Key Takeaways

- Heavy reliance on digital ad revenue and third-party platforms increases vulnerability to privacy changes, digital ad market volatility, and margin compression.

- Intensifying competition, content bundling by tech giants, and a maturing streaming market threaten Roku's growth, platform differentiation, and long-term earnings potential.

- Rapid revenue growth, rising margins, expanding advertiser base, high user engagement, and diverse innovation initiatives support Roku's strong financial outlook and long-term profitability potential.

Catalysts

About Roku- Operates a TV streaming platform in the United States and internationally.

- Roku's heavy dependence on digital ad revenues makes it highly exposed to the risk of stronger global privacy regulations and anti-tracking measures, which would directly erode the effectiveness-and thus price-of its targeted advertising formats. Over time, this could significantly constrain both the company's top-line ad growth and net margins as advertisers shift budgets elsewhere.

- While streaming adoption surged due to cord-cutting, the growth rate of new streaming households is likely to reach a plateau now that the vast majority of consumers have already switched. This structural slowdown will limit Roku's ability to grow active accounts and sustain double-digit platform revenue growth as its addressable market matures.

- Intensifying competition from vertically integrated tech giants like Amazon, Apple, and Google increases the risk that leading ecosystem players will lock users into their walled gardens and restrict Roku's access to premium content, gradually eroding the company's platform differentiation and long-term revenue potential.

- As the company continues to expand reliance on third-party demand-side platforms for ad monetization, any economic downturn or change in the digital ad market could result in heightened revenue volatility and compress EBITDA margins, especially given the forecast for operating leverage and margin improvement in coming years.

- The proliferation of super apps and content bundling by larger competitors threatens Roku's ability to aggregate and monetize content effectively, and its lack of scaled proprietary content puts it at a lasting disadvantage in user engagement and ARPU, ultimately capping earnings power and dampening long-term platform profit growth.

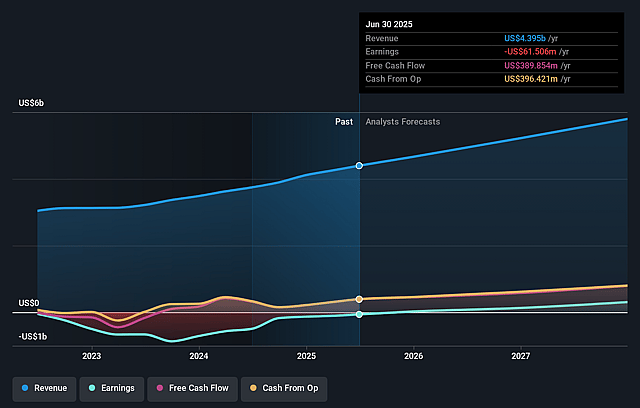

Roku Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Roku compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Roku's revenue will grow by 10.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.4% today to 3.4% in 3 years time.

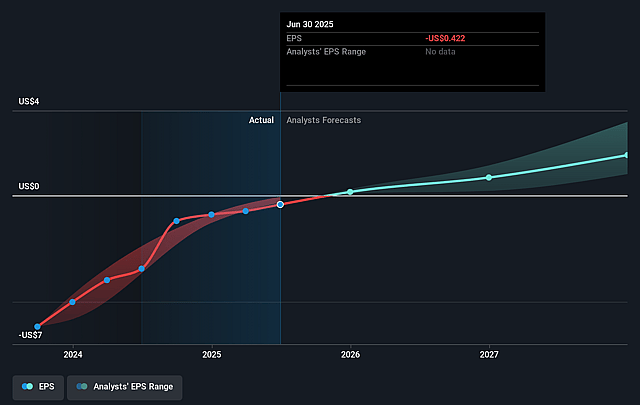

- The bearish analysts expect earnings to reach $197.9 million (and earnings per share of $1.35) by about September 2028, up from $-61.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 73.8x on those 2028 earnings, up from -235.9x today. This future PE is greater than the current PE for the US Entertainment industry at 37.3x.

- Analysts expect the number of shares outstanding to grow by 1.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.05%, as per the Simply Wall St company report.

Roku Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Roku's ability to sustain strong double-digit platform revenue growth-demonstrated by an 18 percent year-over-year increase and accelerated adoption of new monetization initiatives-signals robust top-line expansion that could contradict a bearish outlook for the share price.

- The company sees ongoing EBITDA and operating margin improvements, with a 180 basis point margin increase year-over-year and an expectation for further improvement in 2026, suggesting enhanced net profitability and earnings power.

- Deepening integration with demand-side platforms and the rapid ramp-up of Roku Ads Manager are unlocking new, underpenetrated advertiser markets, including performance-based and small to midsized businesses, which opens up large, incremental revenue streams.

- The Roku Channel continues to exhibit high engagement with an 80 percent hour growth rate in the most recent quarter and expectations for sustained double-digit growth, indicating rising user engagement and higher monetization opportunities from advertising and subscriptions.

- Ongoing innovations in content bundling, personalized recommendations, and international expansion, as well as increased resource allocation to subscription growth, provide multiple structural levers for revenue diversification, ARPU gains, and margin expansion over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Roku is $73.63, which represents two standard deviations below the consensus price target of $101.15. This valuation is based on what can be assumed as the expectations of Roku's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.9 billion, earnings will come to $197.9 million, and it would be trading on a PE ratio of 73.8x, assuming you use a discount rate of 9.0%.

- Given the current share price of $98.47, the bearish analyst price target of $73.63 is 33.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.