Catalysts

About Coeur Mining

Coeur Mining is a North American precious metals producer focused on gold and silver mines that generate growing free cash flow.

What are the underlying business or industry changes driving this perspective?

- The integration of Las Chispas and its sustained outperformance is transforming Coeur into a structurally lower cost producer with rising high margin silver and gold output, supporting durable growth in revenue and free cash flow.

- Rochester's ramp toward a crushing rate of more than 30 million tons annually, with steadily improving recoveries and particle size control, is expected to unlock a step change to 7 million to 8 million ounces of silver and 70,000 ounces of gold per year, expanding EBITDA and cash generation as unit costs decline.

- Portfolio wide productivity gains at Palmarejo, Kensington and Wharf, including higher mill throughput, better recoveries and completed development, are driving multi quarter increases in production with narrowing cost guidance, which is expected to lift net margins and earnings through 2026.

- Rising precious metal prices, combined with Coeur's disciplined cost control, reduced leverage and strong liquidity with over $500 million of cash expected at year end, position the company to convert higher realized prices directly into higher EBITDA and accelerating free cash flow.

- Advancing growth optionality such as the Silvertip project, under a policy backdrop that favors critical minerals, together with a robust exploration pipeline at Las Chispas and Palmarejo, provides potential for substantial future reserve additions and production growth, supporting a higher long term earnings power than reflected in the current valuation.

Assumptions

This narrative explores a more optimistic perspective on Coeur Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

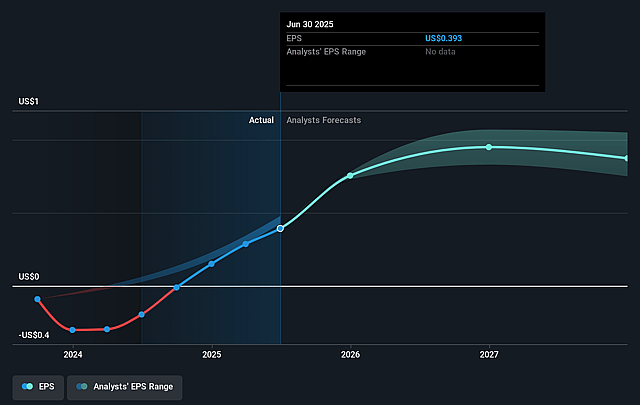

- The bullish analysts are assuming Coeur Mining's revenue will grow by 28.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 24.0% today to 51.8% in 3 years time.

- The bullish analysts expect earnings to reach $1.9 billion (and earnings per share of $1.56) by about December 2028, up from $408.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.0 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, down from 27.5x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.8x.

- The bullish analysts expect the number of shares outstanding to grow by 0.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.17%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The current record free cash flow and EBITDA are heavily supported by unusually strong gold and silver prices. A sustained downturn in metals prices would compress realized pricing leverage and translate into materially lower revenue and earnings over the cycle.

- Rochester is still progressing toward steady state and has already required extended downtime and modifications to the crushing corridor and conveyors. Further ramp up delays or mechanical issues could push ounces and cash generation out beyond 2026, weakening the expected uplift in EBITDA and net margins.

- Higher royalty obligations triggered by elevated metals prices and continued strength in the Mexican peso could structurally raise operating costs in key jurisdictions. This would erode the benefit from current cost guidance reductions and put pressure on future net margins and free cash flow.

- The strategy increasingly leans on underground and lower grade ore sequencing decisions at operations like Palmarejo. If recoveries or grades underperform expectations when more marginal material is processed, overall production efficiency could deteriorate, dragging on revenue and operating margins.

- Long dated internal growth options such as Silvertip depend on favorable permitting, supportive critical minerals policy and disciplined capital deployment. Setbacks in regulatory approvals or cost overruns could delay or dilute the anticipated step change in silver production, limiting longer term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Coeur Mining is $25.0, which represents up to two standard deviations above the consensus price target of $20.86. This valuation is based on what can be assumed as the expectations of Coeur Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 8.2%.

- Given the current share price of $17.48, the analyst price target of $25.0 is 30.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Coeur Mining?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.