Key Takeaways

- Roku's advanced home screen integration, unique ad tools, and global reach position it to capture substantial ad revenue and margin gains as TV budgets shift to connected platforms.

- Expanding first-party content and international growth, combined with increasing engagement and rising ARPU, signal significant long-term recurring revenue and earnings upside.

- Intensifying regulatory, competitive, and structural challenges threaten Roku's future revenue growth and margin expansion despite ongoing investments and a mature user base.

Catalysts

About Roku- Operates a TV streaming platform in the United States and internationally.

- While analyst consensus expects platform revenue growth from home screen optimization, the full power of Roku's home screen is likely still being underestimated-its integration and advanced machine learning recommendations across over half of US broadband households and growing international users could unlock a step-change in both ad and subscription yields, accelerating revenue and margin expansion even beyond current double-digit expectations.

- Analysts broadly agree that expanding SMB-focused ad demand via third-party partnerships and Roku Ads Manager will improve revenue streams, but the addressable market is vastly larger as performance-based video ad budgets migrate from social platforms to CTV; Roku's unique scale and self-serve tools could capture outsized share of a multibillion-dollar market, sharply increasing ad revenues and driving structural margin gains.

- Roku is set to benefit massively from the accelerating shift of TV budgets to connected platforms due to its unrivaled reach, powerful first-party data, and deep integration with global DSPs-positioning the company as the default "gatekeeper" for advertisers, which will both grow top-line ad revenues and boost long-term pricing power, directly impacting net margins.

- The rapid growth and deepening engagement of The Roku Channel (up 80% in hours year-on-year, ranking as a top app globally) indicates that Roku's owned and operated content business has only begun its monetization journey, with rising AVOD and bundled subscription opportunities poised to significantly lift recurring revenue, ARPU, and gross profit in coming years.

- As the integration of smart TVs and home devices becomes ubiquitous worldwide, Roku's OS strategy places it in prime position to scale outside the US, and this global expansion-combined with operational leverage and volume-driven margin improvements-suggests international revenue and earnings could ramp faster than Wall Street anticipates, materially raising long-term earnings power.

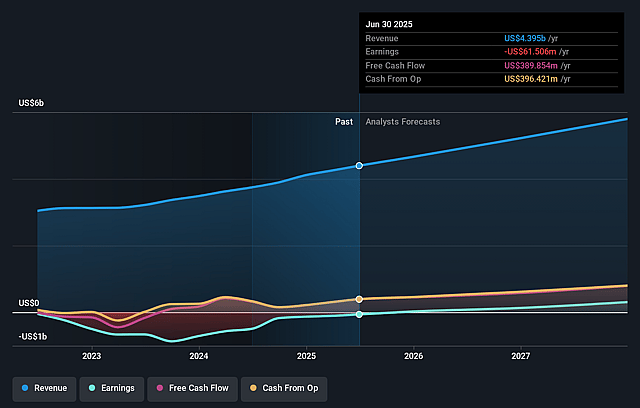

Roku Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Roku compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Roku's revenue will grow by 13.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.4% today to 10.6% in 3 years time.

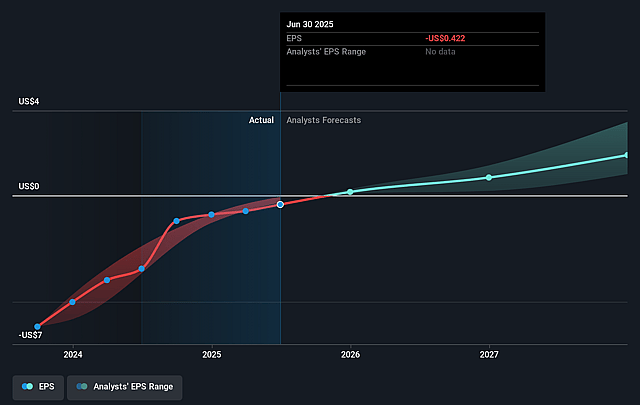

- The bullish analysts expect earnings to reach $686.1 million (and earnings per share of $4.67) by about September 2028, up from $-61.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.1x on those 2028 earnings, up from -232.3x today. This future PE is lower than the current PE for the US Entertainment industry at 39.3x.

- Analysts expect the number of shares outstanding to grow by 1.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.08%, as per the Simply Wall St company report.

Roku Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growth in Roku's high-margin advertising business is heavily reliant on continued access to user data, but tightening regulations on data privacy and evolving laws such as GDPR and CCPA could severely limit ad targeting capabilities, putting direct pressure on long-term ad revenue and platform margins.

- Roku's international and U.S. device penetration is already strong, resulting in mature market saturation in developed regions, which means future active account growth may stagnate, making it increasingly difficult to drive incremental improvements in average revenue per user and ultimately curbing revenue expansion potential.

- The company's rising investments in content acquisition, platform development, and integrating acquisitions like Frndly are not guaranteed to produce proportional increases in platform monetization, increasing the risk that climbing operating costs will outpace revenue growth and suppress net margins and earnings over time.

- As mega-cap tech players such as Amazon, Apple, and Google further consolidate their dominance in streaming platforms, operating systems, and advertising, Roku faces intense competition for both platform access and advertising spend, potentially eroding its share of user engagement and digital ad revenue and reducing its overall competitive positioning.

- The shift of major content providers toward their own direct-to-consumer platforms lessens Roku's negotiating leverage and diminishes the appeal of its aggregator model, which may ultimately restrict content diversity and reduce both user engagement and the company's take rate on subscriptions and ad inventory, creating headwinds for sustainable long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Roku is $135.15, which represents two standard deviations above the consensus price target of $103.27. This valuation is based on what can be assumed as the expectations of Roku's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.5 billion, earnings will come to $686.1 million, and it would be trading on a PE ratio of 39.1x, assuming you use a discount rate of 9.1%.

- Given the current share price of $96.99, the bullish analyst price target of $135.15 is 28.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.