence yet that these will scale or deliver the same returns as traditional models, threatening long-term revenue and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for E.W. Scripps is $10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of E.W. Scripps's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $225.2 million, and it would be trading on a PE ratio of 5.9x, assuming you use a discount rate of 12.3%.

- Given the current share price of $2.92, the bullish analyst price target of $10.0 is 70.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.