Last Update23 Oct 25Fair value Increased 0.19%

Roku's analyst price target has been raised from $110 to $145. This reflects greater confidence among analysts in the company's platform revenue growth and free cash flow potential.

Analyst Commentary

Recent analyst reports reflect both optimism and caution surrounding Roku’s performance and outlook. Analysts have weighed in on the company’s future revenue streams, growth catalysts, and the risks that may temper valuation expectations.

Bullish Takeaways

- Bullish analysts point to upward revisions in price targets. These are driven by increased projections for Roku’s platform revenue and expectations of robust free cash flow generation.

- Several see Roku well-positioned to benefit from the expansive connected TV advertising market. This is described as a major opportunity for sustained topline growth.

- New partnerships, such as the integration with major demand-side platforms and the launch of bundled subscription offerings, are viewed as catalysts that could accelerate growth and lift revenue forecasts.

- Some analysts suggest that consensus estimates may underappreciate Roku’s core platform revenue potential for 2026, indicating possible upside in both revenue growth and EBITDA targets.

Bearish Takeaways

- Bearish analysts maintain concerns about the potential for a deceleration in Roku’s core platform growth rate as implied by consensus numbers. This suggests room for disappointment versus the more bullish targets.

- There is caution about the growing competitive landscape in the streaming sector. This could put pressure on Roku’s market share and margins over the long term.

- Macro headwinds, such as regulatory challenges or shifts in advertising spending, are seen as factors that could hamper near-term execution and dampen valuation multiples.

What's in the News

- Paramount has appointed Roku's ad sales leader, Jay Askinasi, as its new Chief Revenue Officer. This move reflects Roku's influence in the media and advertising space (ADWEEK).

- Roku and FreeWheel have deepened their partnership, enabling direct access to Roku's premium CTV supply through the FreeWheel Streaming Hub. This initiative aims to boost transparency and efficiency for advertisers.

- Roku launched the Philips Roku TV featuring Ambilight technology in the U.S. This expansion adds immersive, color-enhancing features and broad smart home integration to Roku's TV hardware line.

- The first-ever Aurzen Roku TV Smart Projector is now available. It offers greater flexibility for streaming and entertainment at home or on the go.

- Roku introduced Howdy, a new ad-free subscription video service priced at $2.99 per month. The service provides a broad catalog of titles from major studios and partners.

Valuation Changes

- Fair Value has increased slightly, moving from $105.12 to $105.32 per share.

- Discount Rate has risen modestly, from 8.91% to 8.95%.

- Revenue Growth estimates have edged up, climbing from 11.36% to 11.40%.

- Net Profit Margin forecast has decreased, shifting from 5.76% to 5.37%.

- Future P/E ratio has increased, growing from 59.38x to 63.92x.

Key Takeaways

- Migration from linear TV to streaming and digital ads is driving user growth, platform engagement, and higher-margin advertising revenue.

- Investments in content, self-service ads, and operational efficiency are improving margins, financial health, and supporting long-term revenue and earnings expansion.

- Competition, ad market dependency, content fragmentation, data regulation, and risky international expansion all threaten Roku's ability to grow revenue, margins, and platform engagement.

Catalysts

About Roku- Operates a TV streaming platform in the United States and internationally.

- The accelerating shift away from traditional linear TV toward streaming continues to expand Roku's total addressable market, supporting long-term growth in active users and increasing demand for its connected TV platform, which is expected to drive sustained double-digit platform revenue growth.

- The global migration of advertising budgets from linear TV to digital and connected TV, combined with Roku's successful rollout of new ad products (such as Roku Ads Manager) and deeper third-party DSP integrations, increases its share of high-margin digital advertising, which is showing up as both revenue growth and higher platform margins.

- Increased penetration of smart TVs and streaming devices globally, along with investments in expanding Roku's operating system and international distribution, are fueling persistent user growth and engagement, laying the foundation for continued revenue expansion.

- Ongoing investments in proprietary content (e.g., The Roku Channel), self-service ad solutions, and performance marketing are boosting user engagement and attracting new cohorts of advertisers (especially SMBs), adding incremental high-margin advertising revenue and broadening usage, which are supporting margin and earnings growth.

