Key Takeaways

- Accelerating audience shift from linear TV to digital platforms threatens core advertising and retransmission revenues, compressing margins and long-term profit stability.

- Rising content costs and limited digital diversification amplify revenue declines, further weakening flexibility and increasing exposure to industry-wide disruption.

- Strong digital expansion, operational efficiencies, portfolio optimization, strategic sports investments, and improved financial flexibility position Scripps for enhanced revenue growth and profitability.

Catalysts

About E.W. Scripps- Operates as a media enterprise through a portfolio of local television stations, national news, and entertainment networks in the United States.

- The continued shift of audiences away from traditional linear TV towards on-demand digital and streaming platforms is eroding E.W. Scripps' core viewership, which will undermine the company's main advertising revenue engine over the long term and put persistent pressure on both top-line growth and EBITDA margins.

- Fragmentation of consumer attention across proliferating digital, social, and niche streaming platforms is accelerating, reducing the effectiveness and pricing power of traditional TV advertising for Scripps and likely causing ongoing declines in total ad revenue and net income.

- Heavy dependence on local TV broadcasting, coupled with only modest digital diversification, exposes Scripps to structurally lower demand for linear content; as audience migration outpaces digital revenue growth, fixed costs will consume an increasing share of profits, compressing operating margins.

- Ongoing declines in pay-TV subscribers due to cord-cutting will steadily erode retransmission fee revenue, a critical secondary source of cash flow for Scripps, directly translating into weaker cash generation, less flexibility for debt service, and heightened risk to long-term earnings stability.

- Rising costs for sports rights and syndicated content, necessary to prop up engagement in a shrinking viewer pool, are set to put additional downward pressure on profit margins, amplifying negative operating leverage and limiting any ability for Scripps to offset industry headwinds through programming investments.

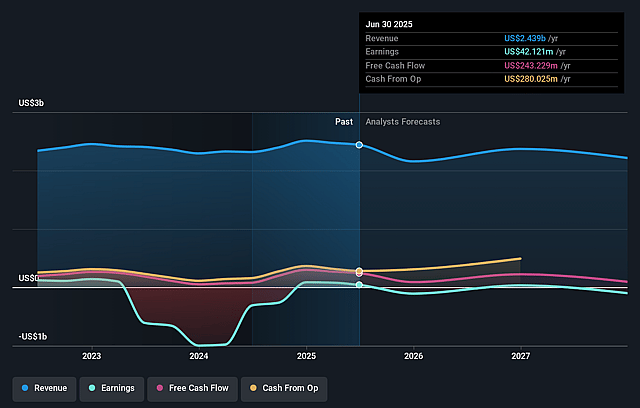

E.W. Scripps Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on E.W. Scripps compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming E.W. Scripps's revenue will decrease by 4.6% annually over the next 3 years.

- The bearish analysts are not forecasting that E.W. Scripps will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate E.W. Scripps's profit margin will increase from 1.7% to the average US Media industry of 10.1% in 3 years.

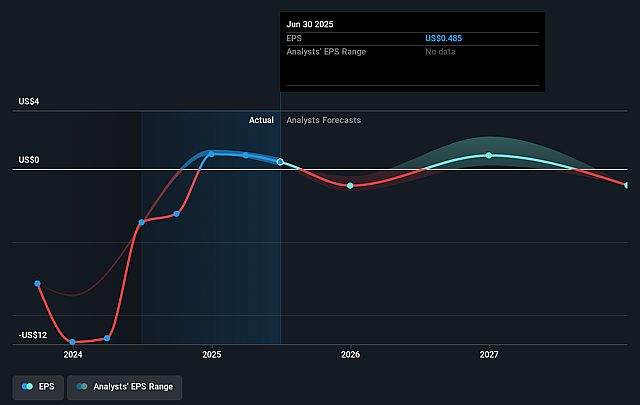

- If E.W. Scripps's profit margin were to converge on the industry average, you could expect earnings to reach $214.6 million (and earnings per share of $2.31) by about September 2028, up from $42.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 0.9x on those 2028 earnings, down from 6.3x today. This future PE is lower than the current PE for the US Media industry at 21.4x.

- Analysts expect the number of shares outstanding to grow by 2.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

E.W. Scripps Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating growth of connected TV and streaming revenues, highlighted by a 57 percent year-over-year increase in CTV revenue and significant viewing hour growth, suggests that Scripps' digital strategy could drive sustained top-line and segment margin expansion as the business diversifies beyond traditional linear TV.

- Structural cost reductions and margin improvements in Scripps Networks, evidenced by network segment margins reaching 30 percent for the half year and disciplined expense management, indicate ample room for operating leverage and rising net margins over time.

- The company's portfolio optimization strategy, including industry-first station swap transactions and potential for further M&A in the wake of anticipated broadcast deregulation, could lead to scale-driven revenue synergies and accelerate debt reduction, enhancing both top-line and bottom-line growth prospects.

- Scripps' investment in sports rights for both local and national platforms-such as agreements with the WNBA, NWSL, and NHL-appears to be meaningfully boosting core advertising revenues and attracting premium ad rates, supporting more resilient revenue and EBITDA performance versus less diversified peers.

- Successful refinancing activities that extend debt maturities and reduce near-term leverage, paired with the stated intention to prioritize further deleveraging, have improved the company's financial flexibility and could reduce future interest expense, positively impacting net income and equity value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for E.W. Scripps is $1.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of E.W. Scripps's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $214.6 million, and it would be trading on a PE ratio of 0.9x, assuming you use a discount rate of 12.3%.

- Given the current share price of $3.04, the bearish analyst price target of $1.5 is 102.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.