- Enhanced operational discipline, margin expansion through operating leverage, and the company becoming operating income positive ahead of schedule signal improving financial health and suggest a potential for net margin and earnings acceleration as monetization initiatives scale.

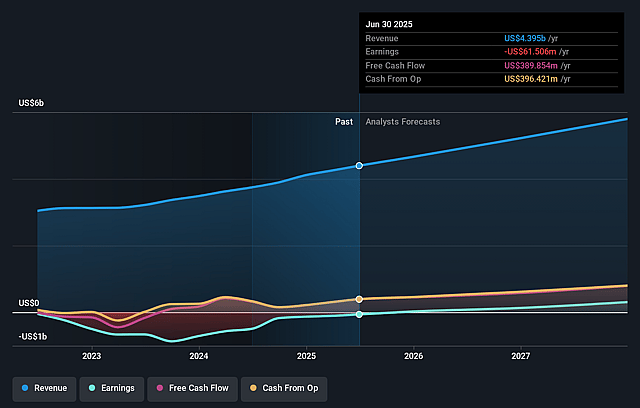

Roku Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Roku's revenue will grow by 11.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.4% today to 6.1% in 3 years time.

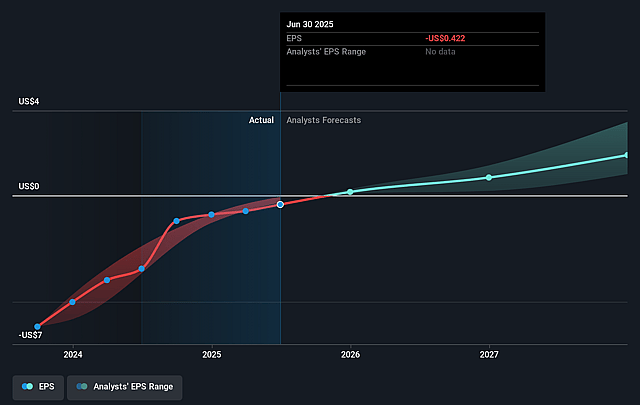

- Analysts expect earnings to reach $372.1 million (and earnings per share of $2.25) by about September 2028, up from $-61.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $513.6 million in earnings, and the most bearish expecting $149.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.9x on those 2028 earnings, up from -235.9x today. This future PE is greater than the current PE for the US Entertainment industry at 38.2x.

- Analysts expect the number of shares outstanding to grow by 1.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.05%, as per the Simply Wall St company report.

Roku Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the smart TV OS and streaming device market from large ecosystem players (such as Amazon, Google, Apple, and now Walmart/Vizio) risks commoditizing Roku's hardware, which could limit household penetration growth, pressure device revenues, and erode Roku's ability to maintain current levels of active accounts-ultimately impacting both top-line revenue and long-term earnings capacity.

- Despite strong performance, Roku's heavy reliance on advertising revenue makes it vulnerable to macroeconomic slowdowns, cyclical ad market contractions, or shifting digital ad budgets toward competitors, resulting in potential revenue volatility and compressing operating or net margins during periods of weaker ad demand.

- The proliferation of direct-to-consumer apps and continued content fragmentation may see major media companies withholding top-tier content or creating more walled gardens, diminishing Roku's platform value proposition, reducing user engagement/time spent, and limiting subscription or ad revenue potential.

- Increasing global privacy regulations and consumer data protection laws may restrict Roku's ability to leverage its proprietary data for targeted advertising, potentially stalling growth in its high-margin ad business and impacting long-term profitability.

- International expansion and new market entry, including performance-focused ad products for SMBs, carry significant execution and scaling risks; initial investments may not generate proportionate returns, which could keep net margins compressed or delay improvements in long-term operating income and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $101.154 for Roku based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.1 billion, earnings will come to $372.1 million, and it would be trading on a PE ratio of 53.9x, assuming you use a discount rate of 9.0%.

- Given the current share price of $98.47, the analyst price target of $101.15 is 2.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